Utilities are running higher today and banks are down big. Do you know why? Of course you don’t.

These industries are very sensitive to rates. Now that bonds are rallying and rates are dropping, banks are down due to flattening yield curve and utilities are up because they are attracting yield hungry investors.

Very simple coward trade here: If you believe rates are heading lower again, fade the shit out of oil–because the dollar will likely strengthen. Also, get long bonds via TLT and your utility of choice. One of my favorites is ETR.

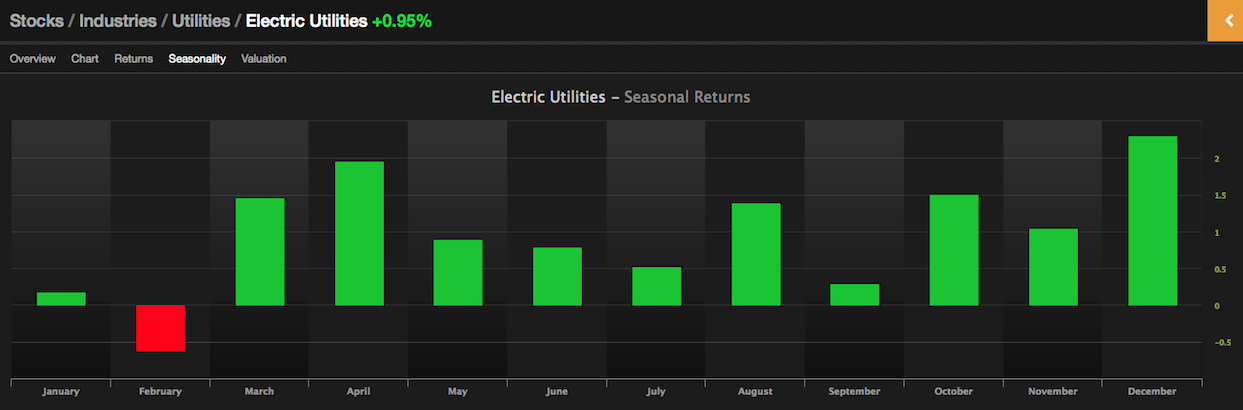

Historically speaking, utilities hold their butter during the arduous summer months, unlike many high growth sectors.

Naturally, I think this is a stupid trade. However, if you were heading out to summer in europe or somewhere exotic, unable to get to a telephone pole in order to connect to the internets, buying utilities here is not a bad idea. You could do a lot worse.

As for me, I’ve decided to raise a little cash, heading into the close. I am not interested in being beholden to any one stock, no matter the appeal.

If you enjoy the content at iBankCoin, please follow us on Twitter

I’m sitting outside as I type under overcast skies, and a high of 72 deg…. in the damned Arizona desert. Summer has been canceled!! (till next week)

It will soon be so hot Mr Buccs, that you will be sitting outside in sweaty trousers wishing for 72 degrees!

Trent – so hot, that all outdoors smoking must take place by 8:30am, or it just doesn’t happen…

2recordhighs

Fly are you still sticking to your no rate hike anytime soon thesis?

You ever play in emerging markets (other than Chinese burritos), Fly?

My charts tell me that now is a good time to short crude.

Curious as to the likely effects on emerging markets if oil suffers another downdraft.

Finally someone experienced enough to explain this head-scratching anomaly. For weeks pundits have been blaming rising rates for all that ails the market’s lately. Yet no one has been able to explain why financials (in which i am long) have been slow to rise and took a flat out dive today and utilities continue to rise (which I am presently short). I thank you for that. And I understand & agree w/ your sentiment that what is happening is cowardly & stupid. But discipline & reality trumps conviction. So the question is this: (and I encourage you to reply w/ absolutely no sense of responsibility for whatever may be the outcome in terms of what I do…) I will NOT be on a desert island during the next few months, but rather right here ready to strike. And this duet seemed the perfectly logical trade for where we were heading…(As did the gold short I might add…A trade I’ve profited from countless times except for the puts expiring worthless today due to this strange unwarranted & very temporary gold rally.) But does it STILL? Or have we completely shifted gears literally overnight? Are rates really BLAMMO shifting back down to neverland out of the blue? Cut the XLF long and XLU short? (again I’m keenly aware this is my call. I’m just seeking your more experienced opinion on the matter sir.) Thank you as always. -E

Look at TLT longterm. It’s starting to call the fed’s bluff. Trend is down. I think TLT surges on any surprise(or designed) equity hit. That may be what theyre counting on

SHOWTIME –Yep. It’s a complete reversal of the last few weeks. “Rising rates and going long the TBT” has been the mantra of analyst all month. Climaxed on Monday with that spike in German Bund rates and then bam we”re back in low rate world again…??? It’s so messed up. Everyone just has 20/20 hindsight.