After facing the first hint of adversity in 2013, I was thinking this weekend about how we as traders, deal with turmoil.

I got into investing/trading in 1998, and if there is one thing that I can take away from this experience, with absolutely certainty, is that long-term success in this biz is crafted from the realized loss of capital and the depths of despair.

I love when I read traders who just started flinging their feces at the walls starting in 2009, “swinging their dicks around” with tales of market winship. Traders who boast of nothing but wins are, in my opinion, a joke.

You want to know why? Because NO ONE wins all the time, every single person who has ever traded in the market has had a losing streak and will experience draw downs.

That is what I care about. How do traders deal with adversity and “lossship”. How do they deal with the humbling experience of have a thesis, throwing real money at that idea and having the market reject that idea, sometimes with extreme prejudice?

From a personal standpoint, my approach to this matter is (and will be) a constant work in progress…as I still do not handle it very well. Few things suck worse than busting your tail to hammer out a few percentage points, only to watch them evaporate in a couple of sessions.

Nevertheless, as long as the market continues to trade, there will always be opportunities to learn. Figuring out how to deal (emotionally) with the inevitable fact that your account will not reach new highs every single day is among the most important lessons to learn.

Being able to survive draw downs within the constraints of your strategy will build self-confidence. Have a sense of awareness that losses are part of the game. Even some of your best conceived ideas will not result in winning trades, and that is ok. Those experiences can be some of the most frustrating, but also realize that confidence is built through having control over your strategy and recognizing that even great ideas don’t always pan out.

I believe that self-confidence does not materialize out of winning all the time (though, keep in mind, that doesn’t hurt); rather it is forged from how we deal with losing. There is exponentially more gratification gained from staring down a grave scenario and figuring out a plan to turn things around, than from jumping in and being successful right away (which, I believe is an unsustainable approach to trading).

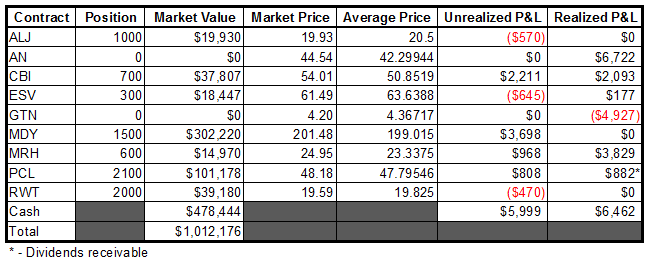

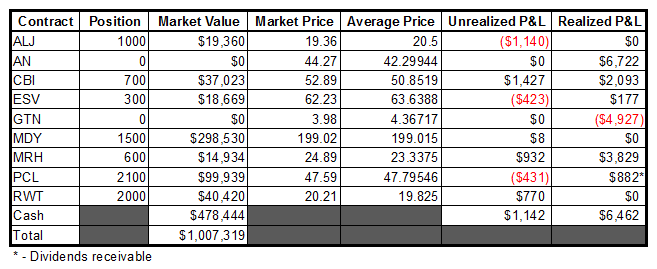

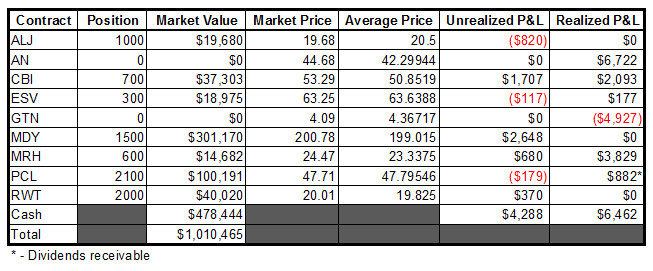

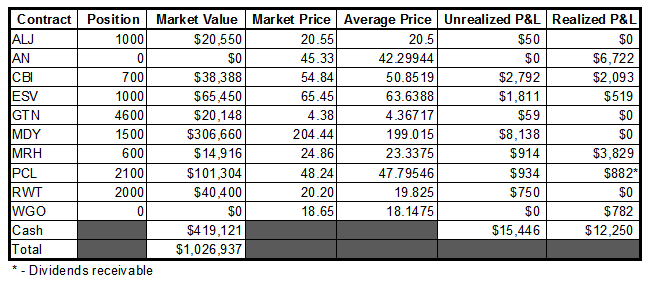

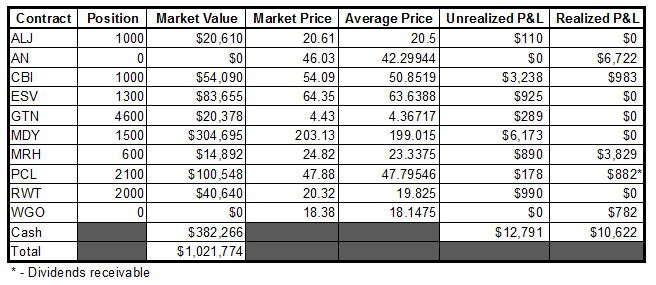

Here is the latest portfolio update, which had a nice rebound on Friday.

-EM