The QID position came within a nickel of stopping out on Friday. It is marked-to-market as of the close and within .5% of stopping out.

The system has selected five diETFs to enter, but the rules will allow only 2 trades on any one day. The other ETFs were TWM, MZZ, and EFU. I would not trade EFU due to the awful slippage I have experienced in the name. MZZ is getting more liquid, but is not nearly as liquid as the other diETFs. As the system trades the open, liquidity is a huge concern.

With QID, SDS, and DXD, the Bamboo will be almost all in, and will have all major indices shorted. Another 4% up on the SPY will take it over $79.00 and leave it under $80.00. The SPX 790-800 levels, (SPY $79-$80) looks like strong resistance, but these diETFs may stop out before resistance puts a halt on the recent advancement.

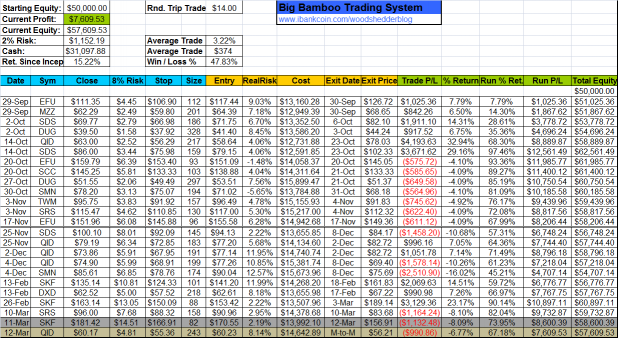

Since November 15, 2007, the Bamboo has closed 90 trades with 78% of those being winners.

Comments »