“Pandemics are not covered.” States and companies want them to pay — but he says fuck off. UNCONSTITUTIONAL! “The loss potential is infinite.”

His advice: THE GOVERNMENT AKA THE TAX PAYER SHOULD PAY.

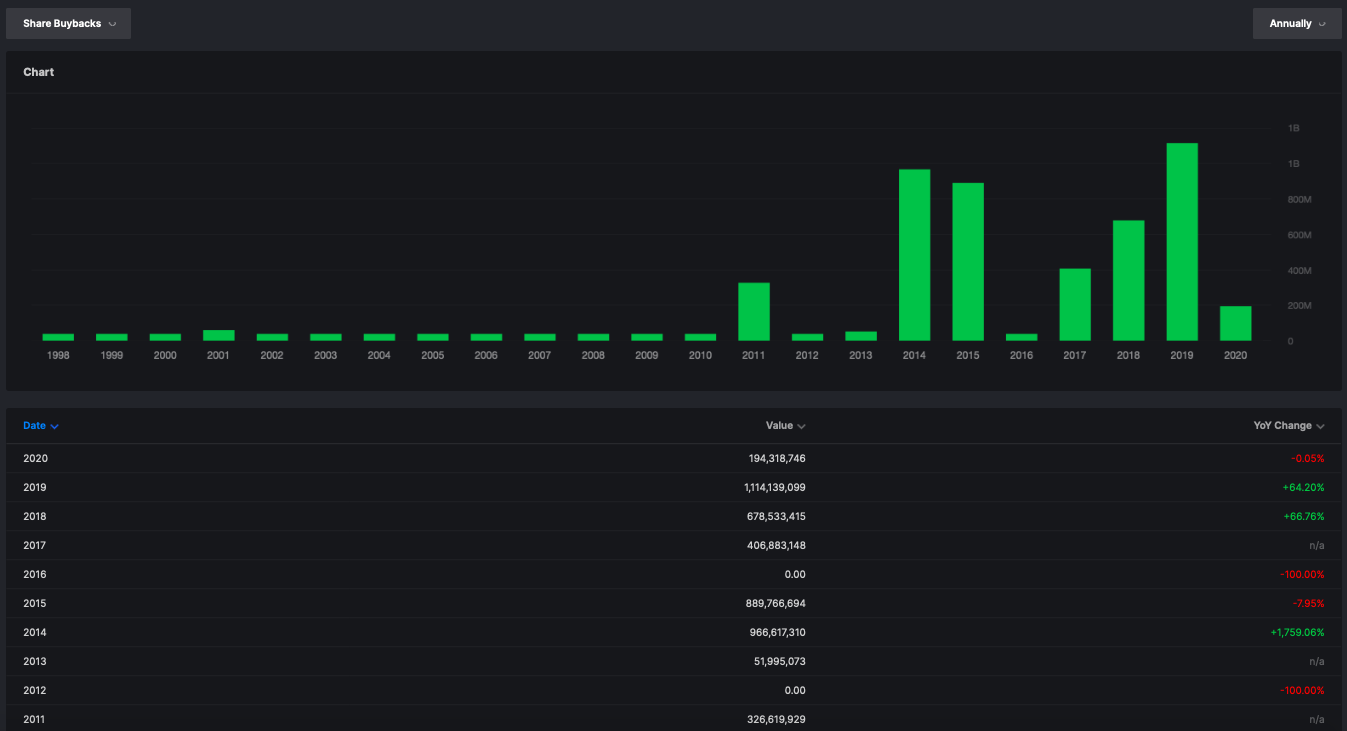

The billions in share buybacks by Chubb over the past years.

And their bountiful free cash flow.

If you enjoy the content at iBankCoin, please follow us on Twitter

I think you’re quite the populist

Ordinary people won’t get their fair share of the wealth of America until people like Greenberg are terrified to be out in public.

Ordinary people now understand that.

Lmao Trump’s reopening America plan includes two initial phases of restricting all gatherings of 10 or more people, with the earliest phase possibly kicking in in May.

We’re just codifying the shisper number now. This shit is getting locked down until fucking June.

Without enough testing we’re flying blind.

Trump just wants to dump on the governors and run away. He failed and we pay the price.

We’ve done more raw testing than anyone at this point.

Percentage of population is the only number that counts.

FAIL.

We’re the worst.

Nope UK and France both worse, amongst numerous others.

Besides these other countries are so small, they do like a hundred thousand tests and their rate soars. But does anyone care? No, not really. What Europe really did that helped is they all closed their borders, breaking the EU covenant, then isolated.

Oh OK. You found a couple worse? Is this your MAGA moment?

The UK and France are a couple? They’re fucking half of Western Europe.

And looking at the time line, we’ve done as many tests per capita this week as Germany had done last week or maybe the week prior at most. We’re barely behind the best performing major country.

Selling my AIG tomorrow.

Hey, European countries are starting to end lockdown, why not look at their results instead of formulating your own personal models based upon an ever-changing multitude of info.

Gettibg the numbers right is one thing. It’s the ethics / politics that are hard to pin down

European countries are more analogous to states. Not much similarity.

but Zombie Apocalypse, Covered.

He is correct that this will lead to Ch. 11 for many insurers. Many policies are still “all perils” with the rare exclusions being war. If policy language is open to interpretation (business interruption) the courts favour the insured in all cases. The insurance names that have rallied should be screened for shorts. AIG was almost brought down by their financial products division, they were the elephant in the room in the CDS market and for sure would have been the insurance Lehman followed soon by GS, TARP saved the day and the mkts. 9-11 was the biggest single insured loss and the losses were quite evenly split btw property (towers deemed separate losses in court), life (group life as the 3,000 poor souls who lost their lives were early in their work day) and business interruption. Terrorism became tough to get cover for after 9-11 there have been zero claims since (knock on wood). Chubb and others think $13bln gets paid for business interruption due to planes hitting a building and they chose on legal grounds to not pay out for a global pandemic? I think not, China trojan horse or not, the insurers will have to pay out. I’m quite certain. https://www.japantimes.co.jp/opinion/2020/04/16/commentary/japan-commentary/opportunity-crisis-exploiting-global-disarray/#.XpjwJ1MzbFy

*** If policy language is open to interpretation (business interruption) the courts favour the insured in all cases. ***

What world are you living in?

Isn’t that what capitalism is? I’m only 47, so I don’t know any better.

Yes! Capitalize on Government money. The survival of the fittest. You got this.

Nice little break from the routine but back to reality.

Foreign buyers of US government bonds are going to be hard to find and the treasury needs to sell 4 or 5 trillion at interest much worse than a CD used to pay. Good luck with that.

So if no one wants our stinkin debt and they see that nobody else wants it either then what? Petrodollars? Petrodollars, then the Fed buys forever. Stocks in chapter 11, junk bonds, scrap metal.

China’s vendor financing is off the table.

Maybe Fly’s retirement account could suck up a few trillion but after that, damn.

The US needing a good credit rating? “Fiddlesticks”.

The Fed is the only buyer. Here’s the problem: low interest rates have created unfunded liabilities in pensions, and even in social security.

In addition, government bonds at lower bound interest have lost their ability to stabilize financial markets during economic shocks.

We’re down to monetization.

It was sarcasm.

Limit Up! There is no downside. Period. Go long or go the F home!

We’re coming out at the open like Gandalf on the Bridge of Khazad-dûm, by mid after the balrog will whip him down without a word.

The bull market is back.

Blow off top. Not a good time to sell shorts. At least wait until afternoon.

They won’t let us lie on the couch and smoke it out. Capital wants slave mask labor now goddamn it! This will be good prison factory practice for all of you on here with kids / grandkids.

Thanks to a few good whippings and solitary, my lawn is now perfect. They are model prisoners.

The Vix is even backwards. As soon as it goes under 30, get 300% short.

“Ordinary people now understand that.”

No. They. Don’t. Folks understand that Trump is sending them a check for $1200.

Definitely, not all understand.

They have to keep up the charade until all small businesses are dead, and the Feds have bought up (nationalized) all the big corporations (Boeing etc).

This is how they get their socialism. It’s working beautifully, too.

I don’t understand.

I stepped in this morning and bought more SPXS. Look at fucking oil. Treasuries are reversing lower again and the dollar is barely down. Dollar channel is higher.

Stock buyers are going to get lanced. It may not be today. It may not be Monday. But it is coming. And soon.

Triple long it is. Thanks for the suggestion.

Do it, good luck.

Cain! We agree on something!

Can you point back to a single blog post of your own or comment here that was a correct market call? You’re batting well below the Mendoza line

Scroll through yourself. I make money.

Was a reply to Cain. All good Edge

Lol yeah I used to be a contributor actually. And up until a nasty oil trade I outperformed the market basically every year.

I double my money in APC after that Gulf of Mexico oil spill. I tripled my money in the frac plays and still walked away beating the S&P by a couple of points after it all blew up.

But again, I don’t really give a shit if you bet against me. Do it. If you’re right you’ll win. If it’s that easy this should be no problem for you. You even have a built in advantage in that these leveraged ETFs overwhelmingly favor the long side.

Ha I don’t bet. I just talk shit.

I can confirm alty’s last statement

I can confirm alty’s last statement.

Occasioanlly, he’ll buy puts to hedge his portfolio, then brag when the puts profit ignoring his overall portfolio loss. He is consistant, and I think he represents the investor class well, as opposed to the typical RobinHooder calfs and cubs we see on this blog.

Love you man

Tho there is something to be said about risk adjusted returns. What makes me extra bitter this morning is I moved about 45% of my 401k into a bond fund yesterday. Moving my overall asset allocation from about 71/31 to 60/40. Appeared poorly timed in AH yesterday but we will see what the rest of the day (and year) brings.

69/31. Math is hard

Bought some REK game on motherfuckers

I wouldn’t be surprised if the NDX adds another 100 from here, not that far away from 9k.

So you’re all-in over 100 points?

You’re that bitter about holding shorts?

No. For one thing I haven’t held them. Usually quick buy and sell or hedge. Mostly I’ve been in straddles. I’m in the black since the peak.

Not many can say that. Well done.

Let’s see. I’ve got $18 left. I could buy a burger and a beer, or an ENTIRE FUCKING BARREL OF OIL. Difficult decision. Developing…..

Haha

10 year yields back below yesterday’s close now.

10 yr yields now down 3%. Very bullish “dropping off a cliff” pattern in a risk off asset, I’m sure it’s fine. 10,000 more DOW points on the horizon.

Visa fading like Pete Buttigieg’s hairline

Waterfall algos initiated