Some might argue the data points Joe Lavorgna are worried about are completely useless stuff, backward looking subterfuge. However, Joe wants all of us to give recession a chance.

Hey, anything can happen, right?

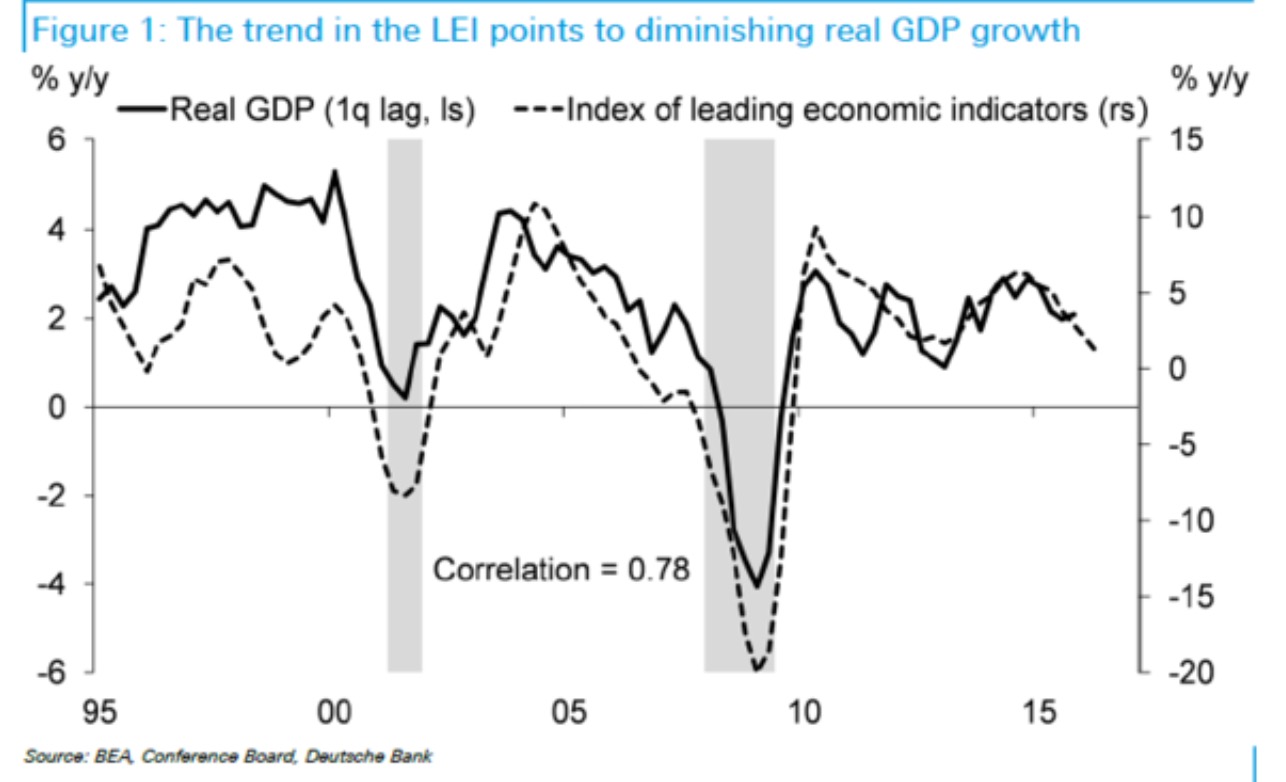

According to the firm’s Chief U.S. Economist Joseph LaVorgna, looking at the index of leading economic indicators — a measure by the Conference Board that includes economic indicators believed to change before the broader business cycle — brings cause for concern.

“While consumer spending was relatively sturdy in the second quarter and nonfarm payroll growth rebounded solidly last month, the downward trend in the growth rate of the LEI indicates that near-term risks to growth remain to the downside,” he writes.

Here’s a chart from the note, where recessions are shaded in grey. “As the chart below illustrates, in the past two business cycles, an outright year-over-year decline in the LEI after a prolonged period of growth has presaged recession,” LaVorgna says.

As of right now, recession doesn’t look likely. However, should we dive lower towards the end of 2016, fueled by energy prices falling to levels that place a sundry of American oil companies in financial distress, the narrative will quickly change from one of recovery to wrought with panic.

If you enjoy the content at iBankCoin, please follow us on Twitter

I’d be wary of analysis using the last 2 recessions, given that the most recent one was very atypical of post-WWII recessions.

Bring it on!! We need some better prices for stocks.