It goes to show, yesterday’s lethargy turned into complete melt up for stocks today, as investors clamor for the many deals made available. I have two schools of thought in the market now.

1. Tactical trading, which by default is rooted in fears and thought and protection of assets.

2. Strategic trading, which requires zero thought after I choose my favorite stocks.

The net result of these two stratagems has been telling in recent months.

Last month my trading was up 9.1% and this month +4.7%. However, my strategic was up 10.8% and +14.2%, respectively.

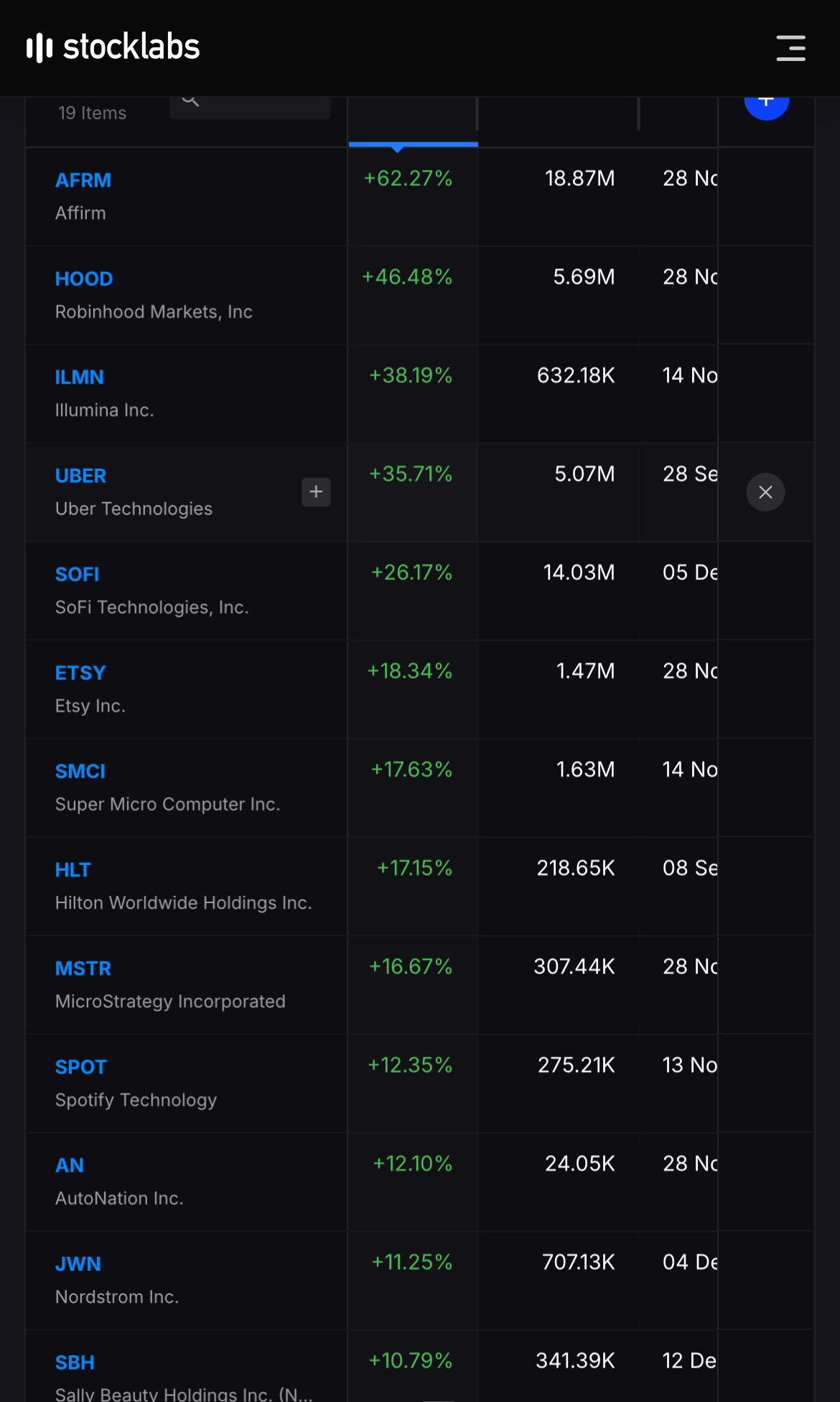

The takeaway: I’m a terrific asset allocator and the less one thinks in a runaway market, the better one is. In the latter account I do not sell and rarely worry about it. The positions are my favorites and they’re not going anywhere. Here are some of my bigger winners since late November, unbooked gains.

Bottom line: we are in a bull market and the more you think about it the more you’ll hate it. This dynamic has been a constant since 2009.

If you enjoy the content at iBankCoin, please follow us on Twitter