Fake a move to make a move?

Comments »MARKET OF STOCKS

It’s early, but my watchlist is green. $WB, $GOGO, $PYPL, $WING, $DATA, $TWTR.

Interesting.

The stocks I bought yesterday haven’t breached yesterdays lows.

$GS is holding the August 24 low, despite banks being beaten today.

FANG stocks are all above yesterdays lows, as is $IBB.

The USD/JPY needs to recover 119.50, and the $TICK needs an extreme upside reading today if the market tries to advance. Despite the selling, there have been no extreme downside $TICK readings today.

This move seems market only, which I mentioned would happen.

Game on.

Comments »THE KNIGHTS HAVE BEEN SUMMONED

As we’ve walked step by step through this process, there are two final conditions waiting to be met, one of which will trigger today.

I like to use the $TICK to look for extremes. The last extreme we saw was Fed day, which was an extreme we have only seen twice in the last 10 years. That extreme in a corrective process, specifically at/near the lows will show an initiative buyer. While we’ve seen all other conditions that engage these buyers, they wait for shit-show moments like today to get the best bang for their buck.

Take a deep breath and follow all the same metrics we’ve used this week. That will tell the overall story.

Comments »MOOD

I said at the open “This is it.” It sure is starting to feel that way.

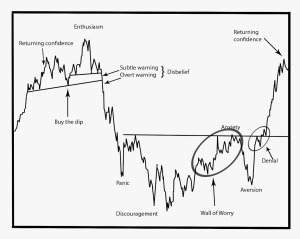

The more I think about this whole thing, the more I’m convinced that the only thing both sides of the trade are watching for here is the lows. All analogues call for a break of the lows, right? Except for the 2015 analogue?

The ultimate pain trade here is that while everyone watches the lows with bated breath, the market has already bottomed.

As discussed mid-day, everything was divergent again. Breadth, Market Darlings, Biotech, GS, Yen, EEM, FXI, you name it. Twice now we’ve seen this into weakness. I said last week that “divergence” would be the theme for this week. It’s been a source of comfort in initiating risk here, into weakness.

There are two checklist items that I need in order to say that this is all over. We need to see USD/JPY breakout, and I need to see the initiative buyer emerge. After that, I hope we can stop watching this market for a long, long time.

Happy NFP tomorrow.

OA

Comments »I CAN FEEL YOUR SENTIMENT

Note: I added to LT positions in $LULU, $FEYE, and bought calls in $SOHU, $NFLX, $FB, and $LNKD this afternoon.

Note: I added to LT positions in $LULU, $FEYE, and bought calls in $SOHU, $NFLX, $FB, and $LNKD this afternoon.

WE’RE DIVERGENT AGAIN

It’s early in the session, but just like Tuesday, we are divergent into weakness.

Here’s a quick snippet of our divergence discussion earlier in the week:

Breadth: $NYMO, PPT, $ADV-DEC, or any other metrics you use will likely avoid the values they hit in late August. If these indicators are significantly higher than their August levels, and the market has traded lower, get long.

Foreign markets: I typically will use $EEM, $FXI, or perhaps even $SSEC, $HSI, $NIKK, $DAX, $FTSE, $CAC, etc to see if the $SPY sees a little more excess than the others. Notice that the $EEM and $FXI are not following the $SPY into the same depth of their late August extremes…yet. If this persists, get long.

Biotech: With the volumes we saw today, 7 days of straight selling, and the trending action on stocktwits for some of the destruction in the space…I doubt the $IBB will follow the market down any further. If we see today’s low taken out later this week, and the $IBB doesn’t follow, get long.

Market Darlings: The relative strength names finally got sold today ($FB, $GOOG, $AMZN, etc). That usually happens near the end of a correction. Again, if these stocks do not follow the market into more downside, get long.

$USD/JPY held it’s opening low, trending off that opening purge.

$EEM and $FXI are higher over yesterday.

$IBB has not taken out its opening lows, while the market is hitting new lows here on the day.

$FB, $AMZN, $NFLX, $GOOGL are well above opening lows. Higher lows on the day with lower lows in the market.

$GS – unch.

Breadth: still too early to tell, but fewer stocks correlate to the SPY here at the moment.

Again it’s early, but note the action.

Comments »