If you’ve traded through one of these market events, you’ve seen how the process works. Whether we’re talking smaller market pullbacks, or market corrections, the procedures remain the same.

Assuming this is a correction of a bull as opposed to the beginning of a bear, divergent signals are an important indicator to validate what the market is doing underneath the surface. In the same manner that we had bearish divergences leading into the Fed several sessions ago, I am looking for divergences to surface here, as they do in market corrections.

One of the most important divergences we’ve discussed is in the USD/JPY. It managed to stay flat here despite the recent run up, and the recent sell-off. When its ready to move, it will confirm the fate of equities moving forward.

Other divergences to watch this week:

Breadth: $NYMO, PPT, $ADV-DEC, or any other metrics you use will likely avoid the values they hit in late August. If these indicators are significantly higher than their August levels, and the market has traded lower, get long.

Foreign markets: I typically will use $EEM, $FXI, or perhaps even $SSEC, $HSI, $NIKK, $DAX, $FTSE, $CAC, etc to see if the $SPY sees a little more excess than the others. Notice that the $EEM and $FXI are not following the $SPY into the same depth of their late August extremes…yet. If this persists, get long.

Biotech: With the volumes we saw today, 7 days of straight selling, and the trending action on stocktwits for some of the destruction in the space…I doubt the $IBB will follow the market down any further. If we see today’s low taken out later this week, and the $IBB doesn’t follow, get long.

Market Darlings: The relative strength names finally got sold today ($FB, $GOOG, $AMZN, etc). That usually happens near the end of a correction. Again, if these stocks do not follow the market into more downside, get long.

There are many other instruments to locate divergences with, but these are a few simple instruments to watch. Maybe they don’t manifest this week, and the idea of shopping for longs is wrong? We’ll know soon enough.

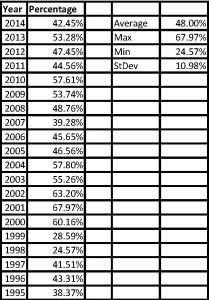

Also, I’ve heard that more and more people are using our current analogue, so I won’t discuss it much more this week, but one of the most critical components of that analogue was the divergence in market breadth. In the last 20 years, here are the breadth stats in terms of the percent of stocks that outperformed the market:

Please don’t tell me about the number of stocks in bear markets already, or that weak market breadth will equal lower prices. 1998 set the fucking bar for worst year in the last two decades in terms of market breadth. I’m well aware.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

WingWong baby!

Hmmm. Extremely interesting that 98 set low for market breath. That definitely feels like this market. I have several stocks at their all time lows today with S&P down a mere 10%

Jeff – any concerns about the longer term volume profile below for SPY:

I don’t use this that much but looks like big pockets between $170 to $180 and $155 to $165:

http://charts.stocktwits.com/production/original_43276416.jpg?1443495846

Same concern as last year. They are there…at some point they’ll fill.

Ok thanks. So are you thinking rally first then big pullback to fill in volume profile later on?

The performance of Tech Stocks vs SPY looks ready for a BIG break out!!! With us talking about a comparison to a runaway tech market, this chart looks great…

http://imgur.com/xM3BLe4

Financials vs SPY performance looks great too

http://imgur.com/PpfEv4D

VIX and VVIX

The market looks good here, just hold your horses and don’t get worked up in a lather.

EUR/USD is a strong buy here.

USD/JPY flashes strong sell.

Looks good??? Futures off 100+

Until they’re not.

God Dam. Shit hitting the fan again

You are supposed to sleep at night….

Bears have had this leg down very easy. Makes me think either it’s very very bad, or there is an amazing squeeze coming….. Even if we head lower after. Look at stocktwits. Jesse Livermore has been reincarnated into about 6000 people. Each one nailed the short at the top.

This little $ENZN that i have been watching hasn’t noticed the sell off so far. I had a Finviz tab that I kept with about 20 smaller bio names and that’s the only one that’s holding up.

The other items that are on my list: $MTU and $NMR from those 20 year charts we reviewed a few weeks back.

$KRE was relatively strong today and I am watching, as well as $BAC.

I may also add to my $EEM leaps, because that feels like the dumbest idea I have got right now and that’s the trade that’s been working.

$FCX shares this week for sure. You don’t catch a company exposed to gold, oil, and copper and have those three commodities all do what they’ve done very often.

God as my witness I will buy either $HABT or $SHAK one of these days.

$CYBR, $JUNO, and $N are the obvious ones as well.

This shopping list is probably 3x what i can realistically manage to keep track of.

ENZN is down 40% from July?

I meant this flush. Very quiet in the face of lots of selling across the board. Looking for exhaustion there and it looks like there may not be any sellers right now. Manage with a tight stop of course in a name like that.

Long shares of $LABU here at 15.25. Stop set at $14.25.

Just got stopped out.

out at $16.45

F it , back in

OA, what was that crazy snapback rally in $LABU? The bottom is in, on it?

Playing those 3x etf’s is like riding a unicycle over bad road while juggling dynamite!

Haha. Nice analogy

Bought weekly calls

NFLX 99s

AAPL 114s

1950’s gets late bears throwing chairs out of windows.

This week, it was all about bringing in late bears. Two traps, one winner.

Your thoughts were, well, well thought out. The worlds biggest chess board.