I’m not a doom and gloomer. Quite the opposite really. I’m like the morning sun — an afternoon cup of tea — the benign Capstone atop of your pyramid, gleefully looking over you and wishing you well. Now if I didn’t show you these things, well then, that would be unkind. You should know what you’re involved in before hand; this way, when the mood differs and the numbers crunch, there can be zero claims of ignorance.

Courtesy of ZH.

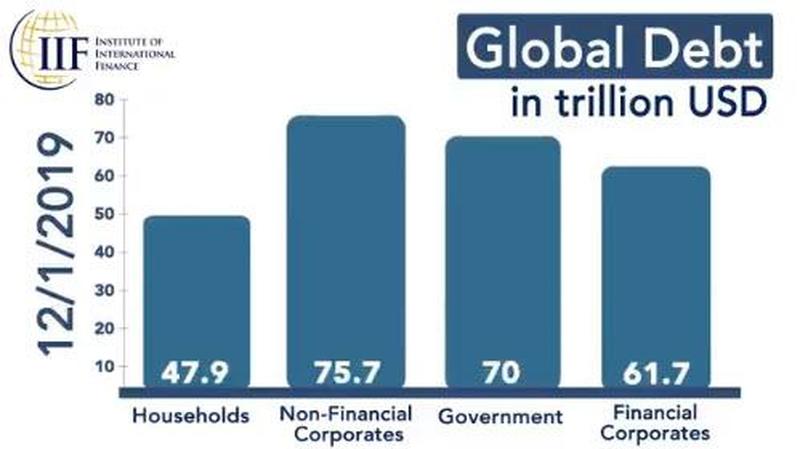

World wide debt is now $255t.

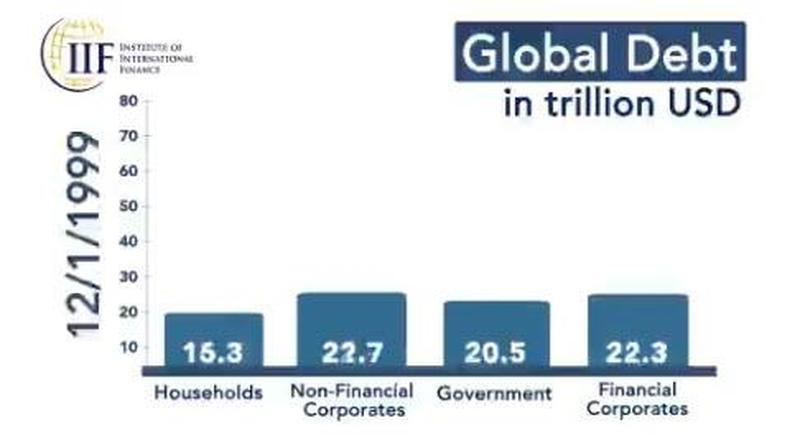

Debt change from 1999 to present.

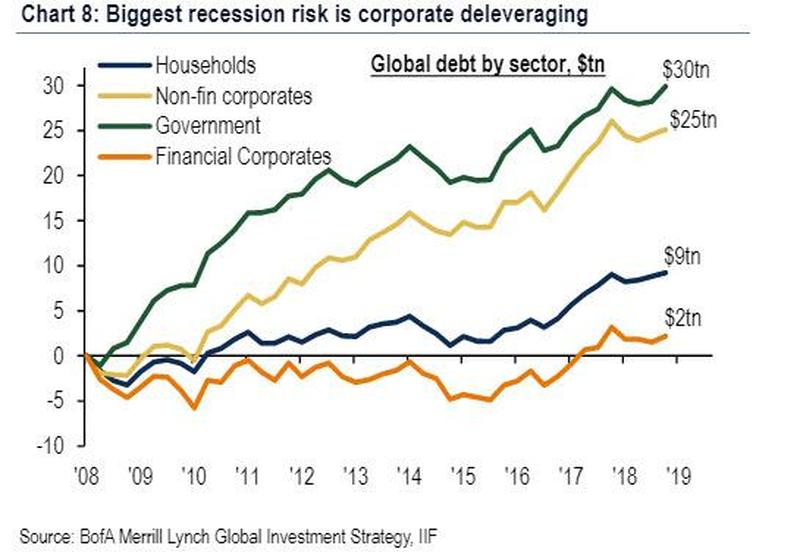

Since Lehman, government debt has increased by $30t. How much GDP do you believe that represented? Moreover, how much of earnings is predicated upon the assemblage of said liabilities?

Emerging market debt is now $71t, up from $66t last year.

Here’s how the overall debt breaks down.

- Household debt: $47.9 trillion

- Non-financial corporate: $75.7 trillion

- Government: $70 trillion

- Financial corporate: $61.7 trillion

It’s important to note, we have a great economy, the best really. Lots of wonderful companies producing great things, lots of growth. Perhaps the best economy ever.

If you enjoy the content at iBankCoin, please follow us on Twitter

what me worry

the biggest game of musical chairs ever

only question — who knows when the music will stop?

There is another, equally important, question:

How will the music stop? How will the moneyed and powerful engineer things so that they profit from the collapse? A new, devalued, currency? Can debt be paid back in “new dollars”? How can average Joe be prevented from paying the bank back in new dollars while the connected and “systemically important” and “TBTF” can do so?

As inflated as stocks are now, owning companies is arguable better when the reset arrives than holding a bunch of old dollars. So the bull lumbers on.

A old, devalued currency. 2% infaltion was the target, and now the FED has openly committed to overshooting that to count for past defaltion (although the political reality of this will probbaly throw a monkey-wrench in the plans).

However, I currently don’t foresee the USD gettign replaced anytime in the next decade (or mayber longer) becuase it will still be stronger than most of its peers (Euro, Yuan, Yen, GBP, etc.)

Give half of ’em higher asset prices and the other half continued transfer payments (along with the usual assortment of MSM distractions), and 4% inflation will be politically just fine.

That’s why this market reminds me more of the late 1990s than any other period. At that time, the hot IPOs were anything internet related and profit didn’t matter.

Now disrupters such as UBer (taxi), WeWork (office space), Roku (cable-cutting) are the hot things wher profit doesn’t matter. AMZN and NFLX fall into this, too. What peoepl fail to realize is that many of these disruptive services are cheaper for thie customers – but are also much **lower margin businesses** than the models they replace.

Uber drivers make less then taxi drivesr. Uber the company is losign money,

Amazon’s retail amrgins are lower than Walmart’s in-store sales margins

NFLX’s streaming margins are lower than their mail-out discs margins

WeWork’s leases space at below-market costs

Plus 1, now fuck off

Thanks for the Thumbs up, now fuck off.

The potential porblems with debt are less realted to it’s size than to two other things, namely whether that debt was used towards productive ends and how much leverage is involved.

Post-WW2 debt is an example of productive investments in the US and much of the world. Present-day China is and stock-buybacks at ATHs will prove (IMHO) as examples of uproductive debt.

In tersm of the problesm with leverage, the Great Recession illustrates this. The popping of the housing bubble would not have been so disruptive without (1) financial companies packaging mortgages into MBS and repackign those into highly-leverage CDOs and (2) people using their home equity as bank accounts for short-term non-durable spending.

..how could you fail to mention OUR borrowing $trillions to kill, maim, and displace millions or people while earning for ourselves tens of millions of additional people who hate our guts and wish us ill?

Yup, I think a lot of people don’t seem to understand *how* US-hating Islamic terrorists are formed. Yet another reason to keep our hands clean in Yemen and ditch Saudi Arabia

On corporate buybacks: contrary to “common knowledge”, corporate buybacks actually **decrease** shareholder value if the stock is overpriced to start with.

Example: Consider a fictional company with Assets consisting of $1000 cash and no Liabilities. Let’s say they want to take advantage of the low-interest rate environment and issue Debt of $400, so now they have $1400 cash and $400 debt (NAV of $1000 is unchanged). However, they can find no suitable use for this cash, so they just buyback stock.

—————–

Scenario A: undervalued stock

They have 90 shares trading at $10 ($900 market cap)

Each share owns $1000/90 -> $11.11 of net assets

After $400 stock buyback:

Assets: $1400-$400 (buyback) = $1000 cash

Liabilities: $400 debt

NAV: $600

Float: 90 – $400/$10 = 50 shares

Each share now owns $600/50 = $12.00 of net assets

Buyback **increased** shareholder value

——————-

Scenario B: fair-valued stock

They have 100 shares trading at $10 ($1000 market cap)

Each share owns $1000/90 -> $10.00 of of net assets

After $400 stock buyback:

NAV: $600

Float: 100 – $400/$10 = 60 shares

Each share owns $600/60 = $10.00 of net assets

**No change** in shareholder value

——————-

Scenario C: overpriced stock

They have 110 shares trading at $10 ($1100 market cap)

Each share owns $1000/110-> $9.09 of of net assets

After $500 stock buyback:

NAV: $600

Float: 110 – $400/$10 = 70 shares

Each share now owns $600/70 = $8.57 of net assets

Buyback **decreased** shareholder value

Great info, thanks for sharing. What Ive learned is that policy-makers are skilled at kicking the can to keep the party going for much longer than anyone thinks. Who is going to step up and put a stop to it? Hence, I’m not going to try to outsmart them by betting against them as I would have done in olden years. I say join the party—buy equities and any other hard assets.