Not Many Treats to Beat the Heat

As we work through the dog days of summer, the market continues to grind about in a range today. The Ukraine news this morning did not lead to a bloodbath, but instead another cliffhanger as we head into the weekend.

Indiviudal leaders, such as Netflix, are promising for bulls, while major credit cards plays continue to look vulnerable to more downside.

Corn and wheat (CORN WEAT), two of the more Ukraine-sensitive commodities, both turned in decent sessions today as they attempt to bottom.

Overall, though, there are not tons of setups lurking, just yet. Let’s see if next week brings more clarity, or if we need to wait until after Labor Day.

Enjoy your summer weekend.

Comments »Update on Two Long-Term Investment Ideas

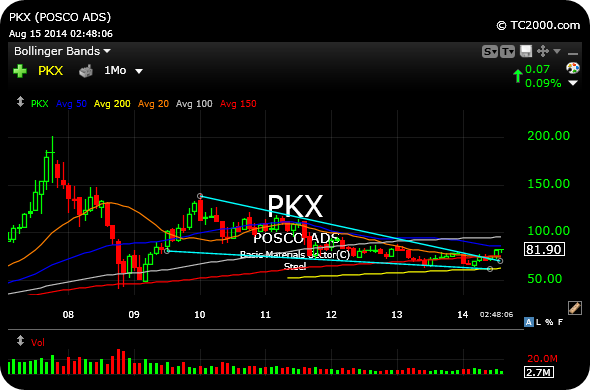

The best values I continue to be are non-U.S. stocks, particularly two I have previously mentioned as long-term plays: The Brazilian utility CPL and South Korean steelmaker PKX.

Both are solid firms attempting to emerge from multi-quarter downtrends, as you can see on their long-term charts, below.

I would add to positions if CPFL clears $19 and POSCO $85.

________________________________________________________________

________________________________________________________________

Comments »Shorter Version of War Hawks Egging on Putin

The IWM is still consolidating its intraday downtrend here. Watch to see if we get a directional break below the bell.

Drop me your top Friday afternoon ideas.

Comments »You Can’t Stop What’s Coming

In the face of a news-related spike down in stocks, we have the ritual afternoon séance by bulls calling for another spirited comeback. Time and time again, this bull run has shrugged off all types of “bad” news and technical breakdown setups. So, I can see why the dip-buyers are giving it another go as we speak.

From where I am sitting, a name like NFLX is an attracting long setup if we see a snapback, while V is looking ripe as a short in any further market weakness.

In an effort to stay nimble, I took partial profits in my Russia short, inside 12631, leaving on a trailer.

Here was my note to members:

Comments »chessNwine

12:32 PM EST on Aug 15th 2014Sold 1/2 of 1/2 $RUSS Long @ $12.74 from $12.22 entry to lock in part of the win. 1/4 left. May add back later today.

Put Them in a Body Bag, Vladimir!

The small caps in the Russell 2000 Index are leading us lower here, with buyers failing miserably, intraday, to hold $113 on the IWM ETF as support.

I have a hard time believing that the machismo-oriented Vladimir Putin will not forcefully respond to Ukraine’s aggression this morning with his own bout of violence, which is another reason for me to stay with the Russia short until further notice.

The volatility ETF’s are starting to pick up steam to the upside, and gold miners are giving it the old college try at a rally again, even with silver scared of its shadow still.

I am looking at other shorts inside 12631 if we fail to see the usual recovery this afternoon from dip-buyers.

Comments »