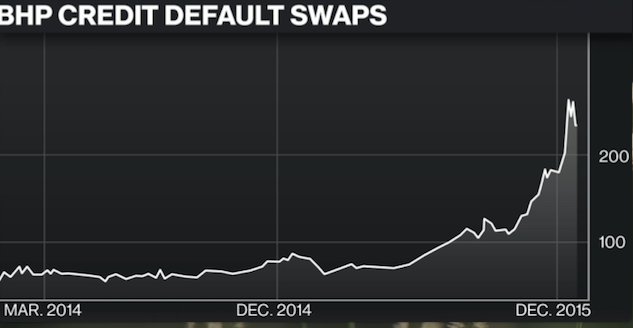

This is what you call ‘big game’, the Goldman Sachs of the commodity game. Interestingly enough, demand for insurance against BHP’s debt have been soaring as of late. Last I checked, they have upwards of $30 billion in debt. With a market cap upwards of $50 billion, the debt/eq levels, as of now, are manageable.

But CDS are soaring and BHP’s debt are now riskier than piece of shit retailer, Woolworth’s–making it the 4th riskiest debt on iTRAXX. Comically, the credit agencies still grade BHPs debt A+.

Whoever is buying BHP for its 11% dividend is a moron. By slashing the dividend, they’ll save billions. They need to do it right away and quit dicking around with trying to pretend things are getting better. The stock is down 62% over the past two years, -14.5% year to date.

If you enjoy the content at iBankCoin, please follow us on Twitter

Well twitter is down a lot more and doesn’t pay a dividend. BHP seems like a steal.

Whenever I see a reference to this company I can’t help thinking of BPH, ie benign prostatic hyperplasia, especially when the reference includes “mounting pressure”.

Lolz, woolworth…