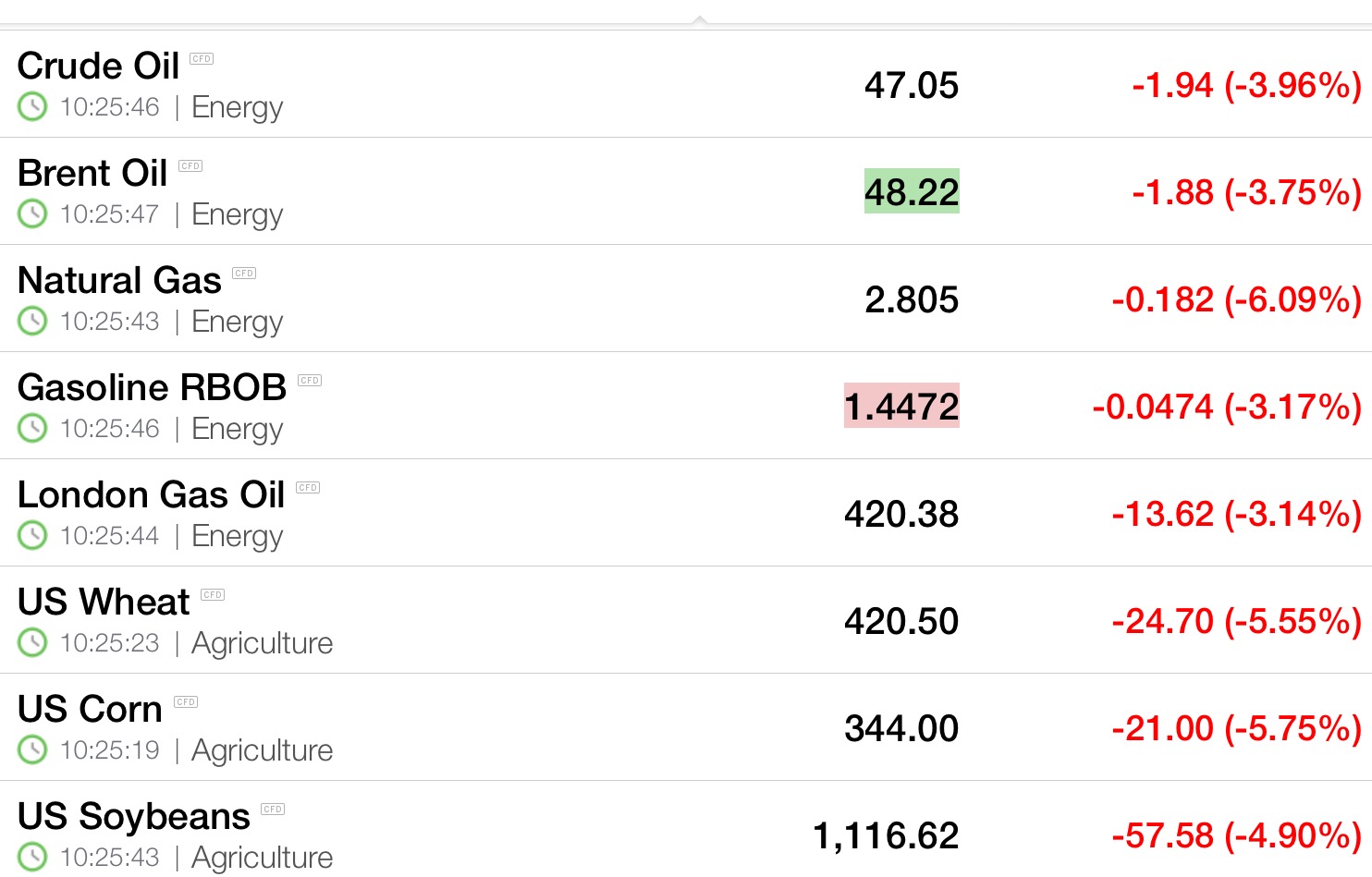

Save gold and silver, the commodity sector is enduring a harsh repudiation of last week’s rally, with corn, wheat and oil getting crushed into little fucking pieces.

Again, and this bears reminding, as sovereign bond yields dive deeper into negative territory so does the world into a deflationary vortex. Under such conditions, asset prices and commodities will get crushed. The only reason why gold is higher is because people are viewing central banks as crazy wall eyed fucking lunatics, willing to do anything possibile to denigrate and debase their currencies, in order to save banks from having to write down losses. At the end of the day, this is what it’s all about. The EU got deep into QE, only after coming to grips with the fact that it didn’t want their banks to write down bad Greek loans. Since then, they’ve been busy little bees at the printing press, trying to paper over the losses. But they cannot.

The only way to remedy this situation is by defaulting on the debt and permitting the system to reset. One does not grow out of 100-250% debt to GDP. You simply write it down and start fresh.

If you enjoy the content at iBankCoin, please follow us on Twitter

“The only way to remedy this situation is by defaulting on the debt and permitting the system to reset. One does not grow out of 100-250% debt to GDP. You simply write it down and start fresh.”

The landed gentry will attempt to stave this off at all costs, and has been for awhile.

Unprecedented territory. It’s a fools guess as to when it will happen.

Is there even a mechanism to take impairment charges with the debt tranfered to the public sector from the banks?

Yeah, it’s called bailouts

Exactly and it perpetuates the problem in a negative feedback. One way I see your scenario playing out is if several countries leave the euro and the currency blows up. That or WW3.

Some of these countries should set their benchmark rates at like -20% and see where that puts the yield on new debt. Wouldn’t it make sense for PIIGS countries to do this and use the negative yield to pay down outstanding higher yield debt?