I could sit here and type all night about how I have this market on a string right now…but I won’t.

If you’ve been following along, the picks here have been nothing short of amazing. It’s one thing to pick stocks that go up in strong market, but it’s entirely different to consistently pick the stocks that are not just moving higher, but exploding higher on a daily basis.

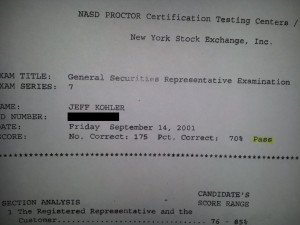

I’ve said this before, but it deserves repeating. I was a product of a bubble that took place on Wall Street in the late 90’s. I got pulled in to be a broker at age 19, pending a passing grade on the 7. I nutted the exam, with a score of 70. See for yourself:

This weathered piece of paper doesn’t mean anything, but I do love the fact that I passed this test with the lowest passing grade possible.

From that point on, I survived multiple layoffs, cut-backs, consolidations, etc. I may not have been qualified to take my position initially, but damned if I didn’t work harder than everyone else around me, ensuring that I would stick around, while all my lazy and unqualified peers were picked off and sent home with pink slips.

I bring this up only because it seems that in the not too distant future, when all is made public about how the majority of individuals still managing your money are significantly underqualified, there will be epic demand for the few individuals out there who actually have a great skill for this game. Those who can make money, manage risk, and who don’t lie, cheat, and steal to make it happen.

It’s funny that someone like myself can help an average Joe manage a portfolio for $60 a month, and absolutely murder all competition. I have an approach that works, and have developed an eye for what the majority don’t see. Through my upcoming premium service here, it will be my objective to help you learn and understand what I see. With time, you will start to see things for yourself as well.

OA

Comments »