I can barely contain myself as this market is blowing minds right now.

Actually, it isn’t.

I apologize for my lack of penmanship as of late, matters of Gas Station and Doughnut Shoppe development require the bulk of my attention throughout the formal trading day. I’m playing and following along, unfortunately I just don’t have the creative energy to bang out posts between updating traffic models.

If you are enjoy my work, please follow me on Twitter and/or share it with your followers (just click on the “Tweet” button at the bottom, it’s simple). </shamelessgroveling>.

As for the market proper, I’m finding very little of interest to write about anyway. Aside from Bill Ackman’s well traveled genitalia being caught in the zipper (I can’t speak to that) and AAPL briefly dipping below 500, things have been pretty boring. Everything just keeps meandering along…I’m lying in wait, but I’m not seeing anything worth taking a chance on right now.

Recently I profiled a couple of stocks that I am actively monitoring. Both Redwood Trust (RWT) and Chicago Bridge and Iron (CBI) are currently within 3% of the area(s) where I’m looking to start a position.

As for the stocks themselves, I think RWT will pause as it closes in on the most recent high of 19.45, had way back in August of 2009. I’ll be keeping a close eye on that situation as it develops…a break to the upside in that region and she could go.

In CBI, the region between 49.50 and 50 is of key interest to me…I’m looking for similar “healthy” characteristics of stock behavior in that region.

As an aside, one of my projects that I have lined up is to see if I can use the daily ebbs and flows in PPT data to try and find (more) ideal spots for buying in these aforementioned (and other) regions.

I must say, the upgrades leaked a while back from PPT 2.0 look like they (the upgrades) will make this task much more enjoyable (coughcoughnudgenudge).

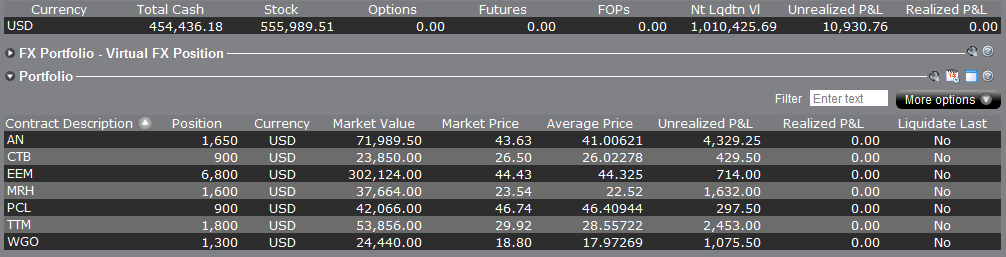

As for my portfolio…some thoughts:

- AN closed higher…appears to be running out of steam…should rest, looking to buy more. Optimal target: 48.50

- CTB. I’m looking at the long term charts of this stock and I think it deserves it’s own post for further analysis. Interesting.

- The only reason why my 1/2 invested portfolio is lagging is EEM. Continued weakness out of emerging markets.

- I think they consider the pattern on MRH a “bull flag”. Correct me if I’m wrong.

- PCL

- TTM was down and came roaring back…unusual looking candle printed today. That concerns me a bit.

- Upon second glace, the situation with WGO is getting much more interesting. Nice looking pullback here. I may look to nibble on a few more shares tomorrow or Friday if it continues to behave in such a manner.

For the day: -0.06%, month: +0.88%. And you thought I was being facetious when I said things were exciting.

-EM

3 Responses to “Portfolio 01/16/13: FEEL THE EXCITEMENT”

charlie

Are you a DNKN franchisee?

elizamae

Hah, no, but we do perform the transportation impact studies for a local development group that local DNKN’s.

elizamae

err…*for a local development group that builds DNKN’s”