Raise your hands if you’re surprised. Goldman came up with a new way to measure the amount of debt in China’s banking system, measuring loans from banks to non-bank financials, and the results showed China has no idea what they’re doing.

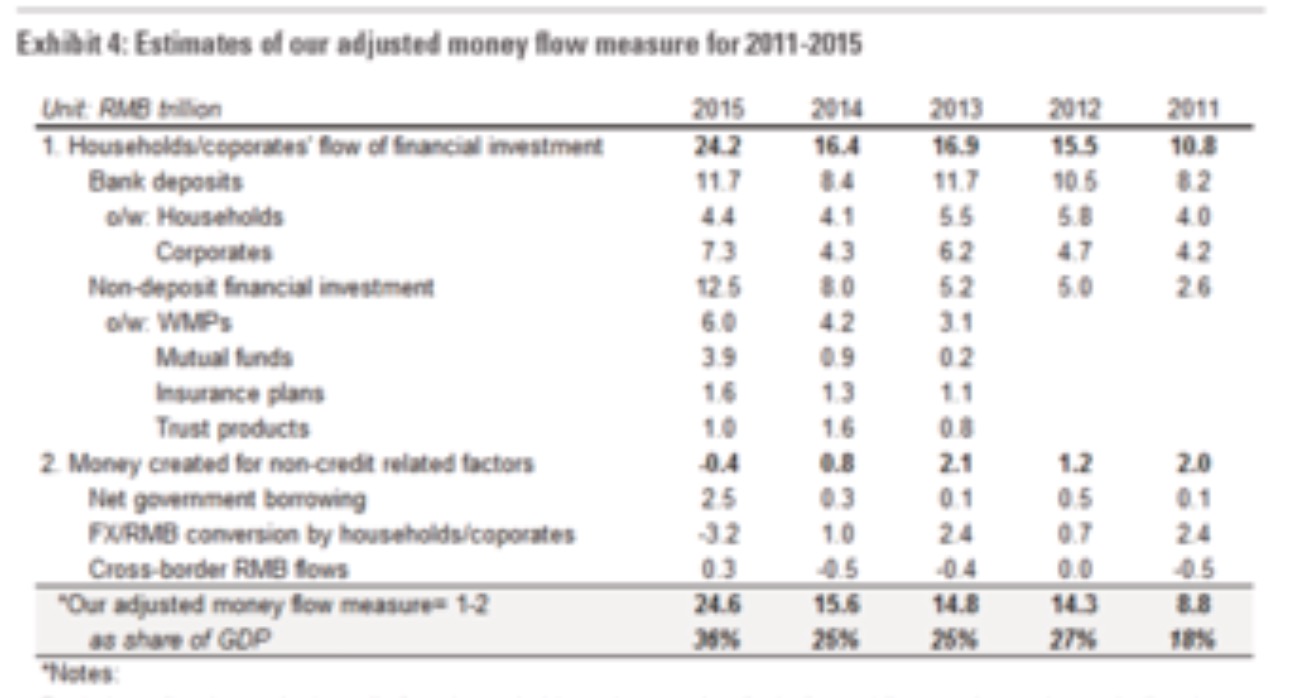

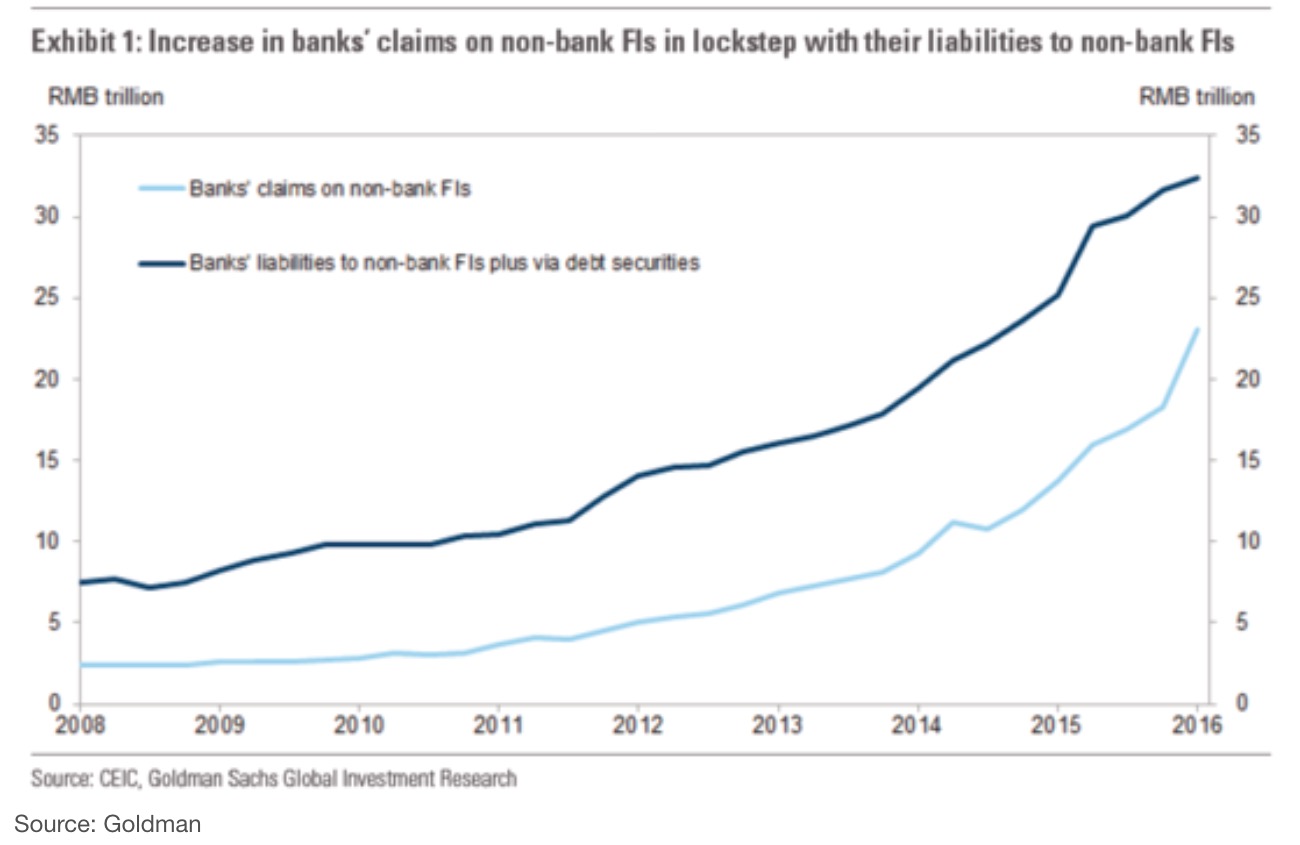

Faced with an increasingly tangled system of financing and a money supply measure that doesn’t fully encapsulate new credit creation, the Goldman analysts opt to take a slightly different approach to gauge the strength of China’s recent credit boom. They look at the (adjusted) flow of money emanating from households and companies and going into various financial investments.

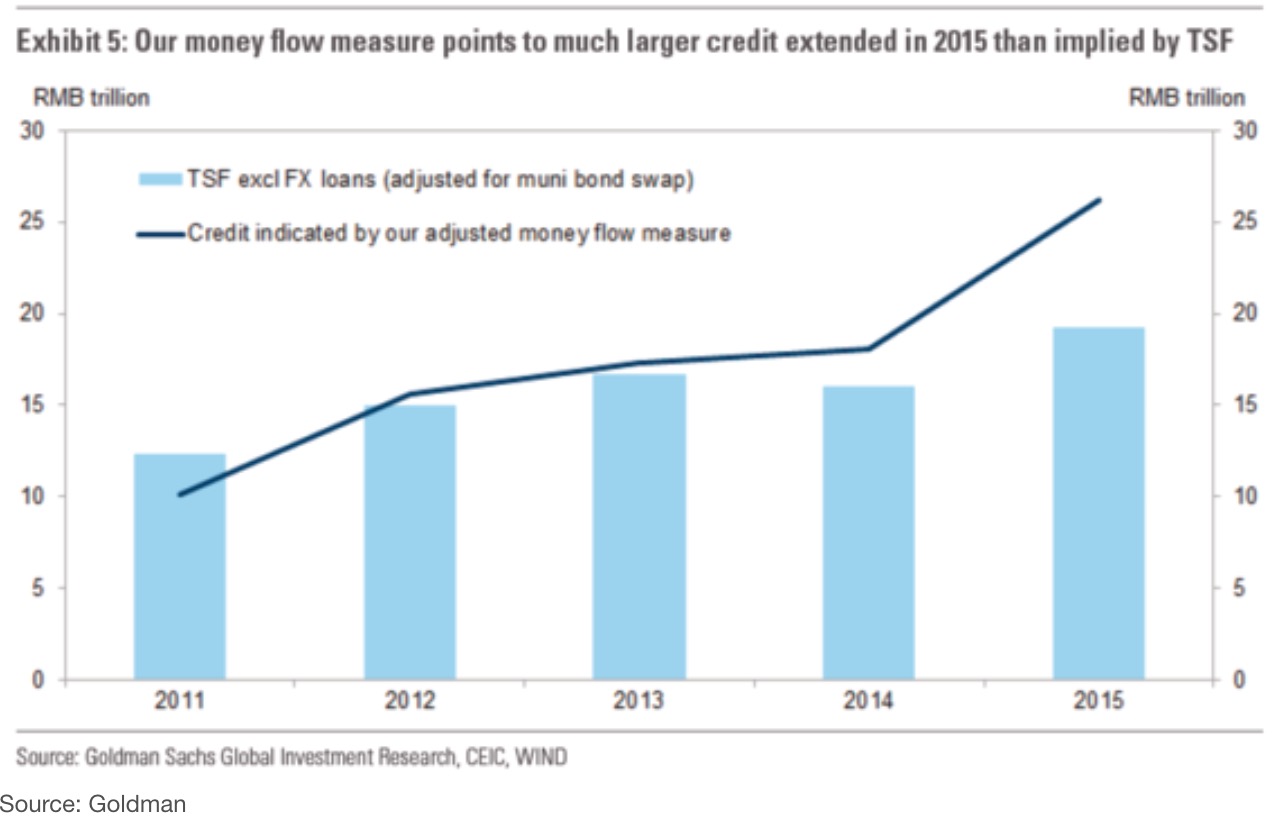

On that basis, China’s credit creation came in at 24.6 trillion yuan ($3.7 trillion) last year — far outstripping the 16 trillion yuan increase in money supply and the 19 trillion yuan of TSF.

“Such a scale of deterioration [in China’s leverage] certainly increases our concerns about China’s underlying credit problems and sustainability risk,” the Goldman analysts conclude. “The possibility that there is such a large amount of shadow lending going on in the system that is not captured in official statistics also points to [a] regulatory gap, and underscores the lack of visibility on where potential financial stress points may lie and how a possible contagion may play out.”

Nevermind all of this unpleasantness. Go about your busy days, drinking your fucking lattes, sopping up Chinese stocks because the charts look good.

If you enjoy the content at iBankCoin, please follow us on Twitter

Maybe Goldman is right. OTOH, their models are themselves very incomplete, being unable to consider all kinds of relevant but hidden information from the opaque economy of China. Still seems like it’s anybody’s guess what is really going on in China.

Agreed, but when a government power hides the real stats, is the real situation ever *better* than the official one?

Not usually. But in the case of China, the government seems to hide all kinds of things all of the time.

That is, the hiding seems habitual, rather than always a means to an end– unless the end is for public officials to get filthy rich by buying or shorting due to inside info.