Happy Saturday fucked for faces.

Let’s really try to scare people now.

We just printed -1.4% GDP and we are coming out from a bubble that popped in Feb 2021. The last time we had a genuine economic storm brewing in the US was 2008 and we papered over it. The time before that, really non bank related crisis, was post dot com, post 9/11 economic malaise leading up to the Iraq war. I recall hating my life most in 2002, so let’s examine — shall we?

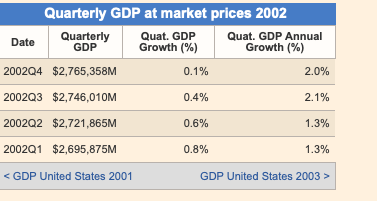

GDP data:

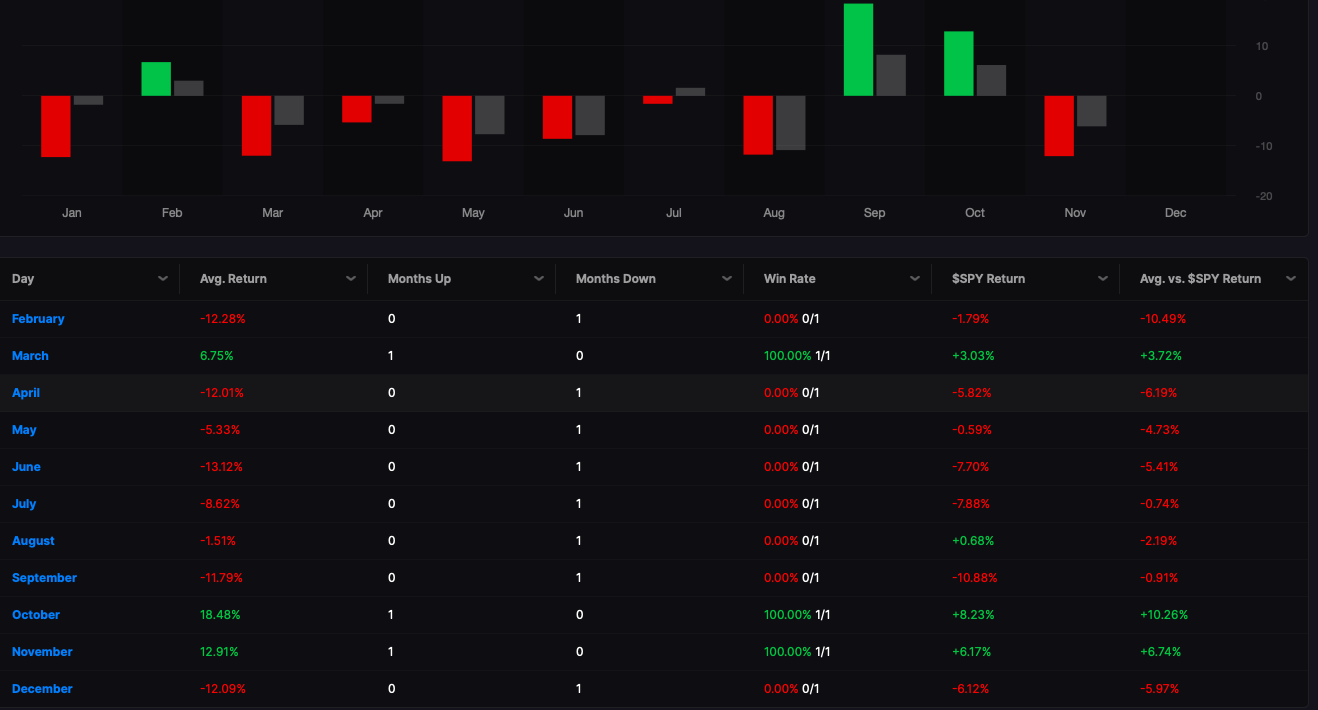

Market fucking returns in 2002, courtesy of Stocklabs seasonality engine.

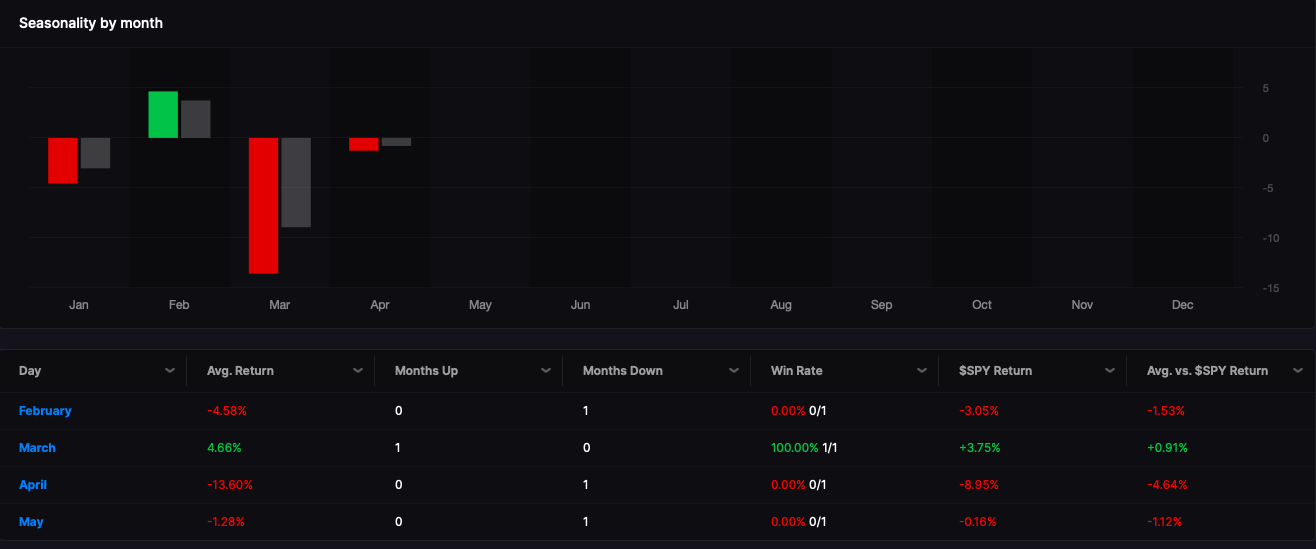

Market returns YTD.

Let me accentuate the 2002 returns.

You stepped into the New Year feeling fresh and bought stocks, only to be horrified by the sheer violence of the collapsing of markets OFF by 12.3%. You thought markets would bounce in March, because fuck that, and it did. Half your losses were erased, as the NASDAQ spiked 6.7%. Feeling good about yourself you doubled your bets — but stocks crashed again by more than 12%. Feeling like you did in January, you doubled your bets thinking May would bounce — but it didn’t. Stocks shed another 5.7% and now you’re miserable. June has to bounce, because “how low can it go?” It can go much lower and the NASDAQ did — dropping another 13% in June. Almost washed out and 100% demoralized, you now resign yourself to “fate” and have concluded you’ll “never sell” because “stocks are so cheap.” Stocks then proceed to drop another 8.6% in July, and again 1.5% in August and finally a bowser of a month, adding insult to injury, -11.8% in September.

Thinking all is lost and somehow it’s all over this time, you sell out in ruins. Stocks then proceed to rally 30% into Thanksgiving, so then you jumped back in and caught a little upside — only to be decapitated by December — off by 12%

Not meaning to shill, but I did write my memoirs on trading this horrible market about 5 years ago. You can buy both books cheaply on Amazon.

Do not be fooled. This isn’t over.

If you enjoy the content at iBankCoin, please follow us on Twitter

Many are aware of how fucked we are …so some level of shit show is priced in. So maybe it will only be as bad as 2002.

But our bubble now is bigger, we have serious energy and other input supply issues, higher debt levels, we are more dependent on others to make our stuff …and so are more dependent on the dollar remaining strong at the very time that DC bunglers have set us on a sure path to losing our reserve currency status.

We’d pop a bit if we made peace with Russia …but we’re still fucked even if peace broke out. And this is why our banker-oligarchs will not make peace with the Slav boogeyman.

Sadly,

There’s no way this level of shit show is priced in. When some speak seriously of winning a nuclear war, you know they are waaay out there wrt reality. They’re not even close to the Denial stage yet.

There’s no way we make peace with Russia.

They’ve been doing unnatural financial and other things for quite some time. We’re headed toward the long predicted (much) Greater Depression.

PS I didn’t get my starter position yet. I will convert more to stable coin and wait for more blood to run in the gutter.

I think you’re right, sir.

Plus, too many fuck faced clients of mine believe all you need to do is put money in the sp500 and you magically print returns year after year (I dont think so..)

First rate hike in 2016 brought indexes into their 200weekly MAs and 2018 we were pushed into that 200weekly as well – Weekly is 15% lower from here – very reasonable we slowly drift into it again.

This is a 40 year old debt cycle that has had some bubble slap-downs but carried on. The regular bounces between inflation and recession have occurred with the Fed intervening. Never pretty but recovery eventually happened. Each time more debt was created and interest rates were ever lower for 40 years. But having reached zero or negative interest rates upon massive debt would seem to be a game limit. We could perhaps hobble on but inflation has determined that we shall not. This will not be pretty.

And we’re running out of the stuff upon which we’ve become dependent. Happily, technology will save us.

Your implant …or your Apple watcher …will know what you want and will see that it is delivered. If you want too much …or if you want the wrong things, your wants will be adjusted to fit what your betters want to deliver. You’ll feel part of a group. You’ll be happy.

As for misfits (like our host on this site), they should get busy improving their social credit ratings.

Intervening? The fed strong armed the markets creating artificial values and subsequent inflation.

Markets need to be free to adjust.

That didn’t take long.

A couple days ago, if you were not signed in to twitter, you could scroll down a few pages before a Sign In prompt blocked further scrolling.

Now, as soon as you start scrolling down, the Sign In prompt blocks further scrolling right away.

Looks like your freedom of speech is not free. The price: your viewing data.

Thanks Elon

I bought amzn at $9 per share in 2002. Also AMAT.

Then look at what happened in 2003