News just came out that Ukrainian troops engaged the Russians on Ukraine soil.

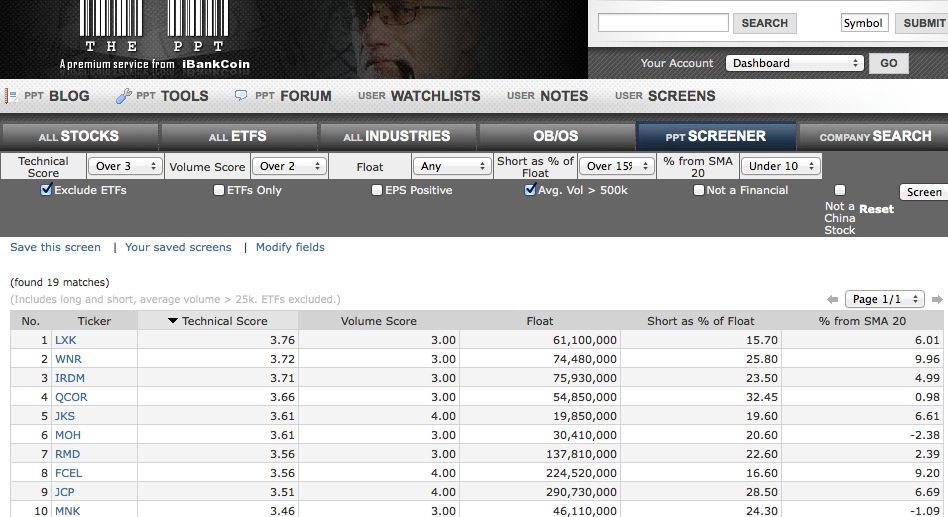

The market spiked lower on that news, and I decided to act and hop back into the Russian short which I locked in last week before a snapback rally ensued.

Inside the 12631 Trading Service, I snagged the triple Russian bear ETF, RUSS, at $12.22. I have a stop below $11.60 and may day-trade it.

The straight-up Russian ETF, below, shows a 30-minute chart rally since last week which is now in danger of both a technical and news-related rollover.

_______________________________________________________________

Comments »