Symbol U, atomic #92, Uranium is Earth’s heaviest natural occurring element in the periodic table.

Earth is dominated by the following 4 elements; Oxygen #8, Magnesium #12, Silicon #14 and Iron #26. For reference Silver is #47 and Gold #79.

Uranium has garnered a lot of attention this far in 2017. Little wonder, as the uranium plays are up nearly 60% since the deemed pro-nuclear Trump was elected in November 16′. Using the largest uranium ETF, ticker URA – Globe X Uranium ETF as a proxy for the space, https://www.globalxfunds.com/content/files/Global-X-Uranium-ETF-1.pdf ,one can clearly see the pain inflicted over the last 5+ years;

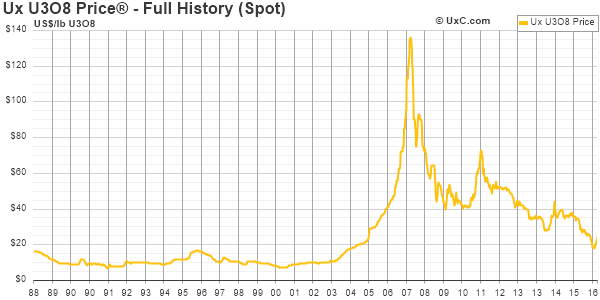

2017 +27%, 2016 -1%, 2015 -37%, 2014 -23%, 2013 -21%, 2012 -19%, 2011 -60.%. From inception (11/4/2010), URA is down 79.5% cumulative.

U3O8 uranium currently trades as $25.31.lb. down 81.4% from the 2007 high of $136/lb.

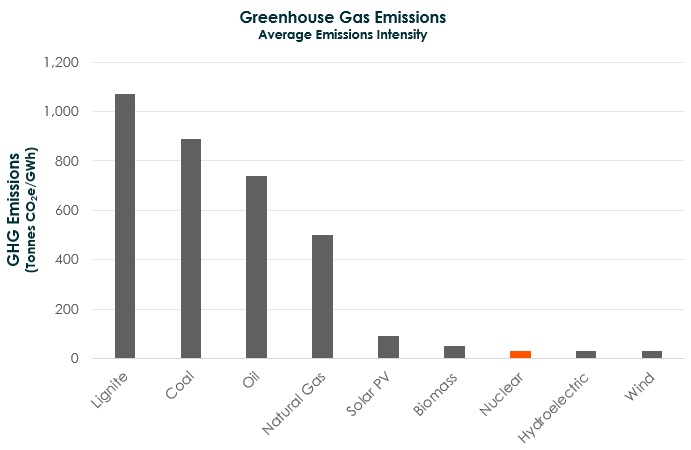

The merit of nuclear power on metrics of both energy security and a low-carbon future are beyond refute. Real facts;

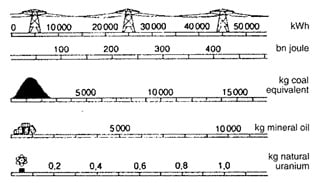

1 kg. of uranium, post enrichment and used for power generation in light water reactors produces 45,000 kWh of electricity. From an output perspective 1 kg. of uranium is equivalent to almost 10,000 kg. of mineral oil and 14,000 kg. of coal.

The comparisons on emissions are as striking as on energy output;

Approximately 10% of current world energy supply comes from nuclear power. There are 447 operable nuclear reactors in the world at present, requiring 140 million lbs. of uranium per annum. Utility stocks are estimated at 478 million lbs., 3.4 year of demand. The largest 3 markets for nuclear power are France (58 reactors, 75% of overall power coming from nuclear), Japan (42 operable reactors, 40% of power pre-Fukushima disaster, only 3 have been brought online since all closed in 2011) and USA (99 reactors, 20% of overall power). A total of 60 reactors are under construction at present in China, India, South Korea, UAE and Russia . Twenty two of the nuclear plants under construction are in pollution ridden China, where 40% of growing electricity demand is still coal-powered, and the liveability of 25 of its largest cities hinge on nuclear power’s hockey stick growth projection. China is expected to have 40 nuclear reactors online by 2020 and to add 10 per annum thereafter. CNECC (China Nuclear Engineering and Construction Corporation) is the exclusive nuclear plant builder in China.

The USA only produces 4.3mm lbs. of uranium at present (2% of global output) versus an annual need of 56mm lbs., hence 93% of the uranium the US needs annually to operate existing nuclear plants is imported from places like Kazakhstan (39% of world uranium supply). Canada accounts for 22% of world supply and Australia 9%.

The World Nuclear Association (WNA) appear to have the best stats on the space. The top producer is Kazakhstan’s KazAtomProm at a 22% share. They recently announced a 10% production cut for 2017 (3% of world supply).

Canada’s Cameco is world #2 producer, not far behind KazAtomProm, at 18% of global production. The stock ticker is CCJ on the NYSE in US dollars and CCO on the TSX in dollarette’s (CAD). Despite all the seemingly good fundamental news on uranium, the price action has been nauseating. Cameco has some issues. Customer concentration is one, whereby almost 1/2 their long term sales contracts are with 5 key customers. Cameco received a termination notice last week from Japan’s TEPCO (Tokyo Electric Power, operator/clean upper of the crippled Fukushima plant) on a contract running through 2028 worth approx. $1bln. To give you an idea how offside TEPCO was on this long term uranium contract, 9.3mm lbs. spot is worth approx. $233,000,000 versus the $1bln contracted value, that is a $767mm potential hickey for Tepco. They have claimed “force majeure” in cancelling the Cameco contract, which might have had a shot of success if they had not accepted deliveries and paid for uranium 2014-2016. Sounds more like force manure to me, most expect Tepco will have to honor the contract via legal settlement. The news sent CCJ shares down 12.5% last week, although it remains above the 200-day moving average at $10.67.

The 2nd blemish to be addressed by potential longs is Cameco’s ongoing tax battle with the Canadian tax authorities, the venerable Canadian Revenue Agency (CRA). CRA are asking for C$2.2bln (US$1.7bln) in back taxes related to a purported tax dodge run by Cameco 2005-2015 where C$7.4bln of earnings were allegedly run through a low-tax Switzerland subsidiary. Most expect this case to be settled out of court in either 2017 or 2018, but the magnitude is unsettling to say the least. Plenty of press on the matter for those that would like to weight the merit of the case. The market cap of CCJ, as noted, the 2nd largest global uranium producer, is $4.15bln or 10% of TSLA ($40.4bln), as a point of reference.

There is a high degree of idiosyncratic risk in buying the listed equity of individual uranium companies. The largest ETF highlighted above, URA has enough daily turnover to be considered liquid, but it small at $250mm in AUM (MER 0.70%). The weighting of the ETF in Canadian uranium names is high at 60% (23% in Cameco alone). The Kazakhstan names do not have listed equity.

For those seeking modest allocations to the uranium space, I would recommend looking at URA for the diversification, but shorting CCJ to reduce the single name exposure. With the proceeds of the CCJ short I would buy smaller US producers (some better described as micro-caps) as they will likely have few headwinds under the current administration (i.e. permitting, production, and expansion). The smaller players are largely unhedged without long term supply contract hence they provide more leverage to the underlying uranium price.

A sustained recovery in uranium equities depends on uranium prices staging a recovery from the depressed levels we have seen over the last several years. We have smoke, we need fire. JCG

Note: Long CCJ (1% weighting), but looking to diversify near term to a broader grouping of uranium names.

If you enjoy the content at iBankCoin, please follow us on Twitter

Thanks for your analysis and taking the time to share. Always enjoy your contributions to the site.

Thanks. The nuclear energy space is quite murky, and clubby, that is for certain. Nuclear reactor makers, it appears, are more toxic than the miners! France’s Areva S.A. has been in the press requiring up to a EUR 5bln bail-out from the French government, “assisted” by 500mm from Japanese investors. Toshiba are shutting their nuclear plant construction division amidst steep losses (primarily out of the US via their Westinghouse acquisition). Hitachi-GE is another major player in the space. Areva is partners with Cameco at two sites in Saskatchewan, Canada. Cameco even has producing uranium assets in Kazakhstan where they JV with KazAtomProm. A case of keeping your friends close but your enemies closer I presume.

Great post!

Confused as to why you recommend shorting CCJ but said you are long?

Well thought out article and thanks for providing clarity.

I bought the biggest player to get long the space, but want a more nuanced uranium exposure longer term, along the lines of the article. Sold my CCJ last night @ 10.68 and bought UUUU.

i think your post are spectacular, well thought out, researched and referenced.

I read you regularly, and i’d like your input for some of my thoughts.

I’m gonna play devil’s advocate for a moment.

How does Tepco backing out of its deal with Cameco effect uranium ?

Cameco potentially could loose billions in revenue, but,…….

much more uranium could/would be in supply as well, which bodes poorly for the laws of supply and demand,….

you thoughts good sir,…

many thanks

Wolfy, High praise, thx. Tepco’s balk at the Cameco contract matters to Cameco and will result in 10-15% hit to near-term EBITDA as per BMO’s Ed Sterck. The total amount of uranium in question is small in relation to the overall market, i.e. 9.3mm lbs. through 2028 or 846k lbs./yr with global nuclear plants using 140mm lbs./yr that is 0.6% of incremental uranium supply in the market. In 2010 (pre Fuk) Japan imported 14mm lbs. to feed 50 odd reactors and only a few have since restarted. A total of 24 are “in process” to reopen, which would result in approx. 7mm lbs. of demand coming back online. Japan was the world’s largest importer of LNG in 2016 at 85mm tonnes (Tepco accouning for 14mm tonnes alone to serve Honshu which includes Tokyo’s 37mm people). They may not like nuclear as much post Fukushima (latest clean up cost $188bln), but they need it both from a costing and emissions target perspective. The data is slightly stale, but the cost of LNG is about 50% higher than nuclear for Japan(13.7 yen per kWh versus 9 yen for nuclear). As noted, Kazakhstan announced a 10% production cut for 2017 which is 3% of world supply (5x the Tepco contract effect). Like with many global finite resources, China is the 800-lb. elephant in the room. Their nuclear power growth pace and hence voracious uraniumappetite will likely outstrip their stated goals, with reactors built more like cars in terms of pace and efficiency. Little talk of India either, but a decade out they will likely be the #2 uranium customer to #1 China. JCG

phenomenal numbers

in simplistic terms, would you say that uranium looks short term bearish,….but

long term very very boolish ! ; )

have a great day

thanks so much, cheers

do you have the numbers for reactors coming on line in 2017, 2018, 2019, 2020 etc,..?

thanks again sir

>60 are under construction in 13 countries, according to WNA, with an expected capacity of 64.5 GWe, 16% of current global capacity (i.e. plant capacity is rising). New plants are only part of the story. Generally, reactor lives are being extended from initial tenors of 20-40 years to as long as 50+ with 70 years being the assumed max life. Many existing reactors have seen capacity bumps of as much as 20% as well as retrofits are done to extend operating lives. JCG

This construction table is from WNA is from April 2016;

Power reactors under construction

Start † Reactor Type Gross MWe

2016 India, NPCIL Kudankulam 2 PWR 950

2016 India, NPCIL Kakrapar 3 PHWR 640

2016 India, Bhavini Kalpakkam FBR 470

2016 Russia, Rosenergoatom Novovoronezh II-1 PWR 1070

2016 USA, TVA Watts Bar 2 PWR 1180

2016 China, CNNC Sanmen 1 PWR 1250

2016 China, SPI Haiyang 1 PWR 1250

2016 China, CNNC Changjiang 2 PWR 650

2016 China, CNNC Fuqing 3 PWR 1080

2016 China, CGN Fangchenggang 2 PWR 1080

2016 India, NPCIL Rajasthan 7 PHWR 640

2016 Pakistan, PAEC Chashma 3 PWR 300

2017 Slovakia, SE Mochovce 3 PWR 440

2017 Russia, Rosenergoatom Pevek FNPP PWR x 2 70

2017 Russia, Rosenergoatom Leningrad II-1 PWR 1070

2017 UAE, ENEC Barakah 1 PWR 1400

2017 China, CGN Taishan 1 PWR 1700

2017 China, CGN Taishan 2 PWR 1700

2017 China, CNNC Sanmen 2 PWR 1250

2017 China, SPI Haiyang 2 PWR 1250

2017 China, CGN Yangjiang 4 PWR 1080

2017 China, CNNC Fuqing 4 PWR 1080

2017 China, China Huaneng Shidaowan HTR 200

2017 China, CNNC Tianwan 3 PWR 1060

2017 Russia, Rosenergoatom Rostov 4 PWR 1200

2017 Korea, KHNP Shin-Kori 4 PWR 1350

2017 Korea, KHNP Shin-Hanul 1 PWR 1350

2017 India, NPCIL Kakrapar 4 PHWR 640

2017 India, NPCIL Rajasthan 8 PHWR 640

2017 Pakistan, PAEC Chashma 4 PWR 300

2018 Russia, Rosenergoatom Novovoronezh II-2 PWR 1070

2018 Slovakia, SE Mochovce 4 PWR 440

2018 France, EdF Flamanville 3 PWR 1600

2018 Finland, TVO Olkilouto 3 PWR 1720

2018 Korea, KHNP Shin-Hanul 2 PWR 1350

2018 UAE, ENEC Barakah 2 PWR 1400

2018 Brazil Angra 3 PWR 1405

2018 Argentina Carem25 PWR 27

2018 China, CGN Yangjiang 5 PWR 1080

2018 China, CNNC Tianwan 4 PWR 1060

2019 USA, Southern Vogtle 3 PWR 1200

2019 USA, SCEG Summer 2 PWR 1200

2019 UAE, ENEC Barakah 3 PWR 1400

2019 China, CGN Fangchenggang 3 PWR 1150

2019 China, CGN Hongyanhe 5 PWR 1120

2019 China, CGN Yangjiang 6 PWR 1080

2019 China, CNNC Fuqing 5 PWR 1150

2019 Romania, SNN Cernavoda 3 PHWR 720

2020 Russia, Rosenergoatom Leningrad II-2 PWR 1070

2020 China, CGN Hongyanhe 6 PWR 1120

2020 China, CGN Ningde 5 PWR 1150

2020 China, CGN Fangchenggang 4 PWR 1150

2020 China, CNNC Fuqing 6 PWR 1150

2020 UAE, ENEC Barakah 4 PWR 1400

2020 Romania, SNN Cernavoda 4 PHWR 720

Toshiba’s nuclear woes are worse than the market expected. Their 1/2 life might not get them to 2018! Reuters reporting delayed financials and concerns about “going concern”. This is big.

What a fantastic summary of the uranium/nuclear industry. Always informative posts! So would the impact of the Toshiba announcement this morning not be extremely negative to the thesis with the likely delays in plant construction? Or do I misunderstand what the impact would be?

“Toshiba said it would withdraw from nuclear plant construction overseas. Reuters reported this month that Toshiba was seeking at least a partial exit from ventures in Britain and India, a blow to both countries’ nuclear plans.”

Strange that in spite of this, the uranium story seemed very positive (Cameco upgrade) for uranium stocks.

Doctor, To my knowledge there has never been a nuclear reactor brought on-line on-budget, they are notorious for going way over budget. Toshiba will be a tiny company if they survive this. Toshiba have announced their 60% funding for the NuGen project in the UK will be pulled. About 20% of the electricity in the UK is nuclear derived (similar to the USA). The UK government is expected to pony up GBP7bln for a 25% stake.

Hitachi-GE are expected to take up the slack on the construction side, but funding is another issue.

Less private funding and more public could stall the ramp in new capacity to some extent. The global base of nuclear power generators will continue to grow regardless though and approx. 1/3 of the uranium required as feedstock needs to be replaced every 18 months. JCG