If you stepped into today with loser stocks, you’re being treated as such — as you deserve to be treated — a loser. Only losers buy stocks with market caps under $100b. If you want to make money, you buy tera caps. If you need tax losses and prefer to lose money, buy everything else.

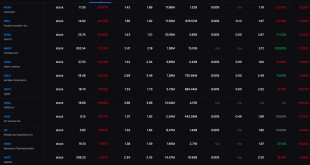

The Tera caps are +0.666% while small caps are down 0.69%. This trend has repeated itself over and over and over and over and fucking over since Feb 2021. It’s over and it’s never coming back. Fuck you and your RIDE; only TSLA goes up.

We are all seeing BTC trade down and maxis are getting panicky thinking that’s over too. But it’s not. It’s simply resting lower you insufferable prick. These things take time and we first need to drink large bottles of wine before we worry about something like BTC or ETH. By the way, my final purchase of ETH will occur in December, for those following along.

Bottom line: It’s Friday and the market is being a dick again. Find safety, comfort, and solace inside of the larger caps and eschew the small one’s as shit — because that’s what they are and that’s how they trade.

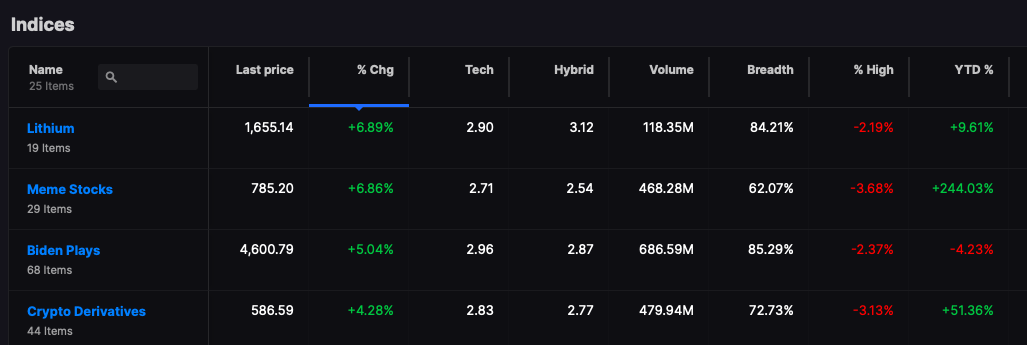

REMINDER: The Stocklabs demo begins in 30 mins. If you want in, email [email protected] now.

Comments »