I don’t even know what to say anymore. I guess higher rates will make CHK go away, finally, and pave the way for a better CHK. And, higher rates will help my mother save for retirement, since she hates stocks and loves CDs. Aside from that, raising rates is like sticking your face into the blades of a blender, on purpose. Sure, you’ll come out alive and in one piece; but you’ll be ugly as fuck.

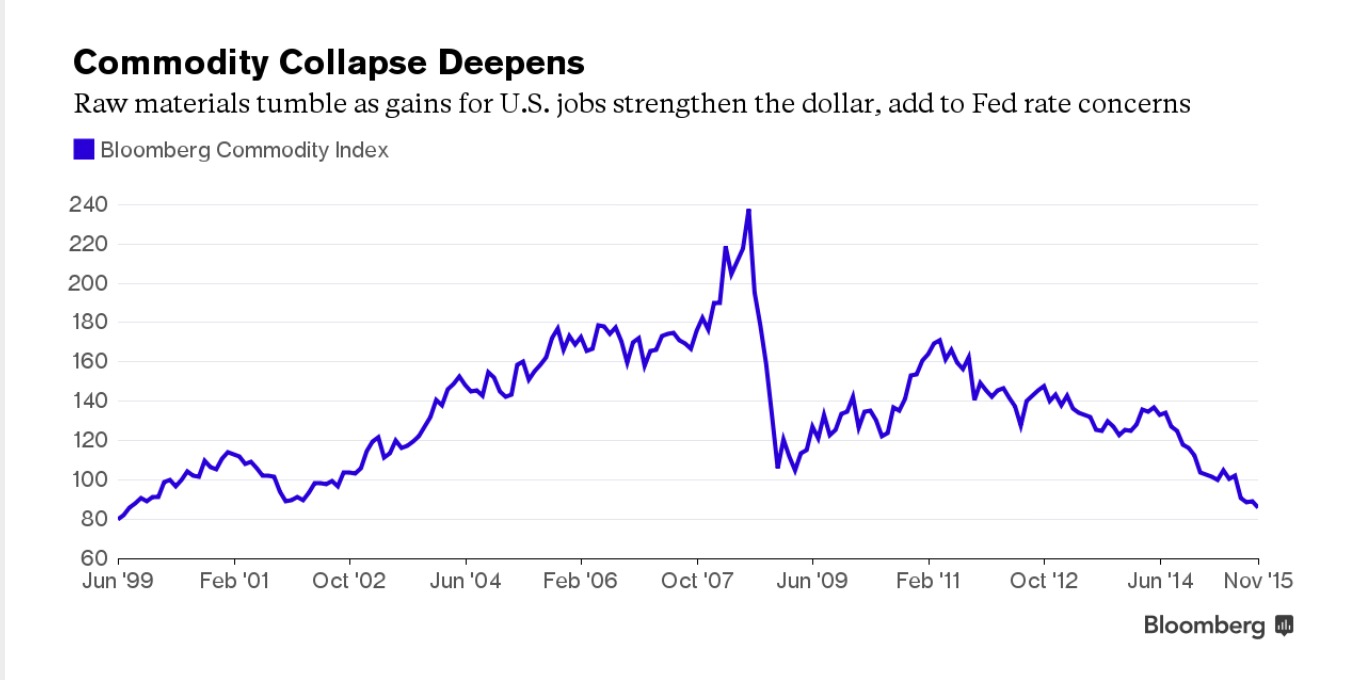

Investors are suffering through the worst commodity collapse in a generation. Bulls can blame the cooling economy in China, the world’s largest consumer of metals, grains and energy. The nation’s slowest pace of the growth in two decades is stamping out demand and leaving the world oversupplied with everything from aluminum to wheat. The prospect that U.S. borrowing costs will rise for the first time nine years is compounding concern that raw-material users will slow or abandon plans for expansion, eroding consumption.

“It’s all about the jobs report and the outlook for the Fed liftoff,” James Cordier, founder of Optionsellers.com in Tampa, Florida, said in a telephone interview. “The quantitative easing in the U.S. that began almost a decade ago boosted commodities, mainly because of the weaker dollar. The infrastructure spending in China has changed dramatically. Both of those are now behind us.”

I guess you cannot have the market you want; but, instead, you get the market you are given.

If you enjoy the content at iBankCoin, please follow us on Twitter

Look at history: equities rise and the dollar drops following rate hikes

All true. But I guarantee you previous rate hikes weren’t coupled with massive deflationary pressures.

Insurers and pension funds need some loving now. They still have fixed income mandates and with ZIRP in place and new issue coming in a shot rates, they are having a challenge matching.

This just feels like the taper all over again. All the buildup to hike – when has this fed come out of left field to fucking annihilate everything?

Just think that if they do hike ever, the catch is going to be their guidance on additional hikes going forward (based on data dependent jawboning)

Seriously Fly, calm down. If you really think a .5% fed funds rate is going to destroy commodities more than they are fucked already, well… I think that tells you that they are already fucked!

Stay away from commodity stocks, focus on services and the internet. This is destined to be.

Dr, I am your grandmother (EXTRA HOMO) and I own 2 CD LADDERS and my rates went up in Sept after Yellen threw up in her mouth, so I’m fine with ZIRP.