The SPY is back to an area where, in a normal market, we would expect overhead supply (price resistance of former trapped buyers at the highs) to kick in.

However, we know the current market is an outlier, with the S&P 500 Index not correcting 10%, nor testing its 200-day simple moving average since 2012. Since then, time and time again overhead supply has been ignored in favor of a V-shaped rally to fresh highs.

Thus, the question is whether the trap will persist, or instead we will have a trap within a trap and this time overhead supply will matter.

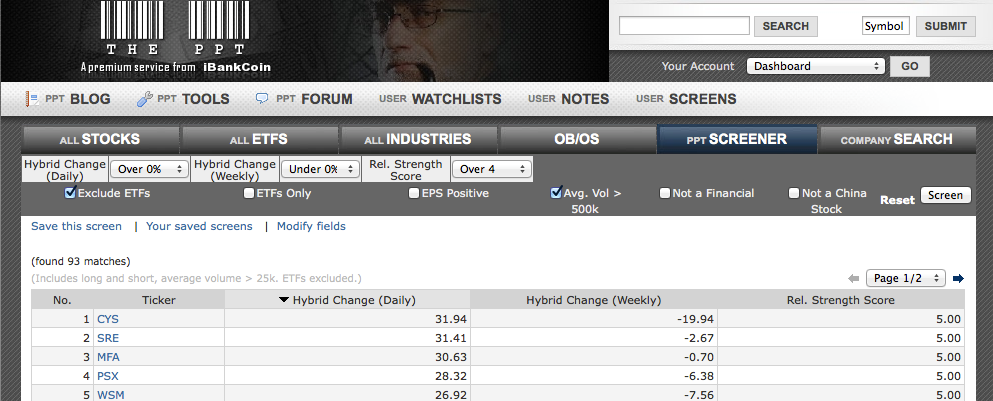

I have no clue as to whether this is it. But I do know that the below chart can help me define risk for any trade I take, long or short.

I am still inclined to think, however, that the many broad market divergences will pressure bulls into next week.

___________________________________________________

Comments »