In yesterday’s watchlist update, I mentioned that Redwood Trust Inc. (RWT) was within 2% of my initial buy point. After reader “bobbin4apples” sarcastically commented about how useful said update was, I figured it was time to take a peek under the hood and hopefully provide some clarity about why I’m interested in buying some shares in this company.

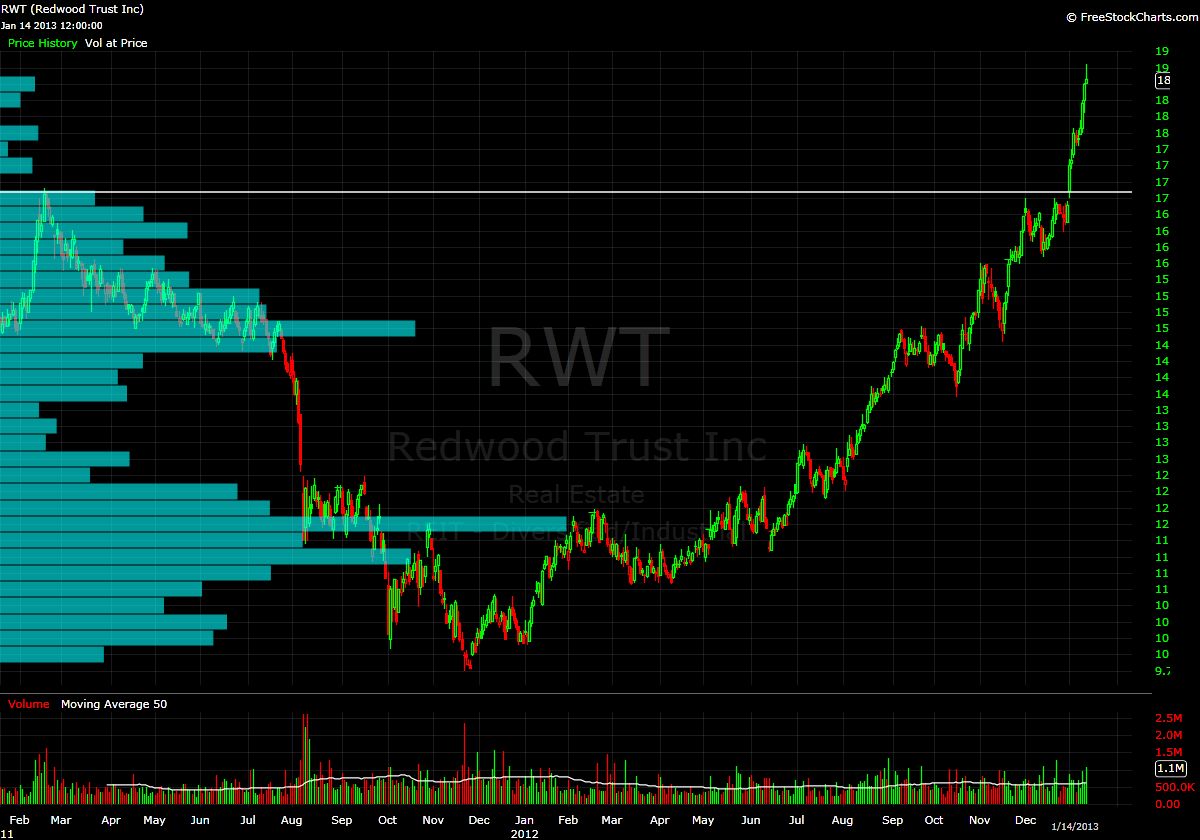

This will be similar to my analysis of Tempur-pedic (TPX), however this time I would like to start with a view of the daily chart. This is backed out to show us the last two years of trading:

Here we can see that price initially stalled as it bumped up against previous resistance from early 2011 at 17. This can also be seen in the volume profile on the left…as there was a a ‘bulge’ of volume that existed and was expanded upon when the stock meandered back and forth in this area throughout most of December.

So we can conclude: “wow, this stock looks like it’s taking off to all-time highs”, right? As Lee Corso is apt to say: “not so fast my friend” (I actually ran into Lee in an elevator at the Biltmore Hotel in LA when he was there for the USC/Oregon game in 2010). Now, let’s take a look at the weekly chart. This will give us nearly 10 years of price and PbV data.

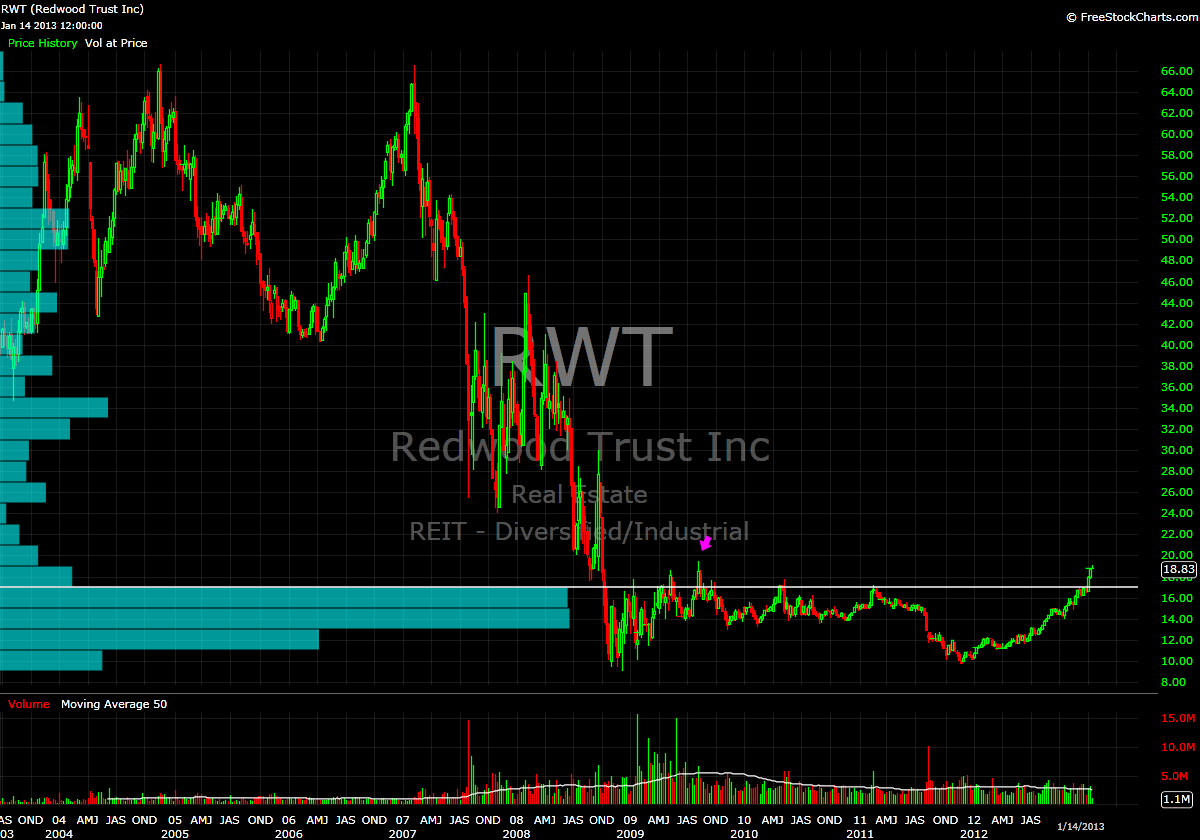

Wait. What? So this company was obviously taken to the woodshed along with most other REIT’s in 2008.

However, since then what has taken place could be viewed as the formation of a massive (4+ YEAR) bottoming pattern. Clearly, we have broken above the area of volume resistance and are now into the crisp, clean air of the low volume vacuum.

Currently my by point sits at 19.40 (which also coincides with the high from the bottoming formation, seen by the magenta arrow). Instead of jumping in immediately upon a break from a high volume region into a low volume region, I instituted the placement of a buffer to avoid getting shaken around by possible resistance. This modification was instituted because I am looking to catch the ‘meat’ of a move, not every single single tick from the bottom to the top.

If this stock can clear 19.5, what is to stop it from going to 30? Sure, one could say “common sense and logic”…and that would be a reasonable hypothesis. But we are also entering the “no logic” zone where demand far exceeds supply.

This being an REIT, there is likely going to be a decent dividend…which at these prices, RWT yields around 5.3%…so we have that going for us as well.

I hope this helps to provide some insight into the the stocks I’m maintaining on my watchlist.

Yes, these trades will take time to materialize and are not going to light your hair on fire with excitement. Maybe this shit is boring you to death…and that’s fine by me. I’m here to make money, not to entertain you with high-speed cocaine-addled trading. Check back in with me in December and we’ll see what I was able to accomplish.

I had enough hair raising excitement in 2012 to the tune of beating the shit out of my account balance…so I have decided to take a much more conservative and patient approach in this new year.

My best to you all

-EM

5 Responses to “Searching for Crisp, Clean Air Amongst the Redwoods”

Raul3

Nice

Jworthy

Thanks for the in-depth look. I appreciate your explanations.

elizamae

No problem, glad you are enjoying it.

iybc14

I like it. Love reading these posts.

elizamae

Thanks!

I’m currently following 43 other stocks (and growing) in a similar manner.

Since I’m receiving positive feedback, I’ll keep pumping these out, as they also help me get a bearing on what I’m looking at as well.