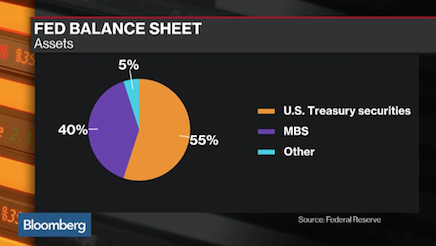

There are estimable risks associated with the Fed’s desire to extricate itself from their quantitative easing programs, put in place to save western finance circa 2008. The balance sheet is ~$4 trillion, up from $750 billion before the crisis. All of us trading stocks seem to enjoy this detente between risk and valuations, merrily cavorting throughout the asset classes like a breeze through a blue mist.

Subadra Rajappa, head of US Rates Strategy at Soc Gen, warned that an unseasonable chicanery might be produced once the Fed starts to unwind assets.

“I think the balance sheet unwind is an underestimated risk in the market. If you look at the amount of duration that is about to hit the market over the next 5 years, we, in out calculations, have come up with roughly $385 billion in duration… that’s going to hit the market over 3-5 years.”

She added, “And that, if you use the betas that you get from the Fed, amounts to 40bps in term premium over the next 3 years.”

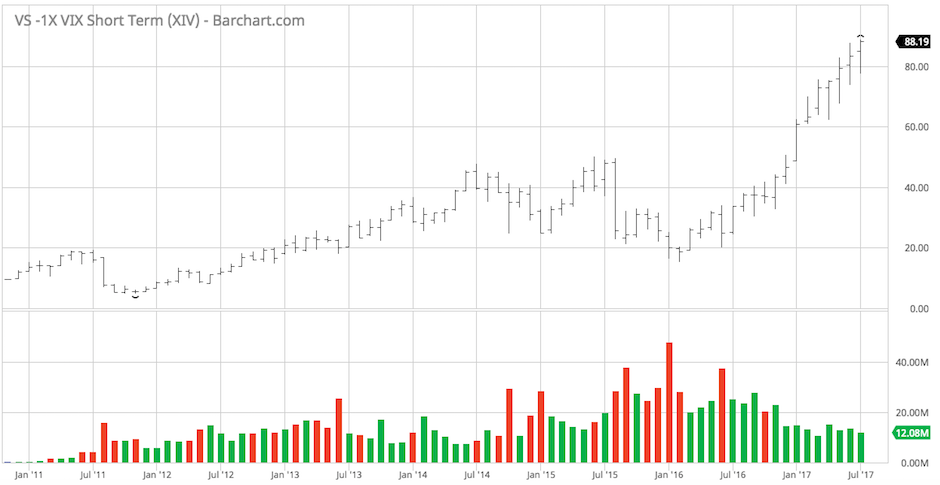

In the meantime, the markets are hitting record highs, without drawdown, providing the holders of inverse VIX products with endless amounts of money to fund extravagant champagne parties.

It’s important to note that when QE was announced, it was priced into the market immediately, not during or after the fact. Ergo, as logic dictates, once the Fed officially announces that they will begin to draw down their balance sheet, markets should respond immediately.

If you enjoy the content at iBankCoin, please follow us on Twitter

Got my finger on the button. Thanks for the most excellent post le Fly.

I’ll believe it when I see it. Yellen has effectively killed all sense and meaning out of “free markets”. The millennial gamblers and algos are the only ones winning.

long SVXY & XIV for life.

Yellen is just the next hiredhand

All the systems and algos guiding indexes and vix were put in place by globalist-friendly branches/elements. Under BenB and then with BenB and Citadel.

And they are providing the 9-five vix. Which is purely a parlor trick lol. By no means sustainable. Yet they stooges like you and general useful idiots to say

“SVXY for LIFE” “Ha” “Look at me” “I’m a useful idiot” We’re entering the endstage of the tools and trends they’ve used and relied on for this bshit

She must make a lot to state the obvious.. “If I open my wallet to pay.. it might reduce the money in my wallet.”

Oh yeah um thanks for the insight.

Jesus…

So said wallet doesn’t grow twenties overnight?

I’m sure cryptocurrencies will make it all OK. What are you so worried about?

Yep, I don’t get the small divergence of a port into crypto, so scary. Weird. Fear is hell of a drug

A new bull market has begun!

Indued my brother

Fly,

Vix futures contango produces a “roll yield” that is the key driver of of xiv, svxy, and vmin. Vmin plays the weekly vix futures vs svxy and xiv play the front month and second month contracts. The Fed’s big balance sheet of bonds is unhedged. When they dump them it should cause a sustained breakout in the demand for derivatives because guys like the risk parity guys don’t just like to buy treasury bonds. They buy them on leverage, extreme amounts of leverage that requires hedging. All of this bond hedging bleeds into demand for spx puts and should cause a sustained rise in the vix. Just my two cents. But stocks can do fine in this environment, even if vix moving average rises. The spx put demand is not always due to stock hedging alone.