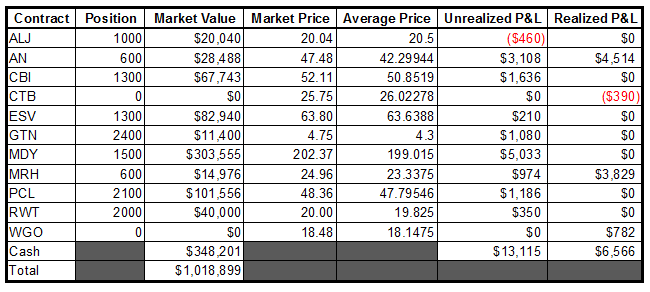

Nearly halfway through the month of February, my overall performance continues to lag, yet I find myself surprisingly content with my progress and approach to trading. My cash levels have rarely dipped below 35%, and while this is the most significant factor contributing to my underperformance, it is a function of my strategy more than anything. Sure, I could be going into these stocks and taking on larger positions, but that is not what I have set out to do.

You see, my 2012 was littered with trade after trade where I eschewed my rules for the “home run”. Far too often I found myself taking on way too much risk and finding myself behind on trades. Losses are part of the game, if I follow my rules, I can withstand a flurry of losses in succession without too much harm. When I start making trades in order to make up for those losses, well, that’s when I start getting myself into trouble.

Thus in 2013, my goal was to stick to my plan, and not get swept up in the noise that surrounds trying to beat a particular average or fellow trader(s). I wanted to prove to myself (and the world, I suppose) that I can be a trusting steward to a decent sum of money. My plan focuses on being conservative and patient. Yes, I realize that doesn’t generate excitement or “buzz” around the interwebs, but I don’t care about that. So, in comparison to the other bloggers here and even compared to the market averages, my returns are mediocre. Still, I feel like I am in complete control of this portfolio, and have laid the foundation for a very successful year.

Now for a few words about the stocks I’m trading:

- ALJ was absolutely crushed yesterday, down almost 5% on no news. This stock is relatively thin, so I suppose moves like this are to be expected, but this was a jarring experience, and a pretty big red flag. Now, I’m not going to overreact and cut this one purely based on one bad day. In fact, this could potentially be setting up for another buying opportunity (if buying dips is your thing…it’s mine). Let’s just wait and see what happens. My “stop” is around 18.8, so there is still plenty of room for correction.

- Another disconcerting session was turned in by AN yesterday. The post-earnings range is still in play here, but that was kind of a crappy looking candle. I’m going to liquidate the remainder of my position on a drop (and close) below 47.

- CBI looked great until 2PM, then basically went straight down the remainder of the day to close up only slightly. I find watching a winner bleeding out to be more frustrating than having a stock that is down from the outset.

- I mentioned yesterday that despite both being in the energy sector, ESV and ALJ appear to have a correlation equal to -1. Monday ALJ was up big, ESV gets hammered, yesterday the exact opposite is true. I figured that owning both of these stocks would give me some exposure to that sector (energy), but they are proving to be one grande (sic) “circle-jerk”. I am encouraged by how ESV has set up right here. Earnings are a week from Thursday (2/21), so hopefully there is some “pop” in this one prior to my forced liquidation.

- I hope you, my dear readers, have been paying attention to my Top 10 list, which has featured GTN amongst the ‘leaders’ for a while now. I am up almost 10% in this position since Friday and am amazed by the strength in this stock. I will be adding on any “constructive” pullbacks until it hits 8.5 (yes, that is not a typo, 8.5) or until I deem it time to sell. Lots of momentum here.

- PCL goes ex-div today for at least 0.42/share. I’ll take the cash and will not re-invest.

New highs:

-EM

6 Responses to “Portfolio 02/12/13; More on My Underperformance”

Raul3

You do good work EM. I’m always watching your picks and watch lists. I agree, the names you play are not hype. That’s okay. You know what’s cool? Banking coin.

Keep it up and when the tide shifts you’ll be glad you stuck to the plan.

Warm Regards,

Raul3

elizamae

Thank you good sir for your kind words…the feeling is obviously mutual.

OldDix

I agree with you on AN. I use Count Back Lines for entry and exits for no better reason than I need the discipline. I sold AN yesterday because it fell through 47.70. I kept it in my watch list for re-entry because I believe it will eventually run. So I’ll wait for it.

elizamae

It’s getting hammered in pre-market today, so your sell was certainly well timed.

OldDix

Doesn’t look that bad!

elizamae

Heh, yeah, it does look ok now. My full position basis in in the 42’s so I’m just watching this without much care other than protecting my profits.