“Seasonality is a gimmick.”

(smacked in the fucking mouth with an odd occurrence)

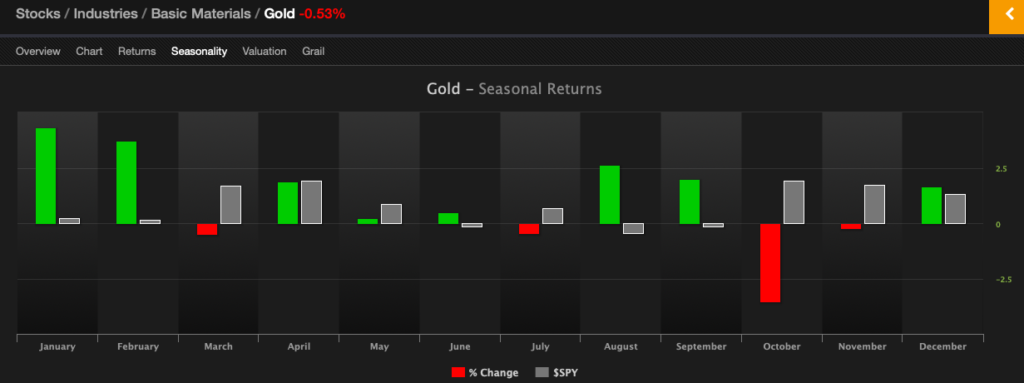

Seasonal trends for gold sector

Over the past two weeks gold stocks are down 5%. This plays very closely to the seasonal trends in gold, with the month of October being, by far, the worst month of the year for the insect metal. I’m not buying gold here, but will be tempted soon.

If you enjoy the content at iBankCoin, please follow us on Twitter

Might could be that gold should have plunged off of that volume cliff by now …if it was going to do so. Same with bonds.

I’m sure you won’t disagree that gold is a farsical investment theme. The very premiss of this asset is based upon a circumstance whereby food stuffs and security become scarce and in such panic must be bought with fucking gold. 5% gold but why even that?

A fine piece of land is way better.

I respectfully disagree. 5% allocation is prudent for an investor, over the long term. Over a 45 yr period gold has outperformed stocks and bonds, while over a 30 yr period the reverse is true. Over a 15 yr period gold outperformed again.

Yes, but do you know **why** those trends existed true? Inflation.

Now there *is* inflation in assets (real estate, stocks), but assumming that you are already invested in those asets, it counter-productive to add gold to your portfolio.

So you would only add gold to a stock portfolio if you exepct inflation in food, energy, etc. (ie, consumer product index). As Japan can tell, pushing on a low-interest-rate string doesn’t get you there. No inflation, no gold.

Agreed.

Also, that chart is uttterly useless without having a thesis on why it is happening, becuase that sh!t isn’t random.

For example, is the 2.5% average August gain consistent (ie, low standard deviation) or is it caused by a 20% jump every 8 years?

A simpler analogy, which game are you playing:

$1 lottory with a 1:10 chacne of winning $5

$1 lottory with a 1:1000 cahcne of winning $500

$1 lottory with a 1:1,000,000 cahnce at winning $500,000

The most precarious time for the global economy since lehman.

You Can’t Get, The Stock Market, Much Higher Now elites

BAAAAAAHHHHHHH HAHAHAHAHHAHAHAHAHAHAHAHAHA

HAHAHAHAHAHHHAHAHAHAHAHAHAHAAAAHAHHAHAHAH

HA HA HA HA (extra Jim Carrey Riddler)

Your time will come partner. I doubt anyone here will debate that.

You threw me a bone

I’ve got a nugget to talk about, but its not yellow: I think this is a good time to think about SAAS.

SAAS is basically just off-site software, nothing fancy. Customers get efficiceny/costs gains because they (particuallryl samller business) may not need or can’t afford a custom commerical solution. SAAS gains efficiencies by having mosre custoerms and by better matching their hardware needs with off-site cloud services – such as Amazon AWS and Microsoft Azure.

Amzon has a masive, rapid-growing, very-low margin retail buisness combined with a smaller but more profitable and cloud business.

Microsoft is more diversified, with 3 segments, Productivity and Business Processes (MS Office, LinkedIn), Intelligent Cloud (inc Server software), and Personal Computing (Windows, Xbox)

What both have in common is cloud, whcih are major profit drivers. MSFT reports tomorrow after close, AMZN on Tursday afternoon. So ask yourself this: if cloud **companies** are doing poorly, how well can thier suppliers (ie, MSFT and AMZN). be doing? The educated guess is “not very well, either”. Of course, this feeds my bearish bias, but we’ll find out the answer. Either way, it’s probably too risky to bet on eitther company directionally.

However, here is the nugget: if I am wrong about AMZN’s and MSFT’s cloud business, then that means SAAS may not be dead. If MSFT and AMZN have good guidance, then SAAS is where you want to be headed.

High risk/reward play: short AMZN based on SAAS guidance/performance

Mid-term play (keeping in mind I’m a genius so it often takes the market a while to come to the same conclusions that I do): good guidance from MSFT/AMZN on cloud -> long SAAS

On the (possible) long SAAS play, don’t be a jackass and be selective: it shouldn’t take a good software company 10 years to make a fucking profit.

The companies who use Amazon AWS, are primarily enterprise customers. The cost and complexity of migrating out of AWS, is astronomical. It’s not the type of shit anyone would ever cancel on a whim. (Consider that revenue LOCKED IN long term, absent some very major screw up)

IT Consultants bill $400 per hour. The costs of leaving AWS are enormous.

AmazonAWS is much more pervasive than you realize.

For example, ibankcoin.com has script that runs on amzon servers. Just look at the page source.

The risk for AWS: using Netflix as an example.

They rely on Amazon AWS to serve video content. As Netflix usage expands, they will require more resources from AWS = increased AMZN revenue.

If NFLX usage decreases, they will need only 2K servers from AMZN vs 3.5K last year.

So they’re exposed to the overall economy via Retail & SaaS as above.

Thanks Numbersgame. Excellent analysis

You do realize that the world Governments are above their fking eyeballs in Debt. There is no choice but to print it out of thin air.

Land is great. But it’s not liquid.

Inflation & Interests rates move in 35 year cycles. More likely than not, that inflation rips over the next 20 years. None of the so called fucking experts have lived through a full cycle.

https://inflationdata.com/Inflation/images/charts/Inflation_Trends/inflation_trends_sm.jpg