Generally speaking, when large and mini bubbles in the market pop, the maximum downside resides in the 70% range. We’ve recently seen this play out in May of 2014 with a wide array of tech stocks. We are seeing it unfold now in oil and have seen it play out many, many times in the history of stocks, from dot coms in 2001 to banks in 2008.

The Option Addict texted me an interesting stat this morning, alluding to the last time oil and stocks diverged like this, which was back in 1998. It’s funny that he should mention 1998, since it was the first and only time I thought about leaving the business. Times were so tough for me then, I thought nothing could salvage my young and miserable career as a stocked broker. I recall owning a lot of stock in a company called Gulf Island Fabrication, just before the collapse of oil prices.

Back then, INTC, MSFT and DELL were the darlings of Wall Street; everyone was buying them, GTW (Gateway computers) too. Being a contrarian, I didn’t want to buy tech, so I opted for oil.

BIG MISTAKE.

Oil went down to drill bits and GIFI descended with it.

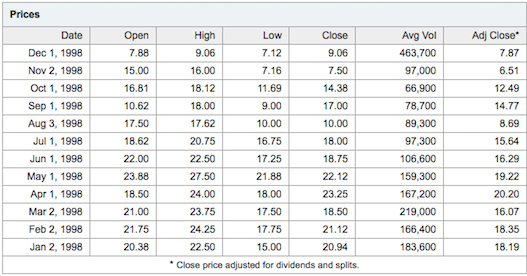

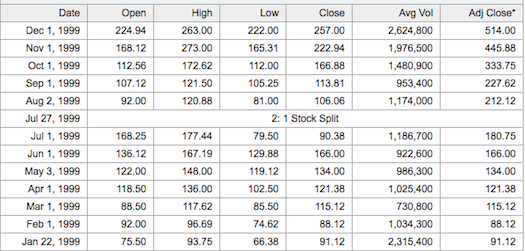

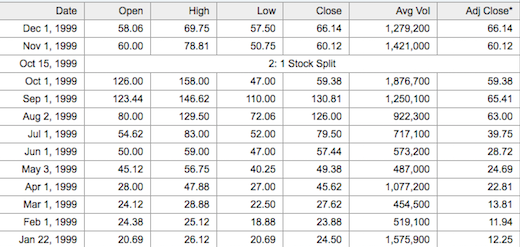

Take a look at the pin action.

I recall blowing out of GIFI around $15, just before the collapse. I then began a fanatical campaign of buying UNDERPERFORMING dot com stocks. I used to spend hours and hours researching prospective internet companies on the bloomberg terminal. I shared these ideas with my friends and co-workers , who scoffed at me and said “MSFT will own everything”. Hardly anyone even knew about these stocks, like Earthlink, Mindspring, CMGI etc. I was an early adopter. What people know about the dot com era is that people made money. What they don’t know about the dot com era is lots of people lost money.

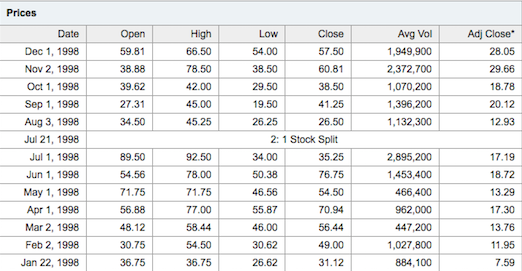

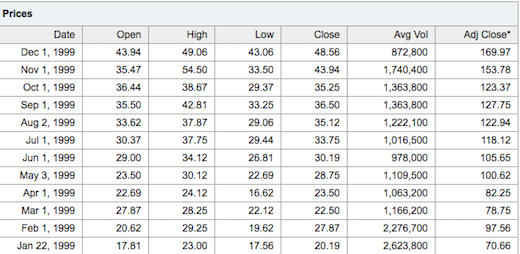

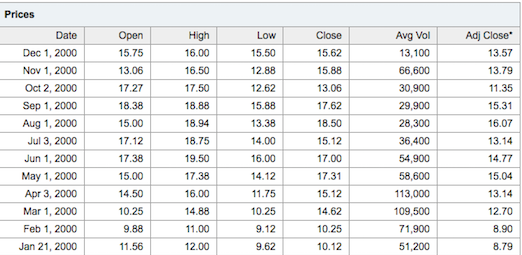

So in 1998, in the midst of a market meltdown, young Le Fly started to buy dot coms in earnest. My buying power was minuscule, but to me, back then, it was an enormous sum of money. One of the stocks I was buying was ELNK. Have a look at the pin action.

Working with the timeline I am laying out here, I sold out from GIFI around May-June and then I started buying ELNK, BYND, CMGI and others from June on. At first, it was dicey. As you can see by the drop in August, I was hating life to the maximum then, hanging around the office, all depressed and shit, playing Tetris. But then things started to pick up; things started to get real colorful (extra Randy Savage). By November of 1998, I was making a fucking fortune.

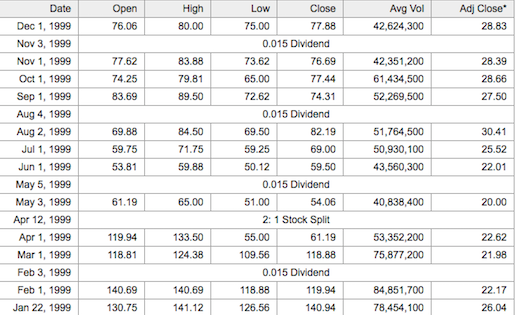

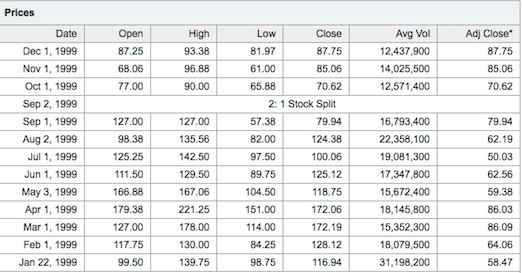

As 1999 rolled in, the old school tech names were dead money. I know this is hard to believe, since the NASDAQ was up 100% that year; but they were.

Here is the trading action for INTC that year.

Not impressive. During 1999, all of the assholes who were shitting on me in 1998 were now my cold callers. My production shot through the roof and they couldn’t catch up, mainly because they had no idea where the money was going. I knew it because I had done the homework.

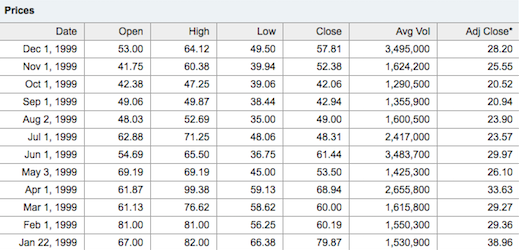

We started buying networking stocks, B2B names and selling out of 2nd tier names like ELNK, who began to underperform, horribly.

Now if you were long ELNK or INTC in 1999, you felt like shit, especially when stocks like JDSU and CIEN were popping off.

JDSU

CIEN

Why was this happening? The market in its infinite wisdom concluded the internet was old hat, despite just being invented. Stocks like AMZN, who went from $5 to $30 in 1998, were now acting like old man stocks in 1999. Here was the mediocre performance of AMZN in 1999.

The theory was that the internet was growing. People had computers. Now we needed to speed up the networks, in order to make it work. So, like the railroads in the late 1800’s, America went on a frenzy to build out fiber optic networks. Companies like JDSU and CIEN were at the epicenter of this craze and their shares ran like wild dogs higher. This, of course, was a classic mistake, which led to over-capacity, which led to the eventual collapse of the industry.

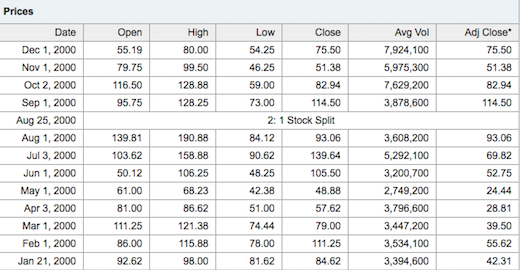

In 2000, the party came to an abrupt halt. However, there were stocks that outperformed, like EXTR.

I remember a friend of mine riding that stock from nothing to its peak and right back down. So many people thought these networkers would outperform forever.

Another one of my favorite names was HLIT, another networker. This stock ran from $12 to over $130 in a year–then right back down in 2000.

HLIT 1999

HLIT 2000

The party was more or less over. Actually, the party was 100% over and I was inheriting 100 new clients from fired brokers per week, by the spring of 2001.

So what have we learned today, children?

1. When bubbles pop, the downside is your worst nightmare. They do not come back.

2. Pay attention to where the money is flowing, else end up a cold caller for an asshole broker.

3. Book profits.

4. Before you can book profits, you have to know where to find the waves.

In conclusion, I don’t know for sure if the oil bubble has popped or not. What I see with my eyes is an industry being taken to the woodshed by Wall Street on a daily basis. Perhaps it’s time to buy up the social media or other web 2.0 stocks now, considering oil is done? Or, maybe this is 2000 and everything is going to drop?

Actually, that’s not how it worked back then. See, while everyone was getting blown to smithereens in HLIT back then, people started to make a mint again in my old friend GIFI.

GIFI, circa 2000

Things work in cycles, people. 2008-2009 was an outlier event, one that saw both oil and stocks collapse in tandem. You and I both know this isn’t happening now. I don’t think we are going to see oil and the rest of the market trade down together. As a matter of fact, if oil continues lower, I believe it will pave the way for extreme upside in a number of high growth industries. Then after those stocks have run their course, you can start buying oil again and dance on the graves of all of those who overstayed their welcome at the party.

If you enjoy the content at iBankCoin, please follow us on Twitter

interesting

Of course it’s interesting. This is an instant classic post.

one of your best!

Yes an instant classic, good sat reading too. Tetris! lol. Like that bit about people forgetting that many lost money in that era. Easy money isn’t easy.

Reminds me of some of these 3D stocks in the last few years.

3-d stocks happened and are old hat.

What’s hot now is the question?

So what’s the answer?

Calculator Tetris or Gameboy?

The answer is YELP.

Computer Tetris

so how come you weren’t fired after the oil collapse? I didn’t think the industry had a high tolerance to errors.

Ironically, regarding your ‘Microsoft will buy everything’ phrase, Microsoft did end up buying out the Russian engineer who made Tetris. I went to Junior High with his son, who was a total douche.

Dewey

I was fired. It’s under fly stories on the side and how it was the best thing that happened to me.

The story of how they took your desk away from you at your second firm really tickled my deeply hidden sadistic tendencies. You must be a pretty tough guy. YELP indeud.

Excellent post. Thank you for this.

I’m big on banks right now specifically

$C.This thing is the last to move of the big banks.Has done nothing split adjusted in 5 years.But if you believe the economy is improving in America then this thing can’t help but catch a wave.

Terrific post by the way Mr.Fly

Im definitely starting to think harder about trading more around the criminals – I mean banks.

The 50 thousand dollar question has to be ‘How big is the oil market?’ How much financial fuckery is involved. 20% of the total corp debt market sounds huge. Was oil the lead employer of thye reasonable paying jobs back in 1998? I was alive then, and do not remember a oil boom.

No, it wasn’t.

What a wonderfully constructed history lesson. Fly, this was a true pleasure to read.

Do you think just oil or all hard commodities?

I remember buying CMGI one morning in the premarket, going to the kitchen to get a bagel and coming back 5 minutes later to find myself up $17/share. I took it and at the end of the day was the biggest jackass ever. It closed up $43

Good piece Fly, my first foray into the market was 97, not as a professional but just with my own money, buying all the big tech names they talked about on CNBC. I remember telling my friends, “this is how I always heard rich people make money, stocks, it’s pretty easy”. The B2B names in particular were unbelievable for a while. My broker at Dean Witter was charging me 10% of the total value of my trades!

A friend of mine loaded up on a fiber optics co. MRVC in ’99, road it from 7 up to 140s and back down to mid 30s before selling. He was calling the investor relations dept.,drinking the kool aid…Question: do the new americans (latinos), India and chinese population be able to afford battery cars in the next 15 years,?

nice post

LED stocks are working

New IPO restaurants are working

Airlines are beast mode

Your Gas Station stocks are working

Big Pharma is working except for GILD

Micron is definitely working great but here also constantly making new highs

I think that’s it; oh and old software companies like MSFT and ADBE

So, Tetris then. What is it today? Assassin’s Creed?

I don’t play games anymore.

I might be premature, but I went long oil via USO on Friday. I don’t think the Saudi’s will leave the other OPEC and non OPEC nations hanging that cannot survive on $66/barrel oil.

NON Solo, I am with you on this one. OPEC and non OPEC members and for that matter the shale industry have to much invested to have oil lingering around the $66 mark.

Here is the full, 3 part series, of when I was fired and how it helped me.

http://ibankcoin.com/flyblog/2009/03/17/the-best-thing-that-ever-happened-to-me-part-1/

Thoughts on financials? Seems banks run the show. Not sure how that energy blowup will effect them yet though.

When oil collapsed in 2011 down 36% from the peak the market collapsed 20% over 3-4 weeks. I love you Fly but you are wrong. Sell everything and run for the hills.

This is not 2008. The economy is booming.

True, ‘dat.

Inspirational story of dogged determination to succeed. I suspect BlueStar has gone native, dancing around the fire in waterman attire.

Everyone is looking for reasons why mining and energy trade like crap while everything else goes higher.

The simple answer is the rest of the world is experiencing global slowdown while the US is seemingly unaffected.

This is ZIRP in action, skip the recession and business cycles and just have 2% growth forever. The US is now Japan.

Earnings should be entertaining though, anyone that exports heavily will have fun time with the dollar and poor demand.

Mr. Fly, I didn’t want to bring this up because I know how it is to be called out on a bad trade only to feel the pain again and again. BUT, why would you let a trade that you have such a nice gain in, turn into a loss? That’s trading 101 stuff. We all know at the very least, sell half and put a stop at break even. I have been bothered by that trade since I read it in your blog three days ago. WHY! WHY! WHY!!! I hurt for you buddy!! But, that was worse then dumb, that was arrogance!

Boone Pickins was on with Cramer on Thursday he thinks oil will be over 100 in 12 months again.

Wow, Fly, in addition to being a brilliant satirist, you are a perceptive historian too. This blog is incredible. Whenever you retire from trading, you definitely should write more if the spirit calls you.

I don’t see why you don’t write a book everybody else does you got a little bit of the following I think the book would take off I’m dead serious

Sloop

GPRO is not a loss. My basis is 68. As to why I didn’t sell, I have a head like an ox. Most of the time that stubbornness works for me.

As for writing a book: balderdash.

My life isn’t remarkable enough and I haven’t lived and/or accomplished enough to warrant others buy it.

I do write satire, daily, and that’s for free.

Almost 10,000 blog entries since inception.

I am really glad to hear that it indeed it was not a loss and as far as the book, I’m sure your book would be a lot more interesting than most that are put out today, but I hear you.

My God! This is the longest weekend so far this year. I don’t know why but I cannot wait for that bell to ring tomorrow

How much longer can this market hold up with the XLE being taken to the wood shed. Oil already down 2% on the futures.

Not long. The premise that ‘This time is different!’ Is fucking insane. Every cycle has a leading indicator of coming doom. Internet in 2000 housing in 2008 and now OIL in 2014. Oil must stop going down. But hey Walmart has some much needed greeter jobs for the holiday. Sure all the engineers, truck drivers, roughnecks, cafe owners, motel owners, bankers, mortgage brokers etc etc etc from the oil patch boom will be happy about the new prospects.

Great post.

Kick ass David Byrne video and one of my favorite all time songs.

i’m torn between wanting to get into oil dividend stocks, and betting the house on social media/tech. TWTR especially.

I’ll buy you a nice cardboard box. Let me know how things turn out.

This oil collapse is a clusterfuck. Can you imagine back in the 2008 talking heads proclaiming how great a housing bust was? They are overpriced and killing the economy! Fuck the boom and all the jobs! Now the plebs can buy other stuff!

…and who texted the Options Addict 😉