Fund flows over the last few weeks show that money came out of index and equity. The echoing sentiment out there is that these daily fades are going to connect soon and lead the market lower.

The problem is, HF’s have already sold and retail has been raising cash and positioning for lower.

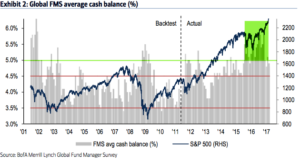

This chart is still paramount, IMO.

Cash position stayed in extreme high territory for the longest duration on record. Even now, we’re still sitting around that 5% threshold. When we dip UNDER 3.5%, that is where markets top and correct.

Last week, we hit the lowest bull sentiment reading for the year, as well as the highest bear sentiment for the year via AAII.

If the market resolves this little chopfest higher, people will be forced to chase back in at higher prices. That will be the first bull trap scenario we’ve had in ages.

That is why I think you wait for May to play for downside.

If you enjoy the content at iBankCoin, please follow us on Twitter

*crickets*

My previous comment on the VIX curve is some pretty inside baseball stuff. Could easily see it playing out without much more of a pullback.

So, is there a catalyst for May, beyond an expectation of where cash and survey results will be at that point?

makes sense

According to that chart, the last time we dipped under 3.5% was near the end of the ’08 bear ..not the beginning?

Summer of 07. Maybe you aren’t looking at it right?

Maybe your computer made an error and typed 3.5% when you meant 4.5%?

Summer of 07 says their cash balances dropped under 3.5%. That means they were nearly fully invested. That’s where the top occurred and that’s the smallest average cash position listed on the chart.

What am I missing?

Ferd, you need to look at the grey bars and not the blue line which is SPX. The Cash Balance % is the bar chart.

Ah. What a maroon.

Thanks

I’m with you OA. Great analysis tonight, After Hours

Sold down some NVDA puts and VXX calls today for gain. Rode da BABA this morning with calls for the quick in and out gain. Looking to exit more VXX calls tomorrow morning no matter what and then ride the rest. Either sell some immediately on gap down open, wait a few minutes and sell them if VXX is down more than 1 percent and moving lower – or – best case scenario – VXX opens slightly up and then the entire market plummets in which case – I’ll gauge the best time to sell into the carnage.

Blog comments back to being quiet as fuck. Everyone gone because one trade idea didn’t work out 100% as mapped out.

Good profit is coming to those still here with a level head.

I know, you can hear pins dropping around here. Was there even a single mention of that trade today either? Talk about a sentiment flush out today..

As far as 97 NVDA puts that are left and a bunch of 93s – playing those for at least a 95-something print. If I don’t get it – oh well – already have a gain on the trade and I’m not gonna trade them in for peanuts. Already took enough peanuts in to make it a worthwhile trade.

SNAP still 60% bearish on Stockshits. Shorts going to burn here methinks.

Sample size is pretty small here. I’m seeing maybe 4 instances with near 3.5% and 2 of them worked.

Break out your charts and look again. Market hit its 2004 high at that sample, summer of 06 was a bloodbath, summer of 97 market top, and 2010 was prior to flash crash. 2 of 4?

The data going further back is compelling, but I’m not trying to tell you what to do here. Good luck.

Excellent analysis. I will position accordingly.

mmmm

Hi, OA would be very much interested in your take on SNAP here?

What a waste of a great move. Fuck that stock.

Dude–let me help you. The stock (and trade) are deader than Michael Jackson. I hate to see a bunch of people end up with worthless weekly calls, but this thing is going to drift until they report earnings, and more importantly, update Wall St on monetization efforts and user growth. I dont think its known when SNAP will report yet (probably not until end of April or sometime in May) but only then will we see some action in the stock.

FYI–this is what I posted 2 weeks ago on the “Best thing to do? Panic” post.

———————————

stocksnblondes March 29, 2017 at 2:29 pm

Still cant get on board with this as a pure “sentiment” trade. I dont think longs or shorts will make money on this one until that first earnings report is released. May swing a couple of bucks each way before then depending on how the broader market is doing, but thats about it. People learned their lesson on TWTR and wont be running this one to the moon without some fundamental news first (ie an earnings report with news on user growth, monetization efforts, etc.).

But you have gotten zero traction on this comment. Worse, the stock ripped 25% after you said it. Yeah bro, aside from me making over 1000% on that move…your call was much better. Good shit.

stocksnblondes

I understand the theory behind the trade (i.e. new IPO with unproven business model and very bearish sentiment), but maybe because of how TWTR played out, you actually won’t see the same pattern repeated with SNAP. At least now without some fundamental news to show there is a path to monetization. No skin in the game here–just my thoughts.

STAGE ONE: DENIAL

2017/03/20

My call has been spot-on. Not sure how you can deny that with a straight face–but I guess you just tried to. You’re right, there has been some volatility since I posted and if you were an uber trader than maybe you caught a quick spike and sold. But overall, this stock hasnt done anything since its brief foray to 24. It certainly hasnt ramped up towards 30 and hit highs as you projected.

It’s still above where I bought and still higher than your call lower. Easy to see who’s on top here.

Pretty funny spin you put there. I didnt say it was going to drop tremendously, just said it would be rangebound at best and thus betting on weeklies in anticipation of a ramp to its highs wasn’t a good move. Anyway I dont want to argue with you. Youre not very objective.

You haven’t been very right yet. Soon as you are, you can guest blog dat knowledge.

Oa got out of snap?

lol..your asking his take on SNAP now?

Of course, the idea is open and he promised to walk his audience through it. I think it especially applies when things do not go in the most ideal way. Not only when there is sonething to brag about. Or am I wrong?

Out of all VXX calls and NVDA puts sold them down throughout the morning

nice trade

he did the same thing a few years ago with FSLR….the whole group watched hundreds of options expire worthless

Aww man, you too?

How does FSLR relate to SNAP? Did I break any position size rules? Let me guess…you did?

Yeah, for FSLR the post was, “Hey Guys, FSLR is consolidating right in front of a huge pocket and an investor day. I’m buying.” Bitter is very easy to spot on the internet.

Loving all the panic out there on twitter. Very educated people are talking tops and turning lower from here. Turned on bloomberg and they’re talking about corollaries to the 2000 bubble- everyone seems to be waiting for the fall.

Spoke to an attorney yesterday who’s sitting in all cash, waiting for the market correction to buy in at lower prices.

#signals

Added VXX 19 apr 28 puts

XBI May calls and small batch of IP May calls. Stopped out of GLD short this morning again

Something else that’s interesting to note is the vix term structure is inverted in such a way that may vol is the cheapest on the board. This tends to mean that the dealers are all long a lot of may vol/protection/gamma, and will be exposed when that rolls off. It’ll create pin action until expiration which will then flip to a very short gamma position potentially exacerbating any move.

With spot right between the front two months, I can’t imagine how that spread is anything other than free money (famous last words). Barring a big parallel move higher, April’s gotta come down to spot and May has to come up. April expires before the French election, which makes it all the more strange. Makes me wish I traded futures. I’m just sitting here like a piker hoping XIV gets cut in half.

I happened to do a quick drive by on a few earnings.

Great options on both sides.

Longs: $CUDA, $TRIP, $PAGP, $JNPR, $SPLK

Shorts: $LOGI, $AM, $AAPL, and maybe $LOGM.

Also, the regional banks, a short idea I’ve been deeply wedded to for 3 months, look like awesome setups are building on the daily for longs. The weekly setups look a little more iffy. But on daily, a few of the many are $TCBI, $SIVB, $CFG, maybe $KEY. The BEST setup right here though has to be $WBS, of which I am short from higher price, but not yet to my price target. Bummer.

Not a bad setup on BNCL. Wish the options werent so thin

NTNX looks ready

Thanks for your analysis. This supports the anecdotal experience I’ve had the last few weeks as everyone has been getting anxious with the lack of new highs. Thanks again.