I’d be on guard for news of commodity focused hedge funds being liquidated into this maelstrom. The carnage is significant and pervasive.

WTI is off by nearly 5% today.

The current fear is a ‘global glut’ in oil, which isn’t anything new. However, I think people are starting to realize that none of Trump’s pro-growth strategies have passed and GDP is in the pits; ergo, there isn’t a reason for commodities to fashion higher. The culprit, naturally, US shale.

“The market continues to hunt for a bottom,” said Gene McGillian, manager of market research at Tradition Energy in Stamford, Connecticut. “We’ve dropped to a five month low.”

“At some point, the market should recognize OPEC isn’t the most important player in the market any more,” said Commerzbank’s Eugen Weinberg, “That is non-OPEC, and, above all, U.S. shale.”

Other commodities being routed included: copper -1.2%, nickel -2.6%, gold -1.5% and natty -1.7%.

On the other hand, bitcoins continue higher by another 5.2%.

The dollar is significantly weaker v the euro — off by 0.7%, probably because Macron is being praised as the winner of last night’s debate. On the surface of the market is nothing but smoke and mirrors. The commodity sector is being shredded on the equity side too, with losses ranging from 3-8%.

Conversely, defensive stocks, like consumer staples and military, are holding up nicely.

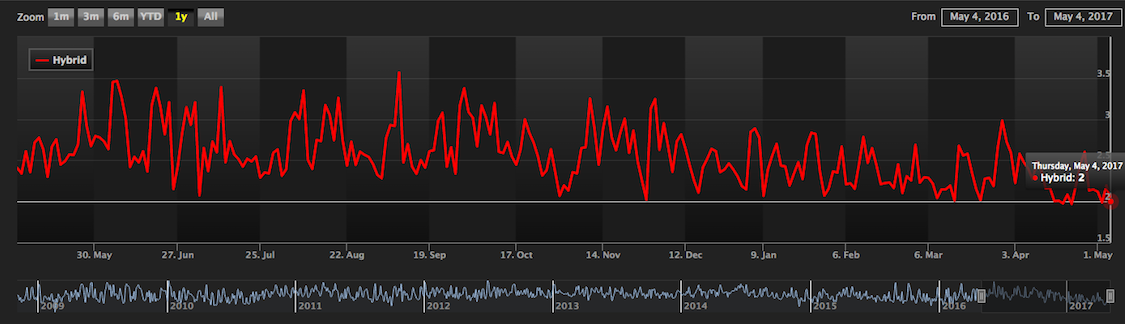

On the algo side of things, oil stocks are at their low point — definitely a prime candidate for a mean reversion move higher.

Truth be told, however, we are exploring new boundaries here and I would be reticent about jumping in with both feet.

What does that mean?

Well, the scores that make oil oversold are based off recent history. The market has been very accommodating to all stocks for a year, rarely trading down for more than a few days. The algos failed XLE recently and have been correcting themselves at these lower levels. The way the program works is price discovery and memory. The old levels of XLE weren’t enough to place in a bottom. The ETF kept trading lower with the sector, leading to even lower technical scores. Eventually, it will find a level that will be helpful.

For example, our 3 mo threshold is now 1.21, the 6 mo is 1.24 and the 12 mo is 1.31. Over time, that 1.21 scores will become the principle OS threshold and, hopefully, provide members with an edge when trading it. It’s important to note that nothing is full proof. As long as we’re learning from the past, we can make better decisions in the future.

If you enjoy the content at iBankCoin, please follow us on Twitter

Fly what is up with the views on these articles, it looks like it’s only showing about 10% of the norm?

We have heavy caching on the site due to 20x the traffic.

the time to start entering is definitely now. the most profitable trades are the ones when you are so unsure and sick to your stomach watching the action.

Lol and now clf is green in this shit show. All I know is if oil doesn’t rebound C&I loan delinquency will pop, lending will freeze up again, and the weak growth we have will evaporate aka recession.

Hello?

That’s essentially what bears said near the beginning (’11ish)

The forced increase in asset prices (which clearly was the case in structure&formal policy) would only eventually crater when puffed prices diverged far enough from base prices

Oh it’s never ever gonna happen, Right? Ever. Never.

Delinquency rates consistently fell from 2009 to 2015, 2011 included you bearshitter moron.

Could you be anymore of a sheep?

WTF LOL YEAH OF COURSE CONDITIONS IMPROVED IN THE FIRST FEW to SEVERAL YEARS AFTER QE POLICIES WERE INITIATED

P.O.S. LOL THE REALITY WILL EVENTUALLY CATCH UP TO THE MIRAGE BUT OF COURSE THERE’S A MIRAGE THAT APPEARS FIRST

So fucking hypnotized. You will get your due shock.

things in lots of areas have started turning those initial bandaids

GM Auto Inventory Hits 10 Year High: Most Since November 2007, One Month Before The Recession Started

http://www.zerohedge.com/news/2017-05-03/gm-auto-inventory-hits-10-year-high-highest-november-2007

Market Cap on GVA (Corporate Gross Value Added): 1.70x (only ever higher in 2000)

Market Cap on GNP (Buffett indicator): 1.70x (only ever higher in 2000)

Market Cap on GDP: 1.10x vs 0.58x historical average

Market Cap on Gold: 1.90x vs 1.55x historical average

Market Cap on Oil: 44x vs 23x historical average

CAPE Shiller Adj P/E multiples: > 30x (only ever higher in 1929 and 2000)

CAPE Shiller Adj P/E multiples relative to 10yr GDP growth: 35% above historical levels

Price on Book Value: > 3x (only ever higher in 2000)

S&P 500 Price / EBITDA: higher than in 2000 and 2007

EV / EBITDA small caps in Russell 2000: almost 30x (from average 15x in last 30 yrs)

Net Debt / EBITDA: > 2x (from 1x in 2007)

Median Price / Revenue Ratio for S&P components: > 2.5x

S&P relative to Velocity of M2 Money Supply: double the levels in 2007 and 2000

NYSE Margin Debt at a 85 years high

Fly, since your posted about avocados, your posts have stopped showing in my feed reader. Did you make any changes on the blog that may have caused that?

Got some cheap OTM, tomorrow expiry, SPY puts here ..in case oil continues lower …and S+P decides to care. Such an obvious play, it is very likely to not work.

The U.S. Rig count is at 870, up 107% from 450 last year at this time. Occam’s Razor explains it clearly, yet again.