This is something that 90% of you need to understand and accept. Trading for a living is not an ideal way to earn money, and it also is, simultaneously, a sublime way to ruin your life and embed yourselves into a permanent state of frantic misery.

Accept the notion that to trade for a living requires a certain fortitude. If you haven’t demonstrated these qualities by the age of 35, give or take a few years, you’re better off focusing on long term capital appreciation. Even if you’re a talented and skilled trader, you should still opt for long term capital appreciation, for the sake of your own sanity and quality of life.

Case in point, the best trader to have ever walked the earth, Jesse Livermore, killed himself after going broke for the thousandth time.

In the end, greed wins and the house capsizes your flotilla.

Consider the following.

Over the past century, markets have traded higher, on an annual basis, 75% of the time.

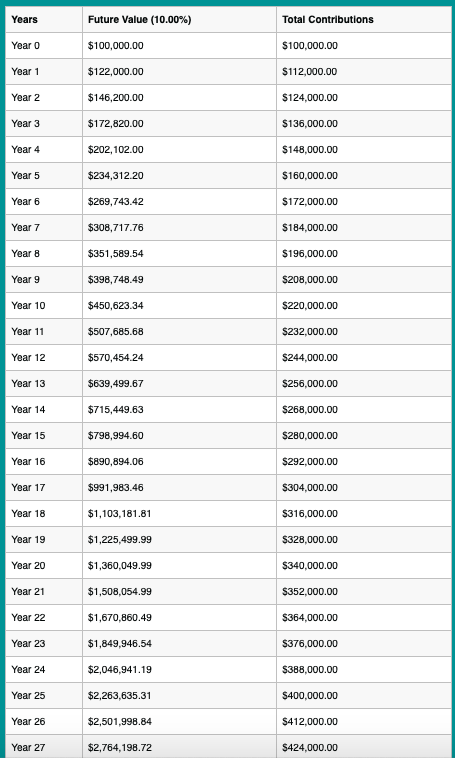

Let’s say you invested $100k and added an additional $1,000 per month to that account for the next 30 years. Let’s assume you could achieve a very reasonable 10% return over said timeframe. By the time you’re ready to retire, you will have ~$3.7m in your account.

You won’t hear or read many stock gurus telling you this, because it works against their marketing schemes. The truth is, and I’ve always believed in this, the older you get the more serious you should become with your money — leaning towards preservation of wealth. Even if you’re 40 years old, this investment stratagem should apply to you. As a matter of act, 50 years olds can do it too, planning out a 20 year strategy.

The death-knell to long term capital growth is, of course, drawdowns. To avoid them, you must not trade with emotion and you must be diversified. In Exodus, I outline how I do it in my Quant portfolio — which is left untouched and only managed once per month.

Keep exposure to all sectors. Model your portfolios against the S&P. Ensure that you’re growing with America and taking advantage of recent trends by assessing your portfolio on a regular basis. Avoid the pitfalls of concentration and be sure to harvest gains to balance out weightings.

When I talk about this shit in Capstone to some of you, I hear nothing but agreement and firm noddings of the head — but then you go out and fuck it all up by trading in dastardly 3x ETFs and ignore all of the things I try to teach you to do. Your worst enemy is yourself and it’s because you’re addicted to winning and greed. Extricate yourselves from the process and live a happier life.

If you enjoy the content at iBankCoin, please follow us on Twitter

I finally figured this out in my 40’s after blowing up my brokerage account more times than I can count. Thankfully I have a corporate pension and 401k to fall back on.

It’s not too late. You have a solid 30 years of investing ahead of you.

Yes

Rebalance through cash flows from primary income source. Never sell. Just buy what’s out of favor at the moment with new money.

Would you mind telling us about your XIV trade?

Wow this is timely. I got my ass handed to me on Friday and spent the weekend kicking my own ass over and over. This piker is fed up. I believed the stock market was the path to financial freedom a long time ago…and still believe it but have to change my approach, as Fly stated, for the sake of my own sanity. I grew up dirt poor and have grinded for the pennies I have now and am tired of losing hard earned money. Pisses me off beyond belief because it is so hard to come by.

Maybe Jesse was an idiot?

Excellent comment. On my part, I restrict myself to a 5 % maximum position and 15 % max for a sector. Trading too much is increasing the odds for bad decisions drive by emotion.

90% is being a little generous.

Fly, you are sounding like a Boomer.

Form memory, I beleive that the stock amrket average has been around +8% More importantly, that was during 30 years of falling interest rates. 99.9% of people underestimete the effect that falling interest rates had. Just for some perspective, look at our economy, unemployment, GDP, tax rates, etc, then look how the market reacts to interest rates hikes now from this low level.

To be more representative, I suggest starting at a balance of $1000, putting $100/month at 5%. Numbers look a little different.

Some people say that it is alwasy a poor financial decision to buy a lottory ticket. I disagree. Some people are at a point where pure luck is the only way to make it (sure, you can sometimes question how they got there). And when I say “some people”, I mean a lot of people. Donald Trump’s election, Brexit, yellow vests are all symptoms of this. So is the fact that white men in the US now have a declining lifespan due to alcoholism, drug ODs, and the quick and easy availabiltiy of self-administereed euthanasia thanks to the 2nd Amendment.

Investing in US stocks based on what worked over the last 100 years in the US stock market is folly. One has to search the globe for pockets where the ingredients that lead to success in the US exist …or at least as many of those ingredients as you can find.

Interrelated considerations might include: political stability, democracy, a large middle class, wealth concentration/distribution, compensation to senior execs v stockholders, sense of entitlement of local population, indebtedness of sovereign

“Investing in US stocks based on what worked over the last 100 years in the US stock market is folly”

Not if enough people *believe it*

Despite the warnings, how many investors actually *believe* that past performance doesn’t equal future success? That is enoguhto sustain quite a bull market

Wow. I’m impressed that Fly has the balls to tell the truth. Maybe there’s some hope to him reverting to the infamous Fly that I once know who masterfully navigated the bear market in 2007-2009 and called out all the bearshietters after the Obama put on national TV.

I’m still not buying crap until 1800-2000 SP500. The best course of action right now is to bust your bum working 60-80hrs a week in order to accumulate dry powder to make min 20x your morning in the upcoming recession – boom cycle.

Truer words have rarely been spoken!

What’s ironic is Fly literally bought a house via faz, tza etc. during the crash

About GD time there is some solid advice on this site.

The best trader ever is Paul Tudor Jones, who continued to build his wealth with math after shorting the Nikkei at the beginning of 1990.

Many of the quants/mathematicians who work/worked for him also amassed great wealth on their own.

don’t I know it all; been through all that; exciting but not a good lifestyle.

Sad , disgrace, we had a great V shaped rally after an exact 20%decline. instead of high fiving folks are rubbing hands.

Technicals? Fundamentals? No, it is psychology stupid.

Technicians hated this rally.

Le Fly is not a Boomer, Gen X like me. A good message. The spec account should be small in relation to the total pie. FX hard no. Most are not wired for success in the vocation outlined. Most successful money managers retain their assets (i.e. save their clients) by keeping their customers hands off the launch keys on the big drawdowns and avoiding concentration on the blow off tops. JCG

Never said he was a Boomer, but that he *sounded* like one.

SNL had a great skit on Boomer thinking vs Millenial reality (“Millennial Millions”). Millenials (as a generation) will NEVER be as financially successful as Boomers simply becuase of the econmic environemnt that they were born into.

I honestly don’t see how we avoid a Great Recession in the next 30 years. Might even be another World War. However, the US’s dual oceans won’t provide as much protection from Asian and European conflicts next time, especially when technology infrastructure (power grid, satellites, underwater internet cables) is targeted.

However, Millenials’ KIDS will probably be fine, assumming that the US eventually deals with their problems.

This is true. I would add—when you have a nice long winning streak from active trading, convert the gains to physical goods like farm land, farm equipment, and high-end fashion pieces.