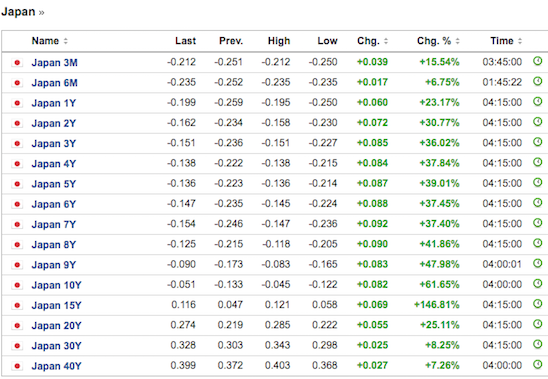

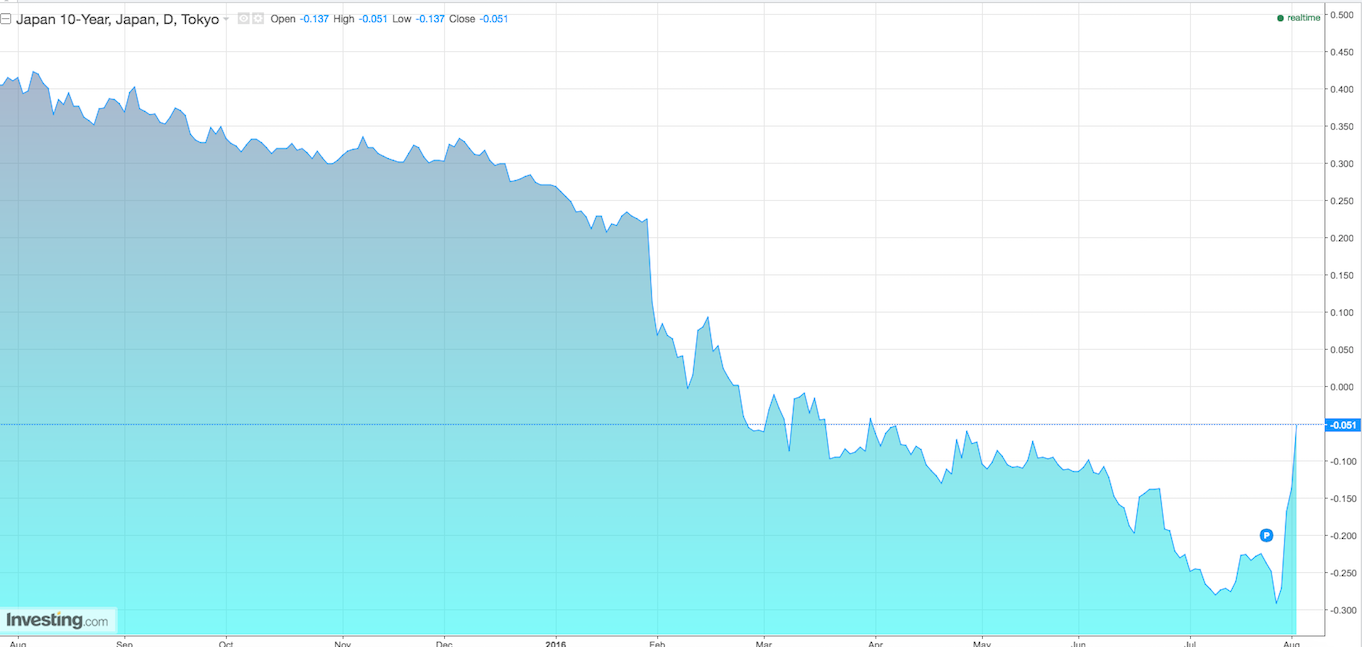

Look at those yield jumps in JGBs. This is some serious distribution taking place in the Japanese bond market. Ever since they announced their bullshit stimulus program, the value of the yen has been driven, the fuck, higher, while bonds have been sold en masse. I don’t know what to make of it really, other than the fact that people are disappointed in Kuroda’s QE swag game. It’s important for the elite to feel comfortable with front running government sponsored QE projects. We all know, to be perfectly blunt, Japan is a nation is dead. Their demographics are dreadful. Their people are more sexually aroused by anime and robots than each other. And, lastly, their fiscal situation, stemming from two plus decades of failed QE programmes, is in shambles.

There’s no reason to ever lend the Japanese govt money when their debt/gdp is in excess of 200%, let alone for a negative yield. At first glance, I’d say JGB yields rising is a good thing for Japan. It signals potential inflation. However, the other side to that coin is the death of Japan will never happen while yields are low. When the end comes, yields will fucking skyrocket and the Bank of Japan will explode.

I suppose that’s a little extreme for a 12:37am post, while markets are at record highs.

For now, I believe yields rising is a good thing, until they rise too high, naturally.

If you enjoy the content at iBankCoin, please follow us on Twitter

Record highs suckas. For the Xth additional time. You all called permabears: asshats, while you yourselves called for higher stocks in longterm deteriorating desperate environments. Now: Who’s the asshat?