Before I tell you the secret to the Holy Grail trading system, let me tell you a story about my experience in learning kung fu when I was in high school. There were quite a few bullies in my school and I wasn’t going to make it easy for anyone of them.

“There are only four basic movements I’m going to teach you,” said my teacher. I was already depressed because four movements did not make an exciting repertoire here. How am I going to impress my friends with only four movements here? I was thinking to myself.

The four movements were deceptively simple. You alternate the two attacking and two defending movements between your partner and yourself on a non-stop back and forth movements until the instructor tell you to stop. To tell you the truth, it did get boring after awhile.

“When am I going to learn the other variations besides these four movements?” I kept asking the instructor.

“Don’t worry about the other stuffs, master these four movements first.” was his reply every time.

“90% of the time, these four movements will get you out of the jam in any physical combat situation,” my instructor kept drumming it into my head.

But as I pushed through these weekly training, I began to realize the wisdom of the exercises. My speed for the movements became faster and smoother. One day, one of the bullies was trying to intimidate me by throwing me an air punch very close to my face; without thinking, one of my practiced movement came out to block the punch at the same time my body was already moving on to the next movement of attacking which caught him by surprise that he almost fell over backward. It spooked the hell of the bully that he never ever wanted to get near me again.

My confidence shot up and I walked like I could take on any bully that came my way even though they were much bigger in size than I was.

In summary, by mastering these four simple movements, I became my own body guard.

Ok, great story, but what is the secret to the Holy Grail trading system?

Patience, grasshopper.

When you are your own body guard, your job is to observe and protect. Thus, if you really know your stuff (like Bruce Lee), your experience and skill set, coupled with the powerful processing power inside your head, will turn you into an ultimate body guard that can defend yourself in any physical combat situation (that doesn’t involve gun, of course). Your mind will size up the environment, the strengths and weaknesses of your attacker(s), and apply the proper fighting movements to counter the attack. You become your own Holy Grail fighting machine. Do you know Bruce Lee actually created his own fighting style?

Basically, my point is that the Holy Grail trading system is you.

To become the Holy Grail trading system, you need to master the basic movements of technical analysis in a manner of speaking. Below are my personal take of the four technical tools/movements that we need to master:

1st movement: understanding price action.

2nd movement: understanding support and resistance

3rd movement: understanding moving averages

4th movement: understanding momentum indicators

1) Price action:

I prefer to use candlestick chart and all the candlestick patterns that have been identified by the Japanese for hundred of years. Candlestick is just one of the price action tools, there are many other types available such as Heikin-Ashi, Three Line Break, point & figure, market profile, etc.

2) Support and resistance.

There are many way to look at resistance and support. I like to use previous year, month, & daily high and low, pivot point calculation, high and low of historical valley and peak, high and low of consolidation areas, trend lines, and Fibonacci calculation. I’m sure there are other ways to observe support and resistance that I’ve not mentioned here.

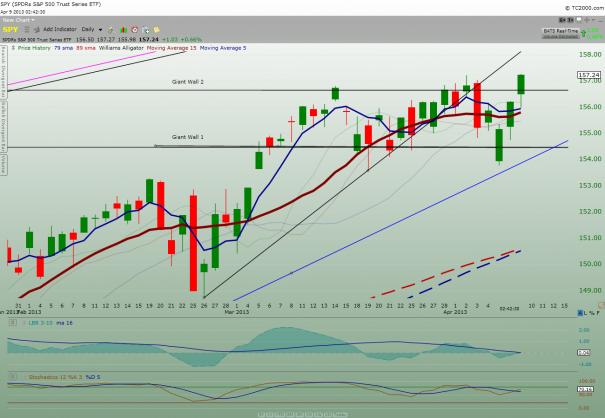

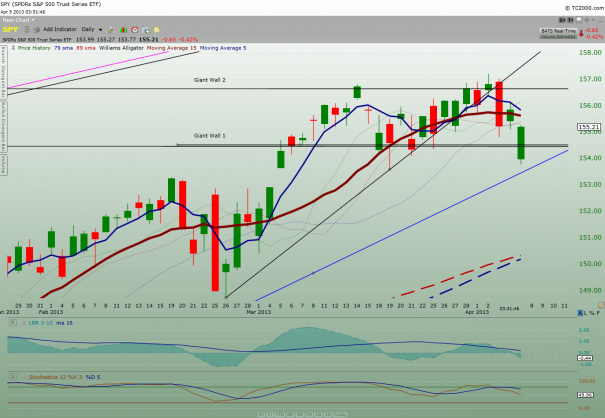

3) Moving averages

There are many variation of moving averages (ma) including those with offset. I have tried ma offset (popular among Joe DiNapoli with his 3×3, Bill William’s alligator, etc) . Offset or not, they all say the same thing, the less the number of days (or time units) you used to calculate moving average, the faster the line. And the faster the line, the more cross you will see (either with another ma or price action) But then the faster the line, the more whipsaw you will get if you take every signals. And if you don’t take every signals, you will have to know which signals to choose from the multiple signals which is something you want to avoid. Therefore, there is an optimal number for each one of you based on your personal preference and tolerance. Personally, my choice of ma changes from time to time.

4) Momentum indicators

Momentum indicators tell you the strength of the current bull or bear. By themselves, they do not tell you if the overall current trend is over or not. It simply tells you that the bull may be getting tired or getting hyper. The momentum indicator may also help you identify the development of peak and valley of an on going trend. I like to use MACD and stochastics and I change the parameter on the indicators from time to time as well.

These four movements are my personal interpretation of what are important to me as a trader, it is not necessary the required movements to be successful. Some greater trader may focus only on price action and nothing else. Some may only use a few of the above.

I remember reading that the Grand Masters of Tai Chi Chuan was so powerful in their art that they were able to condense their skill to a few simple movements. No matter how you attack them, all they did was to simply flip their hand, a simple shake of their body and you would end up flying across the room. In the same token, a master trader can take one look at the chart (or the tape for those tape reading connoisseur) and know if the stock is a buy, a sell, or neutral and is correct 7/10 of the times. They don’t even need to look at ma, indicators, etc. for these information are already absorbed in their observation of the chart. In other words, just by looking at the chart, they know exactly where the ma line will be and where the level of momentum indicators are without having to see them visually. Like a grand master chess player, he doesn’t need a chessboard to play chess, he can see all the possible moves and counter-moves all in their head.

If you’ve read “Reminiscences of a Stock Operator”, you know that Jesse Livermore could read the tape like a chess grandmaster read a chessboard.

Putting it all together

While there are many different styles of martial art; there are also many different variations and styles to each of the four type of trading tools discussed above. We each have to find the style that match our personality. How do you know which style best fits you? The only way you will know is by trying out different technical tools you come upon until you find the ones you are comfortable with. You will know which ones don’t fit you when you find yourself annoy by the indicators every times you open the chart.

Once you master the the technical tools mentioned above, that is when you come into the picture. You are the quantum computer that will bring these four movements together and calculate the next action/decision to execute. Your eyes, brain, mind, psyche, and your heart will process the data and alert you to a stock with a good risk/reward ratio.

I know some of you are keenly aware of this processing power because you’ve experienced it. You saw the signal based on everything you learned. You said to yourself, “price will take off from here“. And Voila, price actually took off like you predicted. Now, you might or might not have taken action based on this observation; but you know I’ve made my point here.

Here is a key reminder to this Holy Grail trading system- there is NO SHORTCUT. Meaning you need to work very hard to achieve this. If you think you can read a few books, watch a few video, spend little to zero time in reviewing the charts, and still become a Holy Grail trading system, forget it. Working hard means you spend hours and hours going over the charts to see how price action interacts with the ma/indicator you are interested to become a master of. You spend hours and hours of reading charts to see the relationship b/w price action, ma, indicators. You raid the bookstores and libraries to find related subjects on the technical tools you are interested in; you also want to read up on the thought of other professional traders to see how they think. You research for a software charting program/package that fit your needs so that you can practice, practice, and practice trading using the simulation module in your charting program during off-market hours. You document your progress by daily journal so you can become aware of your own strengths and weaknesses. You never stop learning from others because you are always interested in seeing things from a different perspective. In fact, it becomes a continued education that you are never tired of. In other words, trading successfully is your life goal. It doesn’t matter how early or how late you start your trading endeavor, you need to make this your life goal.

For those of you who are/were doctors, lawyers, CPAs, and professional in all manner of occupation, you know what I’m talking about. You need to put the kind of commitment to trading you’ve put into your career. Do you know there are doctors out there who are successful traders? They are successful because they’ve invested the kind of commitment to trading as they’ve done to being a doctor.

Having said all the above, there lies the ultimate obstacle to implementing your Holy Grail trading system successfully- your EGO.

Ego = greed = fear = I’m right and the market is wrong!

Eventually, Jesse Livermore, despite being a Grandmaster who possessed the ultimate quantum computer in tape reading in his head, were doomed by his ego.

So how do we deal with the ego? It won’t be easy; why do you think the giant hedge fund invested so much into quantitative trading? The way I see it, if we can put our own ego aside, there is no computer out there that can do a better job than the quantum computer inside our head.

The ego issue will have to be dealt with more posts in the future.

My 2 cents.

Comments »