Busy morning at work; therefore I don’t have much time for written analysis so I’ll sum things up quickly.

- I actually would have preferred to see ALJ sell off a little bit more to form a more “well-rounded” (literally) pullback. I’m never a big fan when stocks snap back quickly to violent selloffs. I wouldn’t be surprised if this ended up in the 19’s in a few days.

- AN is in the midst of making a very interesting pattern with a nice “spinning top” (my favorite candle at the bottom of pullbacks) on low volume yesterday. I believe that this is either the start of a more lengthy correction (more likely) or the bottom of this range. Part of me wants to buy more, but I’m going to err on the side of caution and watch.

- CBI marched higher yesterday on nice volume and is up big (for CBI) in pre-market today. We are in the void here people…get it while the “gettin’s good”.

- ESV marched higher and faded slightly toward the end of the day. I pondered taking some profit on a portion of my position, but decided to let it ride.

- GTN has started to come in a bit. I will be watching the trading closely along with monitoring The PPT score of this stock to determine if/when would be a good time to add (I’m looking for a “technical score” under or around 2.5 for you distinguished gentlemen of The PPT).

- MRH continues to plod right along…that’s ok, I’m sitting on a small position with a very nice profit here, so I don’t mind if it continues to meander right around 25.

- More of the same from PCL, the daily range of prices keeps getting smaller and smaller. This sideways stuff has sucked some of the momentum out of the name, but it could just be “resting” in order to set up for another move higher. I’m always prepared for head-fakes out of these tight ranges…so I will be watching for that.

- RWT has started to “ride the band” on the upper Bollinger Band (20,2). This is a very bullish development, as in the past I have seen stocks glue themselves to the upper band and ride higher as volatility expands (which is what the bands attempt to measure). Again, we are well into the void with this one, and there are plenty of good seats still available.

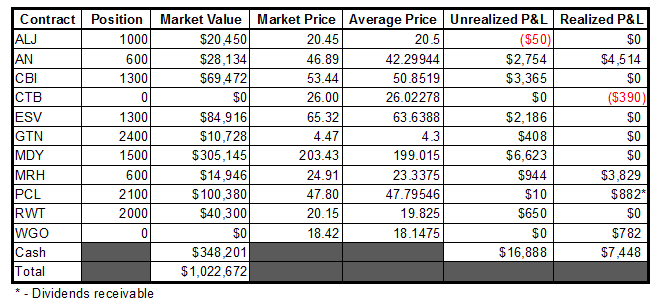

New highs are great. Gaining on the S&P with 35% cash is also a “hoot”:

-EM

Comments are closed.