Today confirms that yesterday Bullish Harami is not so bullish after all; instead today is a day to play defense. The Three Inside Down is a candlestick pattern that points to a possible bearish stance.

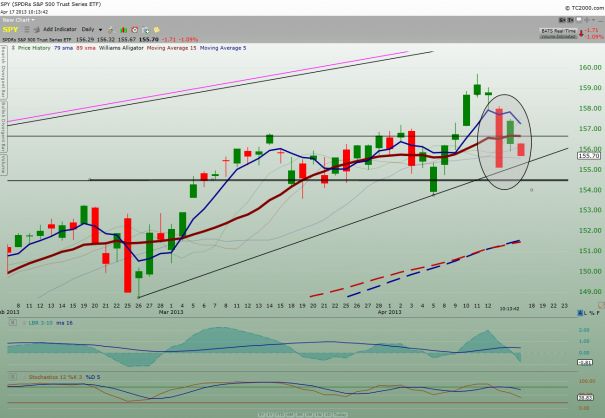

Take a look at the daily $SPY chart below:

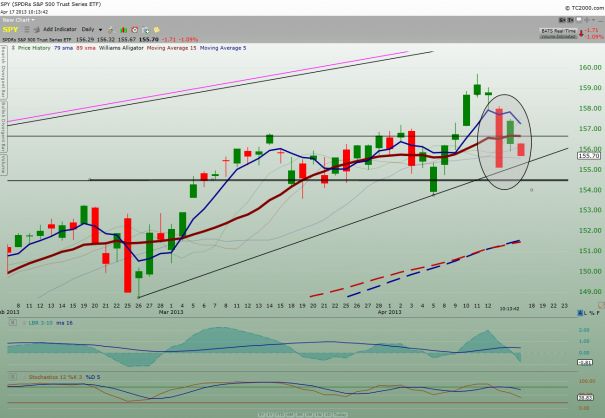

Now take a look at the primer on Three Inside Down below:

|

|

|

BEARISH THREE INSIDE DOWN

| Type: |

Reversal |

| Relevance: |

Bearish |

| Prior Trend: |

Bullish |

| Reliability: |

High |

| Confirmation: |

Suggested |

| No. of Sticks: |

3 |

|

Definition: Get the highest rated stock from Americanbulls for this pattern >>>The Bearish Three Inside Down Pattern is another name for the Confirmed Bearish Harami Pattern. The third day confirms the bearish trend reversal.Recognition Criteria:1. Market is characterized by uptrend.

2. We see a Bearish Harami Pattern in the first two days.

3. We then see a black candlestick on the third day with a lower close than the second day.

Explanation:The first two days of this three-day pattern is a Bearish Harami Pattern, and the third day confirms the reversal suggested by Bearish Harami Pattern since it is a black candlestick closing with a new low for the three days.Important Factors:The reliability of this pattern is very high, but still a confirmation in the form of a black candlestick with a lower close or a gap-down is suggested. |

***

At this point, a more cautious and defensive stance is warranted for those who are heavily long.

I’m currently sitting on 47% cash.

Be safe!

My 2 cents. |

Comments »