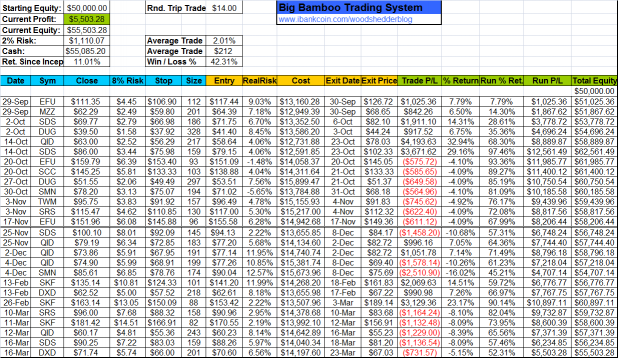

More pain for the Big Bamboo. DXD closed out on today’s open, after the RSI2 for the diETF closed Friday above 70. The trade may have closed with a small loss, or a small gain (hard to know for sure) if the indices would not have gapped on the news of our government signing a 30+ year adustable rate sub-prime mortgage on our future.

All politics aside, SDS closed out on Wednesday last week after the stop was hit.

I am disappointed in the performance of the system. The win/loss ratio is atrocious, compared to what we expected through backtesting. Although this is difficult psychologically, the system is still showing a profit, since inception. Since it is all about making money, I’m trying not to overweight the win/loss ratio and instead focus on the fact that the exit criteria and position-sizing seem to be holding up well.

In the interest of fairness and transparency, the Bamboo selected ROM for entry today, but because I did not run the update over the weekend, I did not catch the trade, or alert everybody prior to entry. The trade would have netted a gain of 6.8% today, and would have been closed on tomorrow’s open.

The Bamboo is now set to get long the bullish levered ETFs (as it did with ROM), as soon as there is a pullback.

I’ve been reading through your excellent posts and a lot of the responses. One thing that concerned me (and I’m sure it was covered in one of the posts that I missed) was that everyone is basing their systems on backtested profitability. 90% of my systems that backtest profitably fail miserably in walk-forward testing. Unless a system is profitable in forward testing, I wouldn’t trade it live.

Fact of the matter is that the market is not running normally. Why change the spark plugs when there is water in the fuel? Until there is a “market manipulation” indicator that we can use as a conditional we have to either 1) let the systems run and take the drawdowns, or 2) turn the systems off until the entry/exit cycles reset.

Thanks Faceoff. Glad you’ve enjoyed them.

Our systems typically have very few variables. They are simple. Therefore, I do expect them to continue working as they are walked-forward and/or traded in real-time.

One thing to be careful about is that all systems go through periods of normal performance, out-performance, and under-performance. When testing something over 15 years worth of data, it is not at all strange to see it hit a period during walk-forward or real-time underperformance, over x number of trades.

A “system health” meter is underdevelopment and it should help determine whether underperformance is normal or instead a sign that the system is slowly breaking down.

More on that later…

I agree with Manuelstop here, in the sense that your backtesting is based on a long period when trading conditions differ substantially than the current market. If it’s showing a profit it’s already doing a lot better than most people!

I concur.

Though, as a thought – have you considered reversing all the elements and seeing how that would work?

Example, if it triggers a buy signal on RSI(2) 80 then reverse them and backtest.

I am giving more and more thought to Marketsci’s ‘Abnormal Market’ indicator.

Though as a post modern analyst – the very thought is a bit ironic.

Oh yeah Cuervo, I’m already on that.

We’ll use RSI2 as an example, but the entry for the bamboo is not at all based on RSI.

For RSI what I’ve been looking at is whether or not trending is occurring since RSI contrary trading is really the anti-trend measure.

For example, run a test that is the reverse of mean-reversion, where you are buying above a MA and selling short beneath it.

Run it and you will see what I mean about the past few weeks or so.

Sounds like much ado about nothing to me. The system is nicely profitable still, despite having less winners than losers.

(It certainly works quite well with options, where the risk/max. loss is set (impossible to exceed the max. risk like it can happen with opening gaps) yet the profits scale similarly to profits with the actual stocks.)

I imagine once the markets ‘settle down’ a bit (once the constant stream of market manipulating news slows), the system will perform even more admirably.

Big Bambi certainly seems a bit streaky, so I’m thinking the next 1-2 picks at least will be money (based off the missed ROM trade).

DPeezy, it tends to be very very streaky. The tests we ran in the beginning had a significant Z score of near -3.00