Latin American issuer Argentina (B- rated as of last week) returned to the bond market with great fanfare, raising $16.5bln across four maturities, making it the largest ever EM bond issue. There were over $68bln in orders for the debt issue which allowed the 10 year (largest) tranche to price a full 50bp (0.50%) tighter than initial price talk. The bond rallied in the gray market, with the $6.5bln of 10’s trading up $1.60-$2.10 in price terms in late Tuesday trade.

Argentina was rewarded for being market-friendly (legacy default on $95bln of debt in 2001 aside) and having a pragmatic administration at the helm. 15 years “in the box” was deemed to be enough by the market and the recent uptick in emerging market sentiment was pushed to full advantage.

Over 60% of bond proceeds ($10bln) are earmarked for hedge funds and other investors, led by billionaire Paul Singer’s Elliott Management, who recently won a protracted court case against Argentina with respect to defaulted Argentinian debt. 15 years is a long time to wait for a 10 bagger. Thirty years is also a long time to hold a B3/B- sovereign credit with a 8% coupon. JCG

If you enjoy the content at iBankCoin, please follow us on Twitter

How anybody can view Argentina as an “emerging market” is beyond my comprehension.

pb_ The gradients are not mine, but the WTO and others still classify Argentina as a “Developing” nation. The only metric currently in the “Developed” category is per capita GDP, with US$12,000 being the cut-off for “Developed” status and Argentina $3,000+ over on this sole metric. JCG

I was in no way referring to you: just amazed at the investment world “party line”. Argentina has been in an “emerge/default” cycle for many decades…

Pretty sure Argentina will now seek funds to explore for more oil/gas. Big shale deposits to exploit in Vaca Muerta (dead cow).

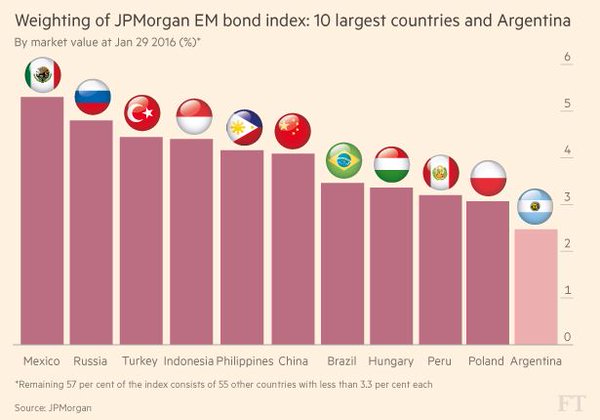

pb_ Very true. There are really 3 categories, Emerging, Developed and Argentina. Can’t argue with the sentiment improvement though. Lebanon was able to issue 8 and 15 years at 6.65% and 7% respectively on the same day.