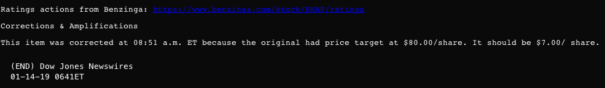

$SNAP is currently my largest position, and my stock of the year for 2019, so imagine how pleased I was seeing this note first thing in the morning: SNAP upgraded to $80.00/share.

__

__

Obviously, we all knew there was a typo this morning, but it made for a good headline tonight. All jokes aside, take a look at the location for SNAP here. We are already up a quick buck to start the year, with the stock flagging out right above the 50 day moving average. A move above $6.50, today’s high, likely takes us straight to $8.00 (minus the one zero from $80.00). Traders can use the 50 day moving average to manage risk here. It’s a buy on strength (I’m talking my book again).

___

___

And, for today’s momentum Monday screen inside Exodus, here are a few tickers to watch for the upcoming week.

__

__