Senior Fly has allowed me to grace these hallowed halls once again, and for that I’m grateful. Last time I was posting on iBankCoin I had one of my most profitable runs ever. This time around I’d like to do the same, but it’d be a mistake to not have learned a few blogging lessons from the last go ’round. Therefore I’m going to try to develop a “less talk & more action” approach in an attempt to post more. The goal is to deliver more actionable trading ideas to the readers without all of them having to fit into some well developed macro puzzle. Sometimes the big picture is unknown and you simply have to trade what’s in front of you… if you keep your discipline (using stops, money management, etc.) you will eventually catch the big move. And once that happens you’ll find the big picture becomes clearer and you’re already positioned perfectly.

That being said, there is a sweet short setup developing on $XLE (the SPDRs Select Sector Energy ETF). Crude Oil has been crushing shorts lately, and that’s all well and good. The thing is, crude and energy stocks cannot stay correlated forever. Why? Because crude is NOT going back to 2014 levels and these energy companies are still in loads of trouble. It’s simple really, the earnings are terrible and the resulting price/earnings are absurd.

Take Schlumberger ($SLB) for example: only the most dimwitted oil bull would buy this stock today trading at a 45 P/E (ttm)!! Look at the rig count, these service company workers are all at home twiddling their thumbs (or working on their resumes). The earnings will only get worse from here… Fracking – psssh – if E&P’s had that kind of capital they’d probably pay down debt with it.

The bottom line is I believe the divergence is starting to play out. For example, today Crude Oil futures were up 3.29% whereas the $XLE was up only 0.29% . It’s time for the energy equities to underperform the commodity. I think a reversal on the $XLE is forthcoming, and if I’m wrong so be it, but the risk/reward is setting up in the short sellers favor.

So Here’s the Trade:

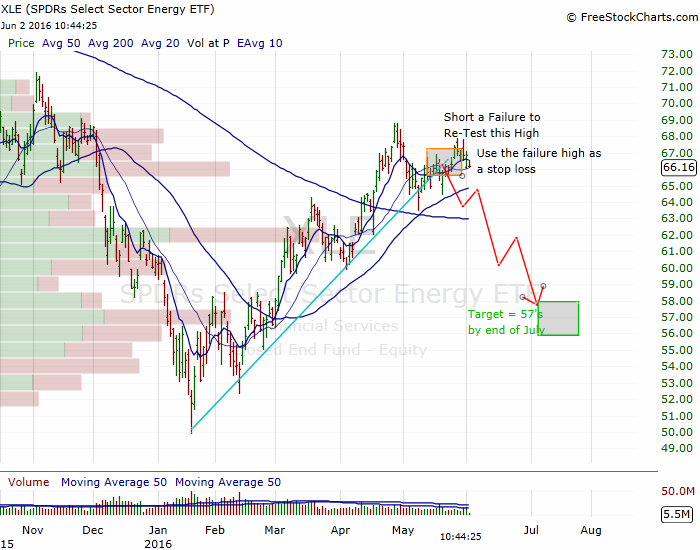

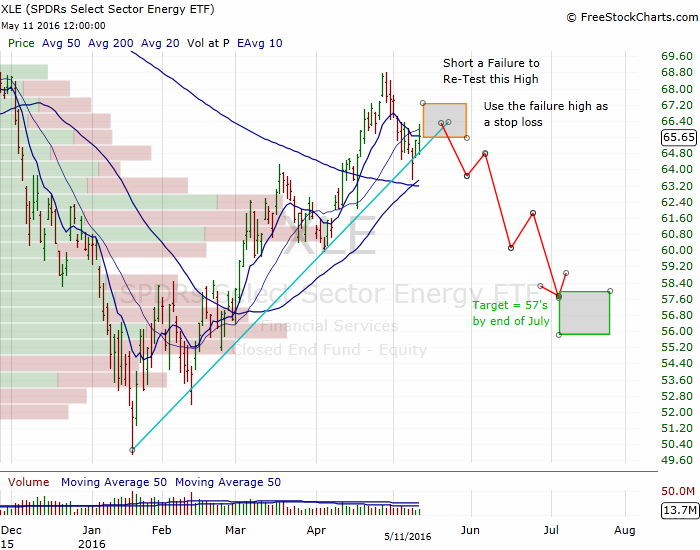

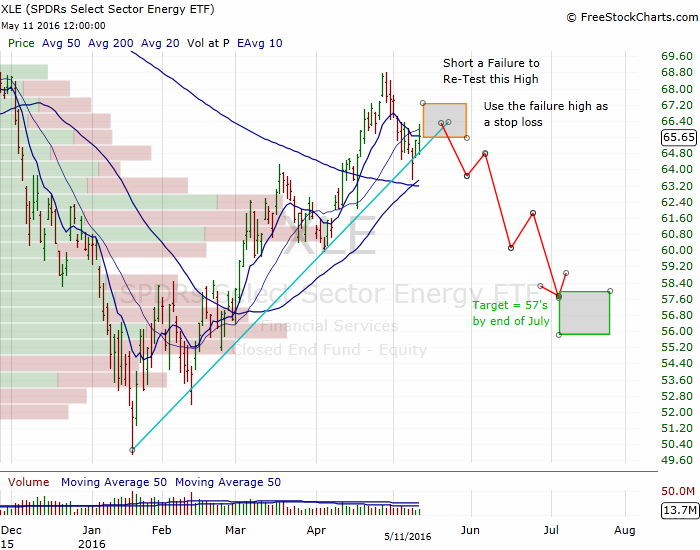

The $XLE is trying to make a run at it’s recent highs in the 68.80 range; I don’t think it will get there. Once it’s clear that the rally attempt will fail, enter it short (or buy puts). Use the 68.80 level or the failed rally high as a stop loss. Take a look at the chart below:

I think the failure high will occur somewhere within the orange box. The target is anywhere in the 57’s (green box) by the end of July. This represents about a +12% setup; properly placed option bets could easily reward +100%.

Good luck and be sure to follow me on Twitter @dyer440.

Comments »