Listen to me.

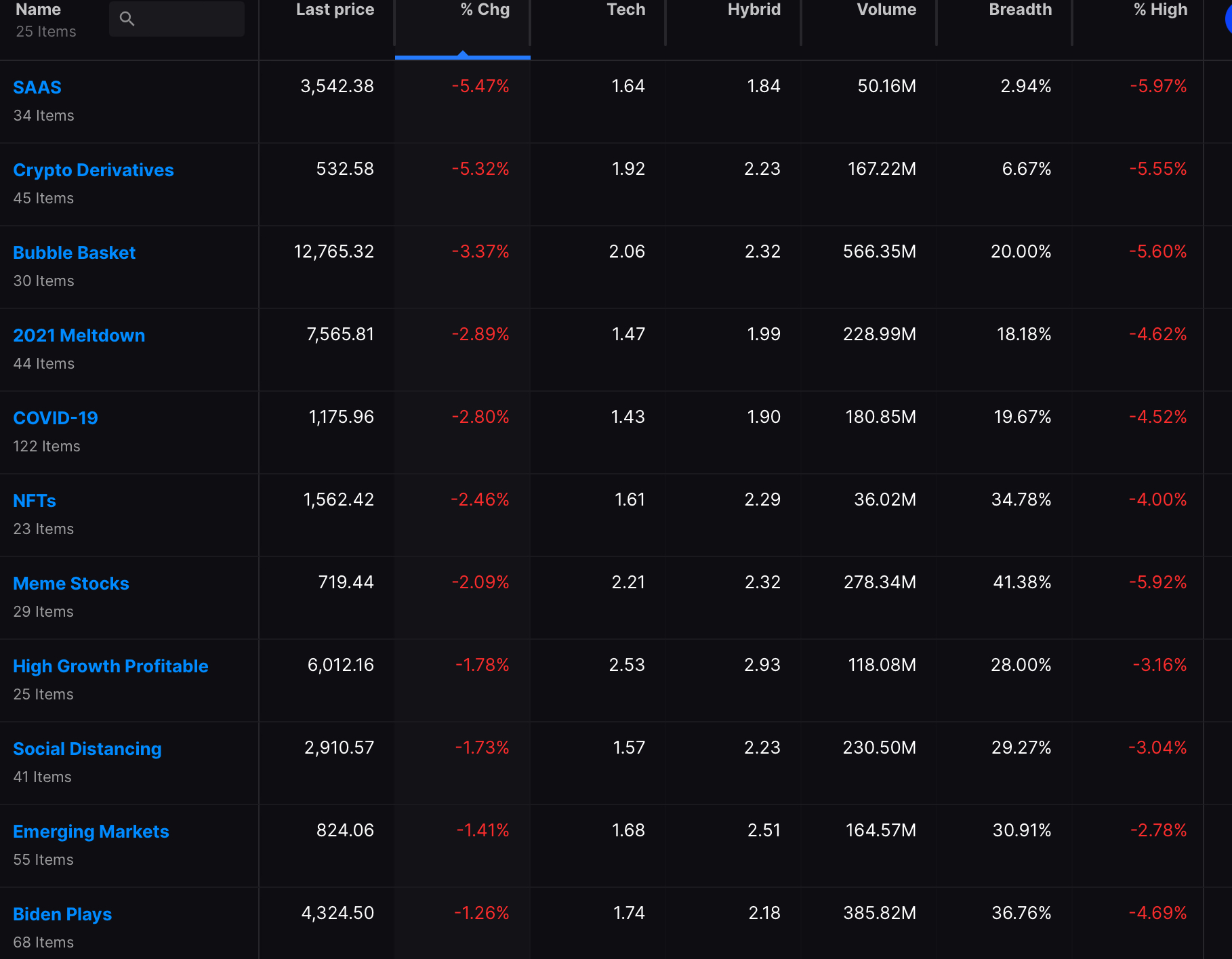

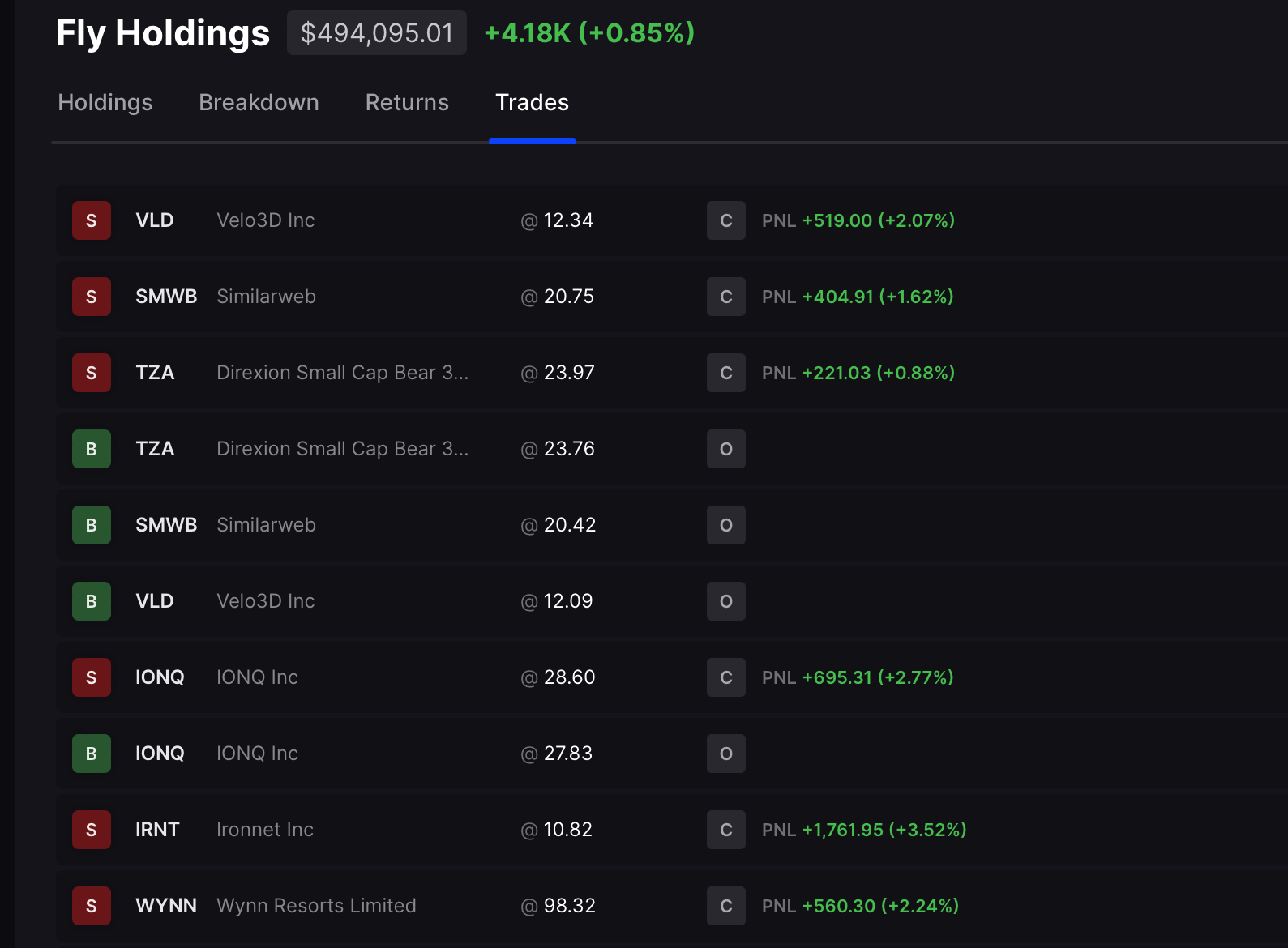

Biden oriented stock, denizens of depravity, are down 5.2% today — much of it based upon the news Apple will make an E-car and deploy its 200b in cash to turn all of the others into Blackberries. The losses are immense and concentrated in the smalled caps, which are in the portfolios of the canaille — the great internet investor who circumvents discord chats for ideas based upon whims. What we do here is nothing less than a science, which is why The Fly is +35bps in his trading, +120bps in his Quant, on a day when the blood is flowing heavily throughout wall.

It’s important for you to know — the markets will not crash during November. There will be corrections and rumors of crashes, but no crashes. The indelible fact that the European cocksuckers are segmenting its populace by vaccine status raises an eyebrow here and I could only guess this public policy will spread globally, as COVID 19 resurges during the winter months.

Alas, as everything falls into hell, the oligarchs thrive — extended and indecorous gains can be found in AMZN, NVDA, M and several other mega-tera cap names, in addition to retail names. I cannot, for the life of me, chase EXPR here into a stunted holiday season with heart attacks on the rise and people angry everything but the clouds.

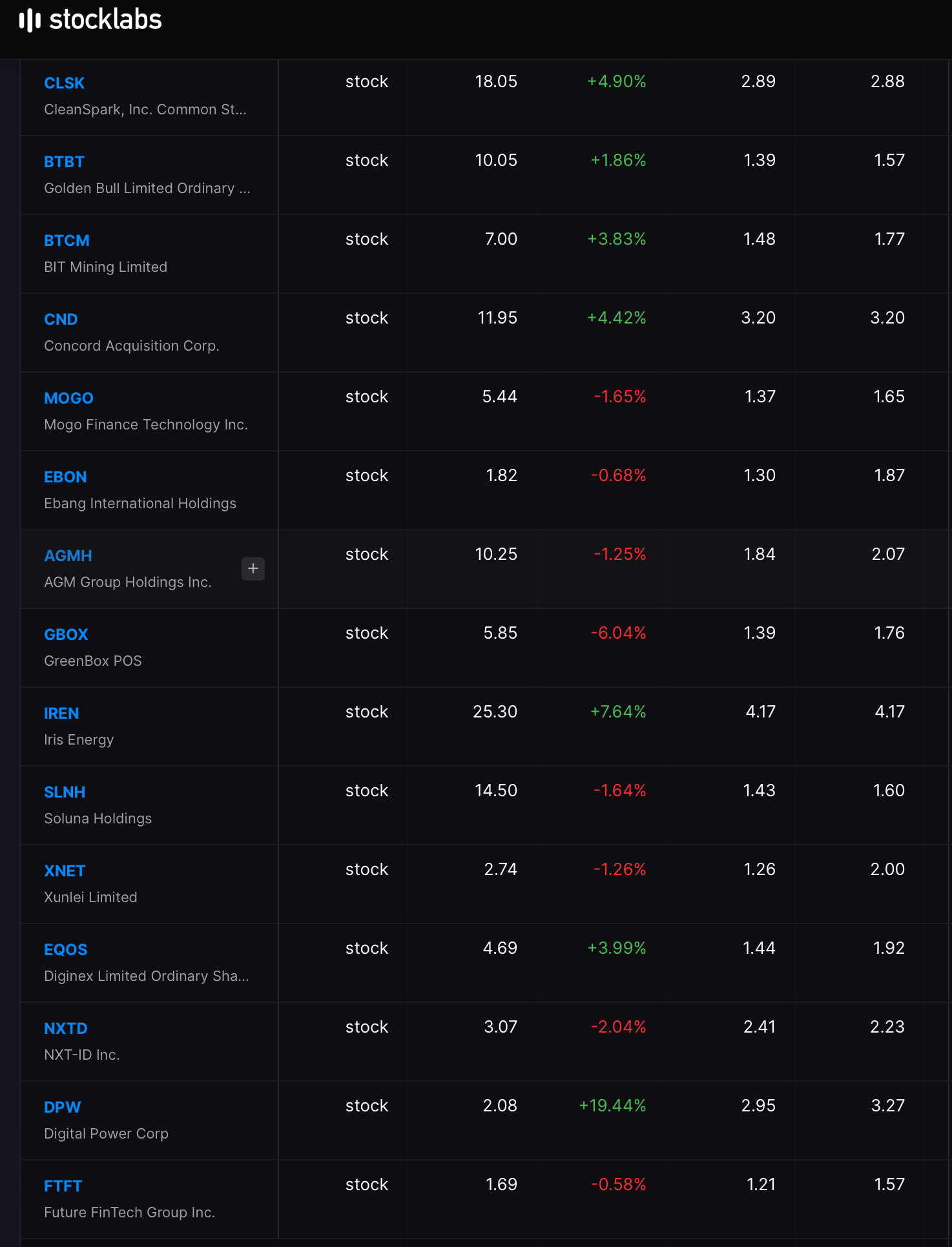

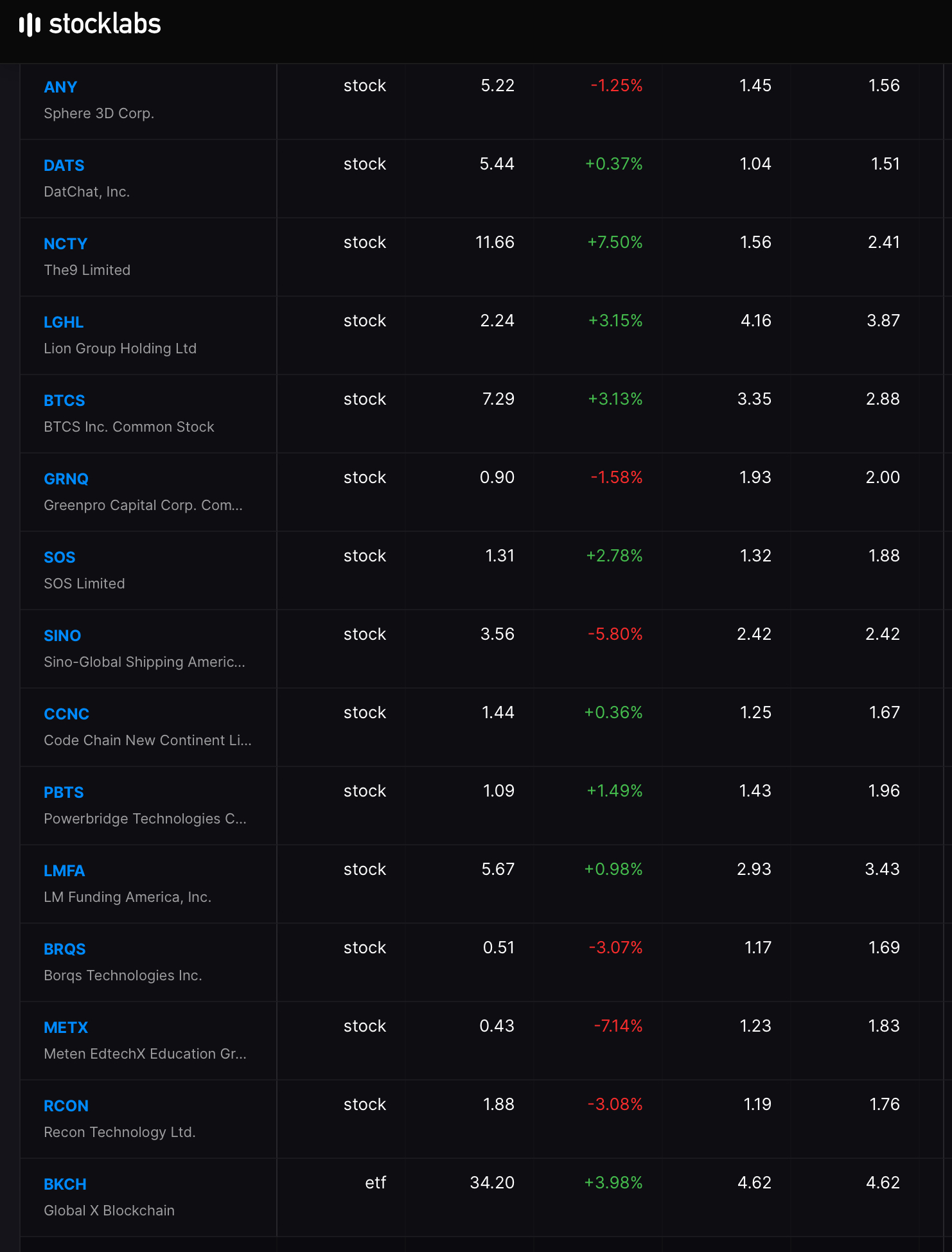

Presently, I am 10% weighted TZA — because fuck the Russell. I have designed to allocated funds by this afternoon — but do not feeeel like doing it now, especially with BTC-ETH and the entire risk on segment of the market in BBQ mode.

Over in Stocklabs, the last OS signal was 9/30 when the SPY was $429. We aren’t oversold yet, but we are fast approaching. If there was ever a time to give SL a chance you obstinate son of a bitches, it is now.

Comments »