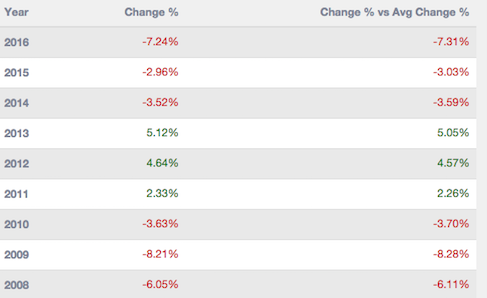

For the third year in a row, January is ending up a loser for stocks. The severity of this decline hasn’t been enjoyed by market players since the balling out days, when the lights were about to get turned off at the Treasury, of 2009. Those were grim days, indeed. So what’s next?

Naturally, history doesn’t always repeat itself, but often rhymes. With that in mind, it appears, either way we slice it, we’re entirely fucked for the month of February. Look at those 2008-2009 declines, boy (extra Raul).

data provided by Exodus

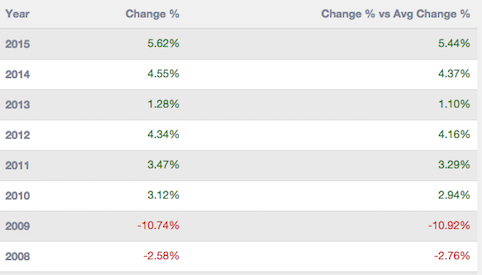

Or, maybe we relive the wonder year of 2014, a time and place when I had my single largest draw down ever, during the month of March.

Bottom line: I hope you’re enjoying the respite and have a mind about you to avoid diving into pools of hardened concrete.

If you enjoy the content at iBankCoin, please follow us on Twitter

Them are some nice declines

Feb 2014 +4.5%

Feb 2015 +5.6% [24% higher than Feb 14]

Feb 2016 +6.9% [ 24% higher than Feb 15]

I think for symmetry and continuing the pattern, Feb 2016 should be +6.7%

What are your thoughts on MNST Dr.? Citron right or they just needed a trade?

No, they are wrong

Thanks for the response. All the best good sir.

Political clarity is coming

Fed is Dead

Trump and Bernie will soon follow

S&P will finish February at 2000

Not exactly sure trump&bernie represent political -clarity-

Not exactly sure 2000spy wouldn’t be another -lowerhigh-

Fed is dead

Bernie and Trump will soon be dead, that is the clarity

This is not 2008….the market could end 2016 where it is today and significant opportunities will be available

way more fun than a sideways tape

Yesterday I was so depressed I went looking for a tall building to jump off of. But tragically, I’m leading a degenerate life at the beach. So I jumped off of a big sand dune. Although I did get some sand up my nose, the results weren’t quite what I would have hoped had I a 20-30 story building and some good hard pavement available. I’m not so depressed today.

2009… the Salad Days. What a fucking year. As long as your long position didn’t declare bankruptcy in their quarterly call you were good for a 20% pop.

There were companies with $5 per share of cash on their balance sheet trading for $0.50. God, that was a great trading environment.