Sorry about the “fat finger” there…sometimes using “Tab” leads you to buttons that aren’t ready to be depressed.

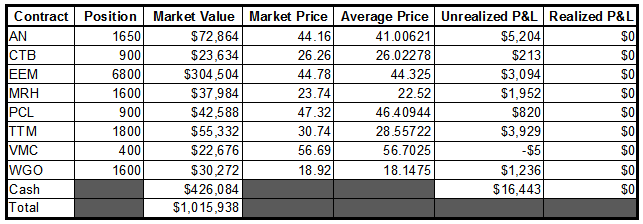

Some brief notes about my positions:

- I will not miss the opportunity to add more shares of AN. Still, this stock needs to take a breather. I will be monitoring to see how it is correcting through time versus price.

- CTB keeps knocking on the door (26.5-27) and continues to be rebuffed. Again, as I have made mention of several times in the past, I’m not in love with this position, so if it starts giving me grief, I’m cutting it loose.

- EEM moved in tandem with the market on Friday, I’m pretty sure that doesn’t mean anything. My 21 day rotation period is approaching, and right now MDY and IWM are jockeying for the top spot…with EEM still lurking in third place.

- The anticipation for MRH to break through 24 continues to build. I will add then.

- PCL could be considered an ancillary housing play, no? I believe that plywood is still an important building material.

- TTM is now toying with 30.8-30.9 pretty regularly. I think that how these stocks behave if/when they break through these resistance points I’m mentioning will go a long way in giving me some sort of idea as to where the market is going.

- I started a position (25%) in VMC on Friday, referenced here.

- Also, as has become a Friday ritual, I added to WGO right before the close, bringing it up to a 50% position.

One minor change: since the inception and YTD numbers would be identical and redundant, I added a column “% from HWM” to this table, meaning percentage from my “high water mark”. This value will obviously always be less than or equal to zero (0).

-EM

Comments are closed.