Reader “Jworthy” commented on this post with the following:

I have been enjoying your Volume at Price approach since you were elected. And I think your oracle could indicate quick upside for $GNW…

But I don’t *quite* have a handle on it yet – despite following your posts closely for the last week-ish. So… Assuming fundamentals are improving… Do you think my GNW can keep running, or pull back?

Would really appreciate your thoughts if you get the time.

Well, let us take a look at this stock, shall we? GNW provides an interesting example of how using Price by Volume to analyze a daily chart can lead to one conclusion, only to be somewhat refuted when taking a larger timeframe into consideration. Let’s start with the daily:

This looks like a very nice Low Volume Node (LVN) immediately above yesterday’s high. If the stock can clear the highs from early 2012, one could say that there isn’t much in the way of resistance until the mid 12’s. Lots of pricing disequilibrium in this area on the daily chart…that’s not to say that it won’t form, but, historically speaking…it’s not there.

On the daily, traders and investors clearly felt that the most ideal representation of value was in the 5-6.25 area. There is much higher pricing indecision where we currently reside…on the daily. Let’s now move to the weekly:

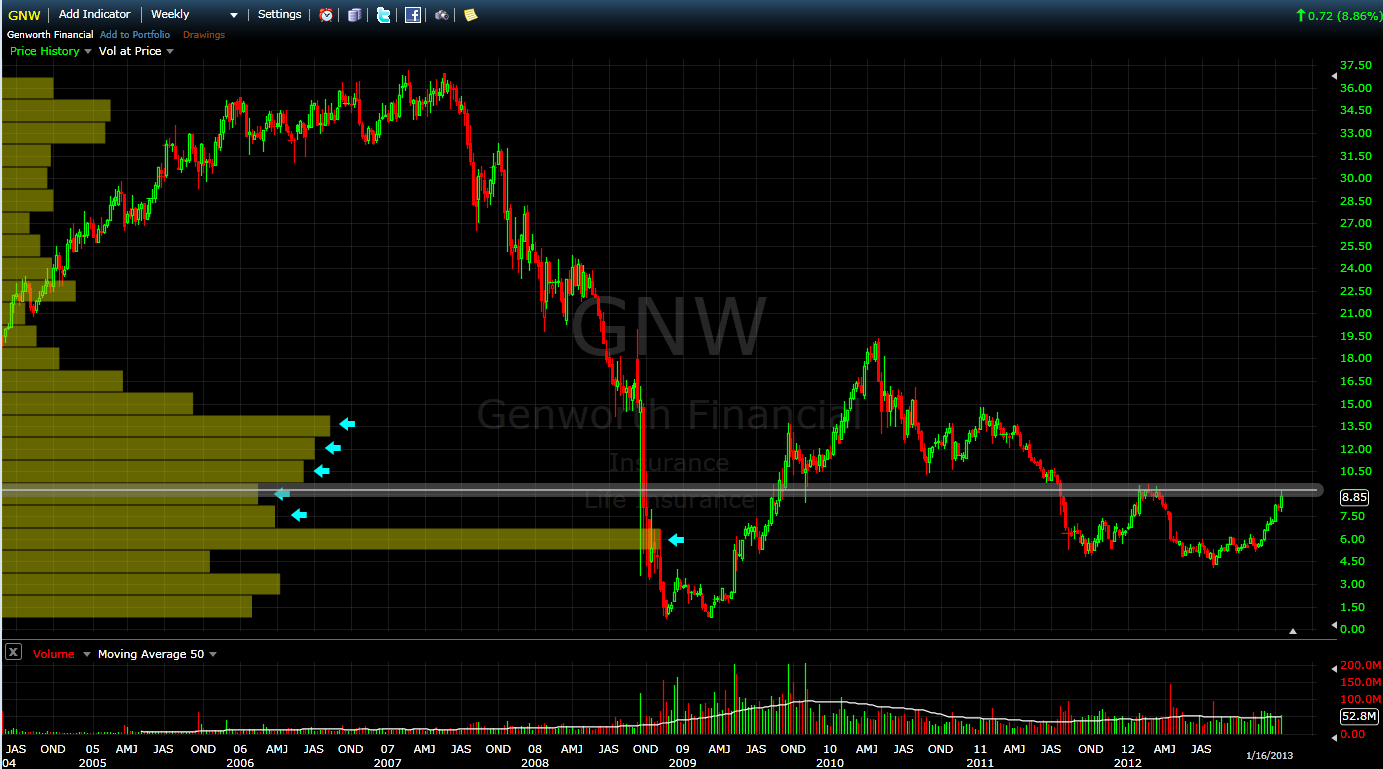

First, take notice of that area we determined as “value” earlier between 5-6.25 still has the largest amount of volume even when taking the entire history of this stock into account. Of course mentioning that information is merely for the sake of using this tool to visually make these types of determinations.

That said, if you are currently trading this stock, that is kind of irrelevant. What is relevant is the blockade of higher volume nodes immediately overhead.

The daily that I presented earlier encompasses two 2 years. As you can see on the weekly, there was significantly more “action” in the area between 9.5 and 12 in the years prior, with the stock basically spending the better part of 18 months in this range.

Since, presumably, we want this stock to go up, what those volume bars indicated with the blue arrows signify is a ‘headwind’. There is nothing that says price cannot blow through those areas, but the simplest interpretation of that (to me at least) is that there are many people who may have bought or sold in this region in the past…therefore the stock reaches an easier state of equilibrium from a supply/demand perspective. i.e., There will likely be plenty of supply for those looking to buy shares and vice versa.

What this means to me is that the chances for a runaway momentum event (where supply and demand are in disequilibrium), is much more unlikely. Now, if we can get into the high teens or 20 area…that’s a different story….you can see the lack of historical volume in that region, all the way to the all-time highs around 37. I’d be much more inclined to join the party there.

Basically, my verdict is this: trade what you see. If you are seeing something that you like, by all means trade it. There are a billion ways to make money in the stock market, Price by Volume is just one analytical tool that I currently use to try and improve the probability of a profitable trade. It makes sense to me…and it forces me to be patient and take a large amount of data into consideration prior to putting on a trade. Those elements are extremely valuable to me.

I hope this helps, and I hope it doesn’t dampen your enthusiasm about the trade, it certainly looks like a winner at present.

-EM

One Response to “Reader Request: GNW”

Jworthy

Thank you!!!

I really appreciate your in-depth perspective, especially the multiple time frames and corresponding explanations.

Also, thanks for doing such a thorough job so quickly!

Thanks again so much for your insights. Really value your perspective here and your expertise with this analytical tool. Looking forward to your next posts already.

Have a successful day!

J