I’m drinking some bullet proof coffee now, not for its ‘medicinal values’, but because I’m attempting to kill myself via clogged arteries. I’m playing the long game and it should be fun and delicious.

Here lies Le Fly — DEATH BY HAMMED BURGER.

So the market corrected last week and now you don’t know what to do. Let’s put some perspective on this dip. The drop from the top is roughly 5%. Some of the higher multiple stocks have fallen more, many dropping 10-20%. But this is standard for any correction.

My Bubble Basket, filled with the highest valuation growth names, is down 6% the past two weeks.

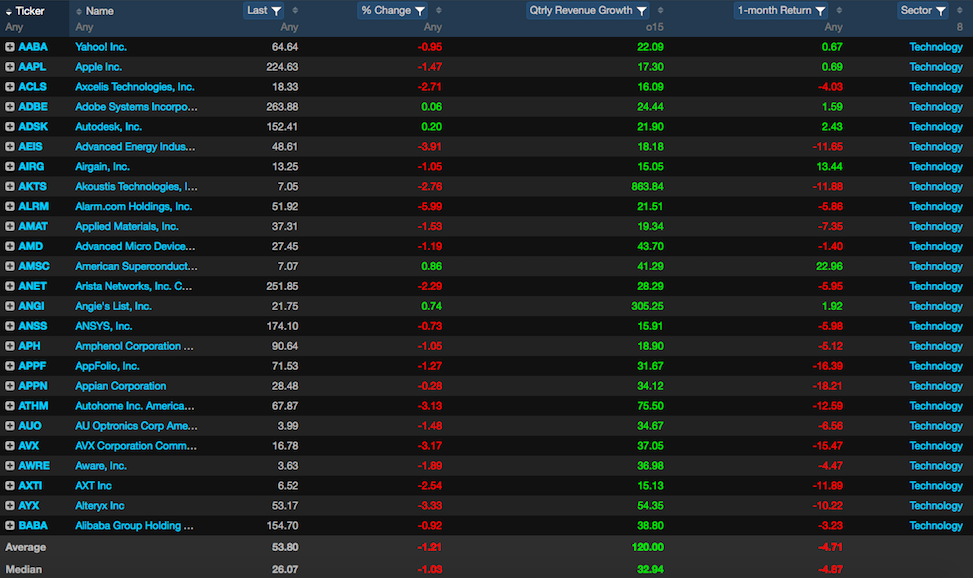

And stocks with growth rates greater than 15% have retreated by 4.8% the past month.

The Exodus Quant shed 1% last month, while the broader indices gained ~0.7%.

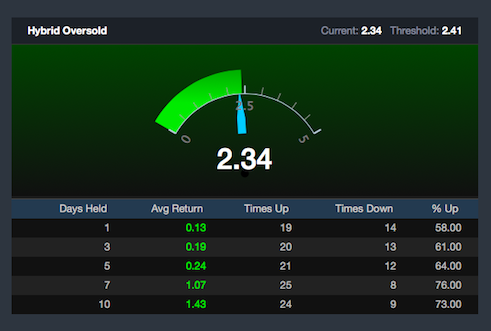

Over in Exodus, I doubled down in ZEN towards the end of the session and have 25% cash in my trading account. We are also, in fact, oversold. Here is the data for this signal. Note how the efficiency of this signal increases with number of days held. By the end of next week, we should, in earnest, be back in the good graces of speculators and markets swimming again in gains.

If you enjoy the content at iBankCoin, please follow us on Twitter

that that it appears that your fag water has roach poison in it the bulletproof doesn’t sound so bad.

Title of post should have been “Everything’s zen”

CFTC positioning has the Bond market expressing the biggest net short position in the history of the bond market. With that type of heard mentality in mind – If rates decide to cool off from here, then stocks will most certainly squeeze back to the ATHs – but if this is the big “oh shit” moment in fixed income, their will be no place to run. Interest rates are your daddy from here on out, deal with it.