UBS is out with a magical note today, suggesting that high yield credit might begin to crack, once oil breaks $40 to the downside. This is an amazing thing, since just a year or two ago it was widely believed that crude under $70 meant complete annihilation for the industry.

12 month WTI at or below $40 will elevate 2015-style risks for HY energy. We estimate a sharp or sustained decline in 12 month WTI below $40 or so (vs mid 40s current) will bring back non-linear downside risks for US HY energy. This is modestly below average breakeven oil prices for HY E&P firms. In addition, almost 30% of firms have only adequate liquidity and are dependent on external financing as hedges roll off.

“If oil prices fall to $40 or below, the negative impact on rest of world profits (via commodity-related foreign subsidiaries of US companies) could be a material headwind for aggregate corporate profits, and a prolonged $40 oil price would trigger more stress and defaults in lower-quality HY issuers heading into 2018 (and could prompt banks to tighten lending standards on C&I loans at the margin). While lower oil prices should limit upside inflation risks, market expectations for Fed rate hikes are already well below the median path projected by the Fed, suggesting the market is priced for a dovish outcome already. A supply-driven drop in oil prices coupled with resilient equity markets and financial conditions could still have the Fed tighten policy more than the market expects.”

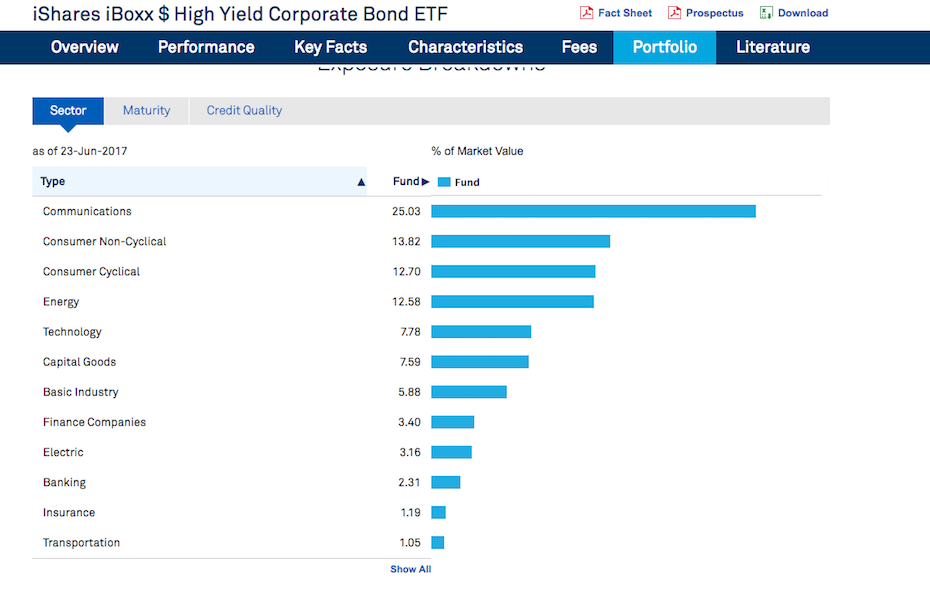

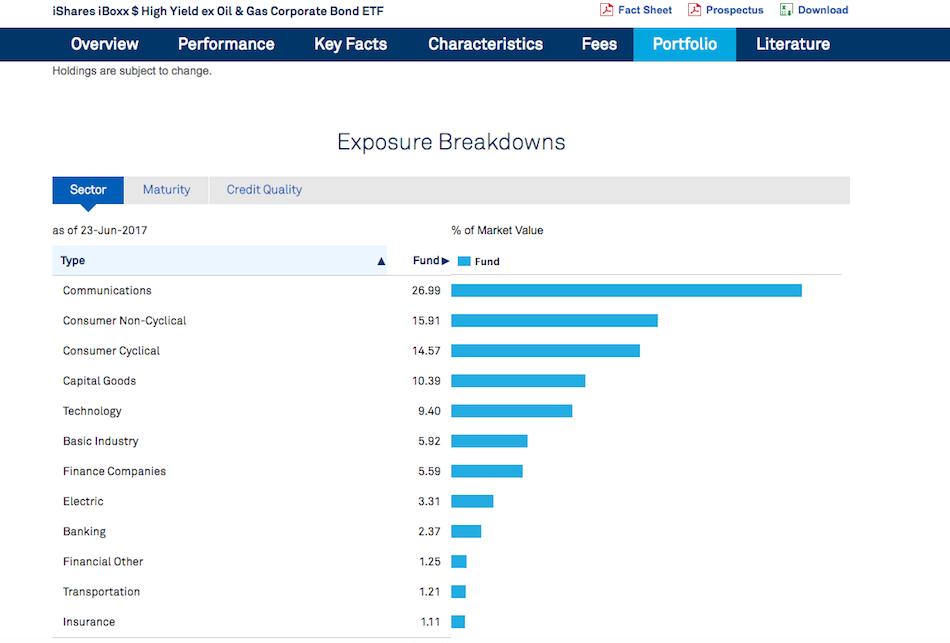

With regard to easy to track high yield credit, people typically watch JNK, HYG or for energy specific HYXE. But this is a total farce, wholly misleading as to the health of the energy bond market. Those ETFs have been rejiggered and are heavily long communications, with barely any energy. Hell, even the god damned energy high yield ETF is mostly communications.

The price action in HYG has been nothing short of stellar.

Is energy credit mispriced?

Yes, absolutely.

But before the market gets around to scaring people in the bond market, there is a pecking order. I recall the sequence of events very vividly, when oil cracked asunder in 2015. First went the stocks.

Oil and Gas stocks are down 40% for the year. Check.

Then went the pipeline.

Pipelines are merely down 4% for the year. No check.

Then went the industrials and then the bond market.

Here’s what you should do to gauge risk in the market, as it relates to energy and high yield.

Watch these pipeline stocks.

ENB, WMB, PAA, TRGP and BPL.

Also watch the stocks of the most levered oil companies.

MPO, CRC, CRK, CHK and BBG will do.

Watch the amount of total debt of companies whose debt/eq rations blow to above 2x. By the time their ratios are at 5x, it’s already too late. I have a screen for that in Exodus. Click here.

The current distressed debt load is now $465b.

Once you see that number balloon, pipeline stocks start to crater, I promise you the market will get torched, taking with it the high yield infants with it.

If you enjoy the content at iBankCoin, please follow us on Twitter

Bulls and BTFDs, do you not think US financial stability is vulnerable to stock levels and valuation?

Bulls and BTFDs, do you not think (inv.) volatility is being consciously bubbled, right now?

Bulls and BTFDs, do you not think recession is slowly creeping in, concurrently, with the extreme dislocations and imbalances lying-in-wait from qe?

Bulls and BTFDs, do you Not think you were duped into helping form boombust# 3?

Do you Not think, you were useful idiots?

Um probably when the fed unwinds it’s 4.5t holdings.

Great blog Fly. Good information.

so which corporate HY junk bond would you short.

Option traders are heavily short $HYG via puts. I mean heavily!