Interesting article on Bloomberg today about the $1 Trillion Dollar short position in the market.

Interesting article on Bloomberg today about the $1 Trillion Dollar short position in the market.

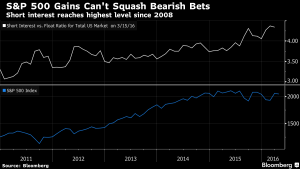

If you enjoy the content at iBankCoin, please follow us on TwitterAmid its biggest about-face in nine decades, a funny thing has happened in the U.S. stock market, where rather than loosen their grip bears have grown ever-more impassioned. They’ve sent short interest to an eight-year high and above $1 trillion, by one analyst’s math. Position reports from the Commodity Futures Trading Commission show mutual fund managers are more skeptical now than any time since at least 2010.

In short, disbelief is running rampant after $2 trillion was restored to share values in six months. A chorus of Wall Street prognosticators says that’s a big reason the rally can keep going.

I felt like Michael Burry into yesterday’s bloodbath…

Anytime the word analyst is attached to a report I stop reading. Unless of course the words discredited, often wrong, or douche-bag precede it.

What are the most shorted POS’s right now?

INSY? Yes, POS.. but at least Biotech.

50000 share block bought at close.

$VSLR?

OA – reason I asked about JDST is the current setup in gold. We are in a large downward sloping channel with the recent up-move testing the upper bound. I’m of the opinion that the bottom in gold is NOT in yet. Anything in the 1229 to the recent highs area is a potential short IMO (a level that got stuffed today actually). Yes, JDST looks like shit but should follow if my thesis is correct, no?

Yes, you should follow your thesis absolutely.

Last comment on that is that it is possible that the breakdown in /GC could coincide with the pullback in /6J, which would give strength to the dollar. The Yen is stretched here and should come in, IMO (or BOJ will make it come down).

Interesting. All the price behavior we’ve seen in the last several months follows that 1998-1999 analogue verbatim. Gold was a great short until the end of the year, but had bottomed before the big short covering rally.

Yikes. Today bad for gold shorts

The battle with my emotions is a losing one today. Logging off and walking away.

I’m with you. I’m having a good day and wondering if I should sell, sell, sell.

I sold half LABU in one account (where I am still down) and sold of LABU in another acct – 20% gain somehow… I know I may regret it but Ill regret not taking a win more. P taught me that

Taking off TSLA weekly 250 calls into 3:30 ramp…….

Nice …. I’m in the equity. ..

the mythical short squeeze isn’t a good bet IMO…Sure there is $1 trillion short – how many trillions are long? If the $1 trillion short is viewed as future demand, why not view the trillions long as future supply?

There he is!

lol – is it the indicator you have been waiting for? Being out of the market for these past few months has been great. I’m always lurking and fascinated by it, whether invested or not. I found near the end that it made me cynical and just rotten to people who didn’t deserve it – i.e. I was rude to you OA which is just ridiculous, once again I apologize for my immature behavior.

No, I just meant when I talk about short interest, that is the only time you say something…lol.

LOL…even on Fly’s blog. Fucking hilarious.

You missed part of the the ride up my man. The future supply you speak of is not going to be sold as long term investors cannot just dump everything and sit on cash. The good news is we still have some upside left that you can participate in. The bears are going to push the market higher before we crash and burn.

Been having a killer year so far. Helps alleviate the pain from last year. My strategy coming into the year was to stay mostly in cash until the VIX dropped below 20. That didn’t happen until about 5-6 weeks ago but since then I’m up about 30% and avoided the drop earlier in the year. I was skeptical I’d be able to make good money after the rally that caused the VIX to drop below 20 (figured the good bargains would all be gone by then) but just wanted to avoid getting shaken out by huge moves associated with a high VIX. Good learning lesson this year and I’ve been trading for 13 years.

Mostly options, Jon?

Nocturne – I haven’t traded options in 10 years since I lost my shirt on them.

Hey OA – any thoughts on CMG here? Looks heavy, no?

Last time we had fed minutes the market had a trend day like this and CMG was red. It rallied hard the following weeks after.

Single best day at the close this year: 2.5%. I’m equity, no options.

Positioned for : Rising oil, higher rates, lower gold, higher equities (overweight tech & dividend growers) (underweight steady dividend stocks such as industrials & Utes)

For 7 – 10 days.

Via Livesquawk:

CME lowers May 2016 crude margins by 2.9% $CL_F

Let the games begin! !!! Long erl.

WYNN back above last weeks’ lows in aftermarket. I doubled my position today at 86.00.

Nice

Sharp pickup in business lending …

http://www.equipmentfa.com/news/5352/u-s-small-business-lending-increases-sharply-paynet

I ended up buying 5% positions in a bunch of high short interest stocks:

ANET

ANF

JD

JWN

MYGN

QUNR

UBNT

VMW

ZG

Only 9?

http://www.masslive.com/politics/index.ssf/2016/04/massachusetts_house_passes_bil_2.html

Cuts for solar companies in Mass

My comments section looks like an old woman’s living room with all these goofy cats running around.

I can’t believe we are rolling into the June contract in USO. Where has this year gone??!!

Expect good back n forth action for three more days at, not surprisingly the 38 dollar level. For day trading, I like to fade whatever happens up to 11:30am.

3 million more outstanding shares added to USO. Been increasing for three days.

TWTR is frustrating me – I have this weeks 17 calls – was holding to let my winners run figuring that 18-18.5 was this weeks target.

They got a downgrade this morning.

Also an upgrade from evercore. Stock is just trash tho

Makes sense – good action this morning – coiled up around 17.30 right now – is it going to break out or down?

Had a meeting at 930, so didn’t make a trade into the strength, now I am looking at a marginal return or hold through tomorrow…

What could possibly be happening in Japan or Europe that hasn’t been known for years.

Looks like the standard back and forth action of this market. Looking to buy an oil dip.

Buying gold and bonds before our open doesn’t concern me. Foreigners better step up to the plate at next weeks’ bond auctions since many strong stocks offer better yield.

However I continue to Hedge my TBT position with TLT and call selling.

Tough day. Gold , oil stocks

NTES climbing from red to green. With a little help from the market it will run.

Here’s where the motivated buyer steps in and gang rapes the bears….bought FB next weeks calls

I am thinking it is too early – maybe tomorrow, but I think let positions stand and work through next week.

GPRO is making me exceedingly happy this morning. Looks like it is on the verge of a breakout

LULU in the buy zone here @ 65.00

Am I stupid for thinking of going short gold here?

almost 0 comments… today is the buy

0 comments on what? Gold?

OA, would you short gold here for a quick trade?

Tuesday we had weak hands reducing risk, with this playing out so many times Oct/Feb, noone was going to come in right away. Wednesday they finish up and bears think this is their chance so continue to push down. Today weaks are out, shorts are already uber-short, but bulls are looking to add on the dip expected at these levels (es/nq), bears last chance before ath.

RLYP just ripped.