Biotech bounced off last weeks balance. If you are not long, trade $IBB long here with a target back to $315…stop at today’s low.

Biotech bounced off last weeks balance. If you are not long, trade $IBB long here with a target back to $315…stop at today’s low.

After that, buy the next dip for the win.

OA

Comments » Biotech bounced off last weeks balance. If you are not long, trade $IBB long here with a target back to $315…stop at today’s low.

Biotech bounced off last weeks balance. If you are not long, trade $IBB long here with a target back to $315…stop at today’s low.

After that, buy the next dip for the win.

OA

Comments »Despite red indices, the current is strong. The $TICK has already seen multiple buying extremes today, nowhere near close to any selling extremes. What does this mean? When given the opportunity of lower prices, buyers respond.

F.A.N.G is non responsive thus far, but as the NASDAQ tries to bottom here, they should as well.

What’s important about today is to notice what is green, and what is being bought. Crude oil broke out of a multi-week consolidation pattern today. True story, I bought this last night: alert was at $46.25, stop at $45.85.

CL bottomed at $45.73 last night. This would have been my third big catch in oil this year. Missing this knocked the wind out of me a little, which is why I am late to step to the blog.

I’ll do a post on $IBB later, as I think the action has a strong sentiment correlation here.

OA

Comments »As you can see, pressure has been released from the lows. The velocity of price has seen the biggest uptick it has since October last year. Once negative breadth signals and divergences meet a reversal, the reaction can be extreme.

The biggest question now is what to do about a market that is reaching overbought signals so quickly. Fly mentioned Exodus being overbought, after a long string of extreme negative readings. The $NYMO is set up for its highest close for the year. Again.

The answer here gets back to your overall underlying bias about whether this was a correction in the context of a bull, or the first extreme rally to sell in a bear. Either way, you’ll know soon enough what the outcome is, but operating under assumption buts you in very uncomfortable situations such as this, or as I was faced with last week on Monday, Tuesday and Friday. The good news is that the profits here have been insane, and I have some excess to work with should I decide to change my bias. I have no reason to do so yet.

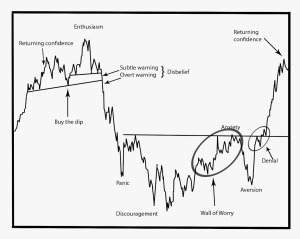

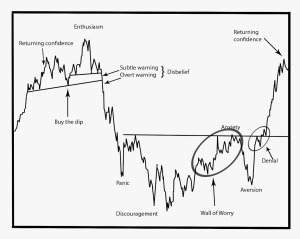

You have to really ponder the crowd here too. Not this crowd, but everyone else. I saw bears engage early on last week, not bulls. I saw victory declared in their camp on Friday. The bulls were silenced.

What did they do into the weekend? Cover shorts? Take longs?

That being said, what do you do here? Chase the short up? Chase the long up?

This is why the traps were critical. Everyone gets screwed on the way up.

Markets can rally on extremes. As it does, the pace slows, individual stocks move without fear of the market and we trend.

OA

Comments »Man, the silence says it all. This all went off way too perfectly.

Let me say this, the way both traps were set in the last few weeks creates the most perfect signal. The perfect signal are all the elements that were needed in order for me to call all of this in advance.

Let me ask you this…

If you woke up tomorrow, let’s say Dow down 100 points…would you be a buyer or seller into that move and why?

OA

Comments »To play fair, I want to discuss the negative divergences occurring here today, as to not act like they are being purposefully overlooked. Many of which I feel were vital last week, and inconsequential this week.

On the day, the bright spots are breadth, Yen, HYG, and risk appetite…all of which were highlighted last night.

The dark spots are the $IBB weakness, perhaps $AAPL, slow overall market movement, maybe you were thinking more enthusiasm in some momo names?

This is the shift in the market where I start talking about the market itself less and less. At this point when signals confirm, the day to day action in groups and names becomes the focus, and the market is just a bi-product. In other words, the market becomes a market of stocks, and not a stock market.

As an example, let’s take $TSLA, $GPRO and $FEYE. All three are clearly not participating in today’s move. That relative weakness should mean that more downside is coming. Mark those three names and let’s see how they do tomorrow.

As for $IBB, I think action like this is bat being set. There is notable weakness, but I am seeing roughly the same # of stocks that are up 4% or more as there are stocks down 4% or more.

As for $AAPL, it wasn’t a needed item last week when we were looking for positive divergences into strength, therefore I don’t think it as important this week. However, at the turns, we’ll want to make sure it isn’t blatantly moving in opposition to the NASDAQ.

More later,

OA

Comments »

Per discussions last night, I’m feeling pretty good about the overall picture here.

The USD/JPY is pegged at resistance, trying to make its way out of this range.

I love the types of names leading the strength thus far today…MU, OAS, JMEI, SPWR, DDD…

Breadth is extreme positive today, $HYG is ripping through last weeks prices, and shorts are engaging again.

I bought Nov $CMCM calls and some weeklys here on $TSLA.

More later,

OA

Comments »