My most sincere apologies in the lack of postings the past couple of days.

There has been familial drama aplenty (in addition to an increased workload, courtesy of my employer) in the world of “ElizaMae” that has precluded my ability to post as frequently as I would like. Nevertheless, I am still chugging away here…refining old ideas and developing new.

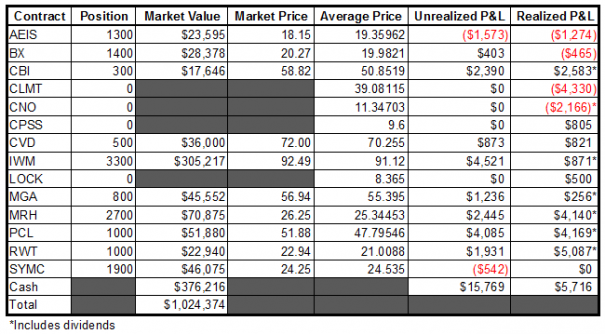

As would be expected, I took a few on the chin into the correction last week. I sold off a few laggards (CNO and CMLT) but held on to most everything else, because I knew, deep down in the core of my being, that we were not going to sell off with any sort of tenacity or vigor (in this latest downturn).

Like I have maintained for a couple of weeks now, I am looking for a break higher from this recent range to suck in longs that are looking for a breakout. Regardless of what the stupid VIX is reading, volatility is on the rise.

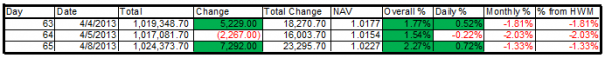

If the daily fluctuation of in P&L of my account is any indication, since the start of April (on the nose) we have been far more apt to experience violent price swings in both directions. For example, yesterday (4/8) was my second largest gain ($-wise) of the year…with over 35% cash.

To sum things up, I am basically looking for better prices in which to unload a lot of risk.

A few weeks ago, I loaded up, thinking we were going to see another push higher. Yes, I got caught leaning the wrong way. The damage was not too significant, but I certainly was wrong. Years ago, I would have panicked and unloaded almost everything right at the bottom, but my market-sense has improved over the years. I most certainly would have capitulated after the hideous jobs number on Friday.

This time I saw opportunity to employ a new system I have been developing, which I have dubbed “The Knife Catcher”. It looks for stocks that are oversold and which then switch to ridiculously oversold. On Friday, it picked up on CPSS and LOCK.

I sold CPSS for nearly a 12% gain yesterday (10.75 from 9.6) and LOCK for almost 7.5% (8.99 from 8.36).

While these early returns are extremely favorable, the backtests I have compiled using this strategy have been even more impressive. With this in mind, I am now implementing the strategy “live” using 10% of account equity. The nuts and bolts I am going to keep to myself, but it wouldn’t be too difficult to reverse engineer the results to figure out how I got to where I am. It’s nothing fancy, but I find there is often beauty in simplicity.

Here is how the portfolio looks, including the updates that I have missed the past couple of days.

-EM