Getting bearish today isn’t brave. It looks like rage. The people who operate and run this market have much to lose and will not bend under the pressure of meaningless trade wars that affect the tax base of the plebs. The important and stylish folk do not care about higher expenses and do not sell their stocks, art, or win because the Fed is cutting rates and enacting a bond buyback programme.

They fucking buy shit — you dumb asshole.

Lower rates means easier access to capital, which in turn means companies who are distressed can be kicked on down the road to bury future shareholders, but not now. This is when you grab your balls and step in, not fade away, cowering in a corner like a girl.

“The Fly” will walk into the fire and come out the other end completely and entirely unscathed.

“In order to be a hero, you have to do brave shit.” -Fly, 2019.

If you enjoy the content at iBankCoin, please follow us on Twitter

Yeah but you’re forgetting that since Q4 2016 the rationale of index increases is so pinned to Repub. or Trump legislation, with elite political powers preferring someone aligned or controllable again, their own Dem victory would mean financial reset shock, which means the setup for timed downturn at some point here is giddy loopy tinkly.

Timed downturn obviously adds to likelihood of a Dem retaking, adding further the probability

A couple weeks after July’s cut, your lovely curve inverted, so overall impact may not be known yet

And qe has solely been manifested in Multiple Expansion, going on 3 years at the very least.

bs multiple expansion fullblown boombust condition

No more rate cuts for 2019! Sorry! Over! Too bad!

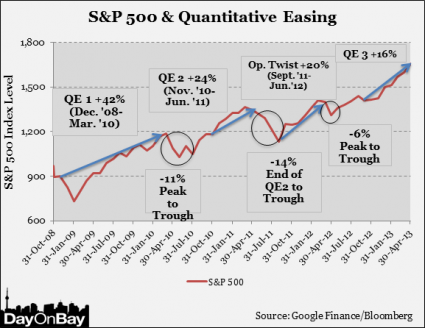

I’ve been predicting (eventual) QE4 for months. It has always been a question of when, not if. However, unlike the ECB or BoJ, QE4 means that the FED buys bonds and MBS, not stocks. Why not front-run them directly (Treasuries) instead of through secondary effects (stocks)?

Also, timing is relevant: QE4 will likely not be enacted at stock ATHs, as even your chart shows. So shorting now is not fighting the FED, it’s giving them an excuse to act.

Too normal a reaction to the Fed Fly. It is strange how normalized our warmongering has become. Be aware that much of MSM is still advocating for a military attack against Iran – – as are the usual ZioRapturetard tools in our politics: Graham, Cheney, and our laughable chief “diplomat” Pompeo.

The more QEs they enact, the stronger the cryptocurrency market becomes. Central banks are digging their own graves. They just don’t know it yet.