After having read many market analysis posts over the weekend, I thought I ought to collect a few charts I’ve been blogging about and organize a view point of some longer term factors that have been dictating my blog posts as of late. In other words, this is why the market is telling me it wants to go higher.

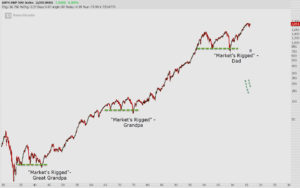

Bull cycles run in three phases. Accumulation, participation, and excess. Meanwhile, while these phases occur, there are shorter cycles that take place about every 1-2 years during a bullish cycle. I call this a “cleansing phase.” For example, coming out of 2011 (participant cleanse), you got 2012-2013 (a run that sucks folks back in). Then you get 2014-2015 (participant cleanse). 2008 was more than a participant cleanse, I view that as more of a generational cleanse. There’s a few ways to separate these cycles, and I like to imagine that there are 3 signals in a cycle that determine where each entry point is within a trend. They usually coincide with the rinsing of the crowd of new experts that surface every two years after the market has conditioned people on how easy it can be to make money. The market has spent the last two years conditioning people for fast sell-offs, destruction in individual stocks, and financial media has done well at prepping everyone for some sort of crash that they all have seen coming. The RBS “Sell Everything” warning is where everything started this year, so I’ll get back to cycles and signals.

There’s a few ways to separate these cycles, and I like to imagine that there are 3 signals in a cycle that determine where each entry point is within a trend. They usually coincide with the rinsing of the crowd of new experts that surface every two years after the market has conditioned people on how easy it can be to make money. The market has spent the last two years conditioning people for fast sell-offs, destruction in individual stocks, and financial media has done well at prepping everyone for some sort of crash that they all have seen coming. The RBS “Sell Everything” warning is where everything started this year, so I’ll get back to cycles and signals.

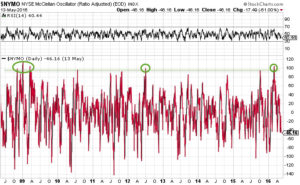

Breadth indicators are usually what I use to isolate accumulation and oversold signals in the market. An accumulation phase will start after a bear market, and will usually be several extreme buy signals consecutively in a short span of time. This happened in late 2008, going into March 2009. You can contrast this with the number of quality stocks that didn’t follow the market down to new lows during that time frame. So many bullish divergences in stocks and various indicators and markets occurred at those lows.

I like to use the $NYMO. There are others that can be used, and can be applied to support this analysis, but here’s the $NYMO going back to late 2008.

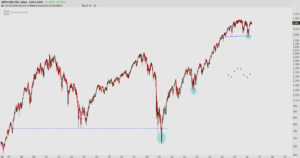

To help measure accumulation at prior to each of these buy extremes, here are the divergences using a standard RSI.

To help measure accumulation at prior to each of these buy extremes, here are the divergences using a standard RSI.

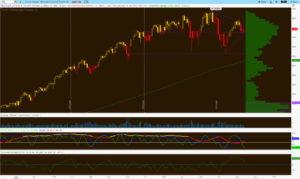

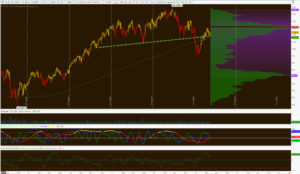

I won’t debate that the Dow and SPX weekly charts look toppy, but I will argue that the Nasdaq and Russell look absolutely compelling here. Considering the equity outflow stats and the profile of these instruments, I’d argue that this is the move you must engage here.

Here’s the weekly and daily /NQ profiles:

I am absolutely enamored with this chart. Everyone that looks at this chart suggests top, head and shoulders, or the fact that it’s lagging behind here. That just makes it so much more appealing.

The Nasdaq is the only index with its POC in the middle of its multi-year range. See below.

I found it appropriate to point this out back on the 29th, as those prices have held ever since that post. Odd that when you have support under a market, it prevents it from going lower.

How about the H&S pattern on the $RUT? If the move beneath the neckline results in a thrust back above the neckline, it’s considered a failed pattern. They say from failed moves come fast moves, and I can’t fathom how this location isn’t actionable or attractive here.

The other considerations here might include discussions on critical groups, sectors or market themes. I think the LT analysis I’ve been posting on $IBB is pretty compelling, but also the rotations into risk or growth over value are healthier than they’ve been in years.

It’s been a choppy environment the last two years, but I think that helps to shuffle the deck a bit and get folks short or out of stocks entirely. I’ve often blogged about the large developing short position under this market, but also the stats on how people are getting out of stocks or have left the market altogether. On this two year chop binge, this action propels prices higher over the next few years. If stocks to make a break for it here, the higher we travel those shorts are forced to cover, and the move higher triggers the emotional pain of missing out. The higher it goes, it attracts more folks to chase. Fundamentally, we probably don’t belong up there, but I’d say it has more to do with being improperly positioned, sentiment, or being too early. Markets don’t crash or sell off without that crowd involved and actively engaged. That’s why the bull cycle always ends with a blow off move, or some degree of enthusiasm or euphoria. As I’ve pointed out on longer term sentiment charts, we were at that choppy “buy the dip” stage back in Jan/Feb this year when that record $NYMO reading hit.

So anyhow, that’s my long term take on how constructive this market is, and the reasoning behind my opinion of higher for longer.

All of these tools will be given to you as a checklist in the upcoming boot camp. Sign up today.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

“Standing O”

Nice work on this piece

The only issue I have with the TF chart is that big supply of volume overhead telling me it’s just going to continue chopping in this range again for a while. I fully agree that looks like a failed H&S top. I have started using On Balance Volume to check some of these Futures Indexes for confirmation as well. Hopefully with the continued break up and out of the neckline, the volume confirms the move. If it should, I may try some June / July calls in $IWM. Great analysis as always.

We knifed through it in the Nasdaq. And all other indices consolidating and accepting these quiet ranges right at their overhead “supply.”

Do you see potential federal reserve hikes of the federal funds rate having any effect, or just minor bumps in the road to higher equities?

No, so long as they go at a “medium pace.”

The Russell is coiling up here nicely since noon

Well, this is how we started off last week. Hope it doesn’t follow that same model and tank the remainder of the week.

False.

Market was flat last Monday.

ok fine. Tuesday was the up 200 day. Apologies for that. Just meant we started off the week strong and ended lower. that’s all. Here’s to hoping same doesn’t repeat.

Are you long?

yes. So you should get short. I know that’s what you were thinking 😉

My apologies for the late notice, but something came up and I won’t be able to meet today after the close.

Let’s plan on meeting tomorrow, 5/17 as usual. We talked about a top down analysis on retail stocks for those interested.

Again, sorry for the inconvenience. Have a great day!

OA

While I was not expecting the apocalypse today, I did not expect this action – solid and methodical – will make tomorrow interesting to say the least

Great write-up.

It’s pretty silent, so I’m wondering if I missed the mark here…lol

Or did the majority go short last week?

Comparing “markets rigged (grandpa and great grandpa)” there were 3 humps before the dip.

When you look at the “market is rigged (dad),” wouldn’t it look like we have one more crash (like the previous two eras) that makes everyone throw in the towel?

I think we’ve moved well beyond that, so no.

it takes some serious insight and work ethic to go against “the crowd” here.

I am always impressed by your findings and that continues on with this post.

I agree that we blow off the top, but what im concerned is what comes afterward. considering we are calling for a euphoric-type move here over the next… lets say, 2 years?, does that not mean that after that move comes a risk reset? im referring to 5+ years out.

I think the most difficult decision ive been tossing back in forth over these last few years is this: “is it worth it to join in for the blow off top , if its going to be followed by a fast move downward? (specifically with IRA money earmarked for years and years away. )

Wouldn’t that be like trying to start a game of musical chairs when the song has already been playing for 45 seconds?

I think this gets into a risk discussion and what your tolerance is as well as where you are in relationship to needing the money you have invested.

I think getting invested now is the only way to get the gains to offset what is to come – even if this next phase is only 18-24 months (which I think is the timeframe OA was looking at).

Tops take time. Why would that not be a good time to trade? It’s the best time.

On a long enough timeline, the survival rate for shorts drops to zero.

bchu’s shorts drop to the ground any time OA makes a post

I am disappoint that there wasn’t any lines from the 1700s that was overlaid on recent price action telling us why stocks are going up

maybe next time

Not your cup of tea I suppose?

Speaking of tea, East India Trading Co was pretty much the first Apple, which is quickly becoming Intel. IMO this market needs something fresh and new. Central Banks and tech aren’t getting the reaction they used to.

I agree with you on sentiment and how it drives markets, but I can’t see propelling to new highs without some fundamental change. Massive surprise Fed QE could do it. Maybe. That’s essentially what cemented Japan into their current mess… raising once then having to cut again after. I don’t know. I think that’s what makes it so hard to buy into the “break out of the range to the upside and stay there/continue higher” idea. I believe there must be a trigger for that and I can’t think of what it might be. Not to say it doesn’t exist… just can’t see it.

Higher is the pain trade. Funds have lowest exposure to stocks, short position is significant, and 15 weeks of outflows. I think that alone can keep a bid under a trend…but you make a great point.

The all afternoon consolidation in NFLX is pretty impressive – looks like a buck-tooth fox on a 15 minute chart.

Great post, OA. Thanks.

The thing about heads and shoulders is that they seem to always be all over the place, no matter what the market is doing or will do. H&S seems to be the indicator that gets the prize for being the least predictive of anything at all– except that you are looking at a chart of the stock market.

you’re about to catch a right hook following me around like that

What’s going on here. I am the token frog on this blog

I’m short, so I’m sure that I have some confirmation bias. However, if I’m wrong, I’d want to know it as soon as possible. With that said, I think that this is a great technical article, OA.

There *are* a lot of shorts in this market, and that combined with the corporate buy-backs may be enough to give it enough momentum to acheive escape velocity, as long as there isn’t a catalyst (will Britain *actually* leave the EU?) to give the bears a claw-hold, so I do see a path up.

However, as you said, “Fundamentally, we probably don’t belong up there.”

I’ll also note that on the decades-long chart, there were strong underlying fundamentals that launched those bull markets, not just fear/greed and investor setiment

– 1940s: obviously creating a huge manufacturing base for a World War and having no countries with solid infrastructure to compete against us

– 1980s: realizing that if we drop taxes and go into huge budget deficits, then we can just pull future growth forward (check out Debt/GDP on the same timeline). This plan continues today (BOTH parties)

Demographics were also a lot more favorable in the past, and now those pose a huge headwind to asset growth, especially on the long-timeline. I still feel that Japan’s 25 year Nikkei performance may be a preview of what’s in store

One possible long-term bull-market fuel could be fundamentally lower energy prices. We have already seen a large drop in oil: maybe the threat the Saudis saw was not “tight oil” but is actually clean, renewable energy. After all, it’s not like they destroyed US oil reservs, they just delayed the extraction. On the other hand, once something like solar becomes cost competative (without subsidies…) with oil, THAT would be disasterous for the Middle East.

Of course, that is why I remain *fundamentally* a bear. On a technically basis, I still don’t know if it is 2007 or 1998 – Russel does look strong…

Someone has to explain why we are being compared to Japan so often. We are completely different in almost every aspect with the exception of some monetary policy experiments. 1/3 of their population is currently over 60. Their population of 127 million is declining and it does not look like this can be corrected very easily. They are on an island with land mass of 145,000 square miles with few natural resources. We have 316 million people and population growth. We have 3.8 million square miles with abundant natural resources. We are also creators, innovators and leaders in many fields of technology, medicine, science, engineering….

It doesn’t make any sense to compare our economic future or that of the stock markets with the Japanese. They made cool cars and VCR’s and other electronics for a while but that’s about it.

I’ll agrre that we are in a much better place econmically than Japan (or Europe or China, for that matter). That outperformance will continue for a while, I believe, fo the reason you mentioned. However, it’s kind of like the tallest midget theory.

The reasons Japan comparisons come up:

– both countries are mature, technically-innovative economies

– both countries have high National Debt/GDP

– both countries have aging populations (BTW in 2010, 20% of Japanese > age 65)

– both countries have very low interest rates – that continue to fall despite predictions otherwise

This is not to say that we are *presently* like Japan, just that we are trending in that direction

Doesn’t Japan have shrinking population vs growing in the US?

Yes, Japan is both aging and shrinking (no babies+ longer life), while we are just aging but not shrinking

(thanks in large part to immigrants).

The key number is that the “working age” (15-64) population is at 66.4% and dropping in the US. In Japan, this number peaked right under 70% in the early ’90s and has been steadily declining.

Japan’s Nikkei 225 peaked in March 2000, June/July 2007, and is down 25% since plunging in Aug 2015 and Jan 2016.

The S&P 500 peaked in March 2000, Aug/July 2007, and is down 3% since plunging in Aug 2015 and Jan 2016.

Of course, that’s no reason to think the US won’t make a new all-time, high this year, right?

OA – great write up. I don’t read many blogs anymore as most bloggers are twisted and bent out of shape. The last few years have done it to them.

Yours is one that I came back to see your views. They are actually thought out and well constructed.

Keep up the great work.

Fundamentally we do belong up here, and higher.

GDP…..2.2%

HMI……-8.8%

LEI….0.2%

CEI……UNCH

CPI…..0.1%

PCE….0.8%

FOMC……won’t raise rates….

Thanks for the thoughtful post. Fundamentally we may well belong up here if the market is telling us that they will be successful in creating inflation.

So Soros bought puts on 2.1 million shares of SPY. Let’s say he bought 21,000 Jan 17 200 strikes or even up 210 strikes. So he put up $10-14 per share. $20-30 million bet and everyone freaks out about how bearish he is. That is .0008-.001% of his net worth. Not a very confident bet

Poof, your bullshit overnight rally has once again been stymied by the Bears….

Bulls that continue to drink the Kool Aid need to keep in mind that any analysis that fails to take the continued flow of money out of equities is flawed.

Lower off open yet tick trending higher? Waaaay too early to declare this a win.

You’re right — too early to declare.

Keep an eye on SPG, MAC, IYR and MCD. Action could imply the much anticipated crash in Commercial Real Estate Market is finally playing out.

So in situations like this where we have a range, so essentially a battle over price direction, what causes the shift one way or another? Is it market forces (an event), large players opting out, sentiment shifts, added money flow (in or out)? Seems to big for one entity to manipulate, but what is the theory? Is it just the invisible hand?

It’s when the passengers all move to one side of the ship. Thursday’s P/C extreme is why we rallied yesterday.

Fokin deja vu of last week. Lame

we will close green. chill

We rallied hard last Tuesday.

That was yesterday. And last Wednesday we dropped

Wonder if this selloff reverses after Europe closes.

Added to CLF calls, May 3’s..

liking the RUT divergence though

Any thoughts on NKE here? Couldn’t resist FSLR, bought June calls…

Transports up nearly 2%

Too bad I can’t borrow this $MGT. Can anyone locate shares?

That thing has gone full retard.

Added to LT positions in $FSLR (now 2/3 position), and $CREE (now full position).

Love the location in $DB, and selling volume is dropping here. Was going to add to my LT position but I think I might go calls instead.

Also did some chart shopping on the mid-cap growth front. I have no idea why, just wanted to look at some new charts and that seemed to be a spot that could do well in the type of market environment I’m positioning towards. My 4 favorites across multiple time frames, roughly in order, were $SYNA, $CERN, $SBNY, $ALK, and I’ll throw in $WETF for laughs.

Scratch those $DB calls, premiums are extremely elevated.

MCD…LOD. Leadership, oh leadership, wherefore art thou???

Look out below….even the defensive names are going down…CPB KO PM KMB PG.

It’s a rotation. Just like these stocks rallied hard late 2012 into Mid May 2013. Everyone realizing that the market isn’t going down, and you can’t add staples and defensive shit into a market breakout. Same 2012-2013 action. Right when markets took out 2007 highs, they ditched the same stuff.

I respectfully disagree. This is not the time of the year to be buying technology so if any rotation were to occur, it would occur slowly throughout the summer.

If you’re a portfolio manager looking to park a few $100 Million, would you prefer to buy Dell’s deal that yields mid-single digits or would you buy AMZN here?

Low put to call confirms yesterday’s complacency and I am still of the opinion that Dell deal will cannibalize a considerable amount of liquidity that would have been allocated to equities. JMHO

Neither, but my top fund manager I follow just made $QQQ his 3rd largest holding. I’m watching the tech buys closely, and they’re active.

Yup. Russell leading down again today

OA, thanks for putting in the time to create this post. I’ve been following you for years, even before ibc. I’m starting to trade again after a long hiatus and hope I can contribute in a meaningful way.