We’re far enough along in this rally that people are gravitating solely towards riskier instruments.

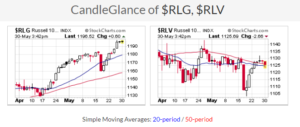

Take a look at these charts…

Growth stocks are in a full blown uptrend and value stocks are in a downtrend.

Is this the stage where you look at your portfolio and decouple from old man stocks?

Maybe you sell some $MO for some $MOMO? Some $DD for $DDD?

If you enjoy the content at iBankCoin, please follow us on Twitter

Jeff when does energy/ xle buttom

lol…wouldn’t that be fucking awesome?

We sure are seeing some very lengthy pull backs, but at relatively low volatility. For 6 straight down months this has been pretty tame. That initial break below $65 in 2015 was when oil cracked $40. Sure feels like a different time now. By my judgement it’s oversold on daily, weekly and monthly. Only thing missing is a final break of key support…but you can’t always have it all.

In short…I’d say it bottoms right around here. I’ll be taking a flyer on an up June.

Looking from a sentiment perspective I think it’s pretty clear we’re in aversion. My problem with that trade is that aversion could very well bring XLE back to 57.5 before finding its footing.

Plus there’s just so much headline risk. I think there’s better plays elsewhere.

I’d certainly have more confidence if we were crashing. Then I’d just buy common, extend my horizon and sit through the pain. This stair step lower month after month wears on me, which is why it’ll be a relatively small position.

my thinking is growth continues to perform through the summer but value catches up with vengeance this fall. then outperforms through 18.

if you’re more into intermediate/long term, would now be the time to start accumulating value?

No, definitely not IMO. The time to accumulate value is into market turmoil.

Great set of comments thus far on this post.

Question: Do you differentiate between “value” like $CG, $PG (old man stocks) and value within beaten down sectors like $BEBE, $BKE (high value retail for instance)?

Another example would be $KMI, great value in a beaten down sectors that looks like a great LT play.

Maybe it is a pass when playing with options, but a good place to get stock for holding LT?

Man it was a bloodbath in the reflation trade on the open this morning, but what a recovery. X reversed a 5% loss and is now flat.

OA, do you lump the trump name in with value? Or are they distinct enough from sentiment perspective that you wouldn’t paint them with that brush?

Agree, funny thing is six months ago the mantra was reflation reflation reflation.

That has turned to tech tech tech.

I hate to generalize anything. I’d take it stock by stock.

Per the value discussion, check out the largest fund inflows in the last week…

http://www.etf.com/etfanalytics/etf-fund-flows-tool

OA

What phase of your sentiment chart do you think qqq is in right now? Confidence?

Thanks

Returning confidence. Wave 5 if you’re into that shit.

OA,

Do you think there are too many people waiting for a June downturn to go long in July/ Aug?

I don’t see the conditions that make me worry about this yet. GFM Cash position still in very high territory.

Throw some D’s on that b…. 😉

I bought a lot of stuff today.

Comment amount in the sweet spot too.

It’s true. Everyone’s as miserable as me I guess. I buy every day I feel this bad. I’m either going to get paid or take up tennis.

Bought some $NYCB this morning. This looks like a bottom to my eyes on the weekly and I want a little more financial exposure as that feels like a dumber and dumber choice each day.

I’m also looking, again, at $SWN. Debating between 2019 leaps or shares. You cross your fingers that 2019 will do the trick, but it would be much lower stress to just buy shares and forget that I had for a few years.

Citron pumping BBRY today. Not so sure about this as they have had more than a few clunkers recently.

BOX squeeze

…or, the other Trump trade

That which shall not be named looks pretty good.

MayBe I need to concentrate more on the Price fluctuations to have suitable investment policy,

My partner and I stumbled here coming from a different website and thought I might as well check things out. I like what I see so i am just following you. Look forward to going over your web page again.