Many of my blogs over the last two years were based upon the high degree of correlation to most asset classes in recent years against price action in the late 90’s.

I’ve gotten this question multiple times this month, so it deserves me repeating my take on it…”Why are stocks moving higher despite the carry trade weakness.”

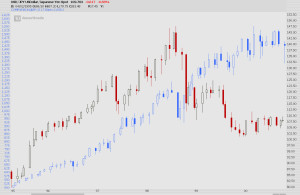

Take a look at the following charts:

Late 1995-1998 stocks followed the USD/JPY in lock step for a three year stretch before the correlation broke. The market correction in fall of 1998 busted this correlation, and the divergence really took off in 1999-2000. Stocks went on their final leg higher despite weakness in the USD/JPY. That final run lasted two years.

Late 2012-current stocks followed that same correlation. During this most recent market correction, the two instruments are starting to diverge. Could be noise, but the historical correlation is worth noting.

If you enjoy the content at iBankCoin, please follow us on Twitter

I’m scaling into YCS

Noticed 10k vol in Apr 127 TLT put. It’s against OI of 12.8k. Could be nothing.

Liking my entry into TBT earlier this week. 35.77ish

Thanks OA! Great to have that perspective. For now I’m just holding and waiting to if there’s aYellen effect in 20 minutes.

For the solar theme, what would you recommend for a global alternative energy ETF if we don’t want stock-specific risk? PBD (Powershares Global Clean Energy) looks interesting. Any comments?

Have you looked at TAN? If you wanted more solar exposure.

Yes, but thought it was too concentrated in solar.

Yeah, ETFs are a great way to avoid picking a dud.

Agree OA, something a little different is going on. Been watching the correlation for some time. The interesting thing is the USD/JPY was range bound 112-114 from mid FEB to recently, while the S&P rallied. I think since the negative interest rate announcement (late Jan?) it has been muddy at best. I mean Japan has been coming out with shitty economic numbers and the Yen rallies? Don’t buy into the whole flight to safety, Japan with their debt to GDP ratio as high as it is, it is not safety it still is carry trade. I think maybe the trade has unwound a bit. It will be interesting to see how this plays out. Watching how the financials trade, but this can be a long term macro idea. Much too slow for my ADD trading,lol. (no disrespect to folks with diagnosed ADD)

pain trade tomorrow up?? i dunno anymore. Seems like every time we ask that question, the answer is up.

OA- I may be interested in some $UA calls. What do you think?

Would you guys continue to hold $CMG stock from $464 here, or cut bait because there are better opportunities out there?

Anyone long UAL? Been watching it for a buy.